Your Ultimate Guide to Sourcing Vans Work Shoes

Guide to Vans Work Shoes

- Introduction: Navigating the Global Market for vans work shoes

- Understanding vans work shoes Types and Variations

- Key Industrial Applications of vans work shoes

- Strategic Material Selection Guide for vans work shoes

- In-depth Look: Manufacturing Processes and Quality Assurance for vans work shoes

- Comprehensive Cost and Pricing Analysis for vans work shoes Sourcing

- Spotlight on Potential vans work shoes Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for vans work shoes

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the vans work shoes Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of vans work shoes

- Strategic Sourcing Conclusion and Outlook for vans work shoes

Introduction: Navigating the Global Market for vans work shoes

In the fiercely competitive landscape of industrial and occupational footwear, vans work shoes have emerged as a critical component for workforce safety, comfort, and productivity across diverse sectors. For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, sourcing the right vans work shoes is not merely a procurement decision—it’s a strategic move that impacts operational efficiency, compliance, and brand reputation.

This comprehensive guide is designed to empower buyers with actionable insights into the global vans work shoe market. It covers essential topics including the variety of shoe types tailored for different industries, the range of materials used for durability and safety, and the latest manufacturing and quality control standards. Additionally, it provides guidance on identifying reliable suppliers, understanding cost structures, and navigating regional market nuances.

Whether you’re sourcing for manufacturing, distribution, or end-user markets, this resource aims to streamline your decision-making process. By understanding key factors such as compliance requirements in Europe’s safety regulations, import considerations in Brazil, or quality benchmarks favored in Germany, you can optimize your procurement strategies. Ultimately, this guide equips international B2B buyers with the knowledge needed to make informed, cost-effective, and quality-focused sourcing decisions in the dynamic global vans work shoe market.

Understanding vans work shoes Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Safety Work Shoes | Reinforced toe caps (steel, composite), slip-resistant soles | Manufacturing, construction, logistics | Pros: Enhanced safety compliance, durability; Cons: Higher cost, limited style options |

| Industrial Slip-Ons | Easy slip-on design, reinforced soles, anti-slip features | Warehousing, light manufacturing, maintenance | Pros: Convenience, quick deployment; Cons: Less ankle support, may lack advanced safety features |

| Waterproof Work Shoes | Waterproof membranes, sealed seams, rugged soles | Outdoor construction, agriculture, transport | Pros: Moisture protection, versatile use; Cons: Heavier, potential breathability issues |

| Anti-Fatigue Work Shoes | Cushioned insoles, ergonomic design, shock absorption | Long shifts in warehousing, assembly lines | Pros: Comfort for prolonged wear, reduced fatigue; Cons: Higher price point, may require maintenance |

| Electrical Hazard Shoes | Conductive resistance, non-metallic soles, insulating layers | Electrical work, utility services | Pros: Safety against electrical shocks; Cons: Limited in other safety features, specialized market |

Safety Work Shoes

Safety work shoes are designed with reinforced toe caps—commonly steel or composite—to protect against impact and compression hazards. They often feature slip-resistant soles to prevent falls in slick environments. These shoes are essential in heavy industries like manufacturing and construction, where safety compliance is mandated. B2B buyers should prioritize certifications (e.g., ASTM, EN standards) and consider bulk discounts for large orders. Durability and safety features justify higher initial investments, but buyers must balance cost with compliance needs.

Industrial Slip-Ons

Industrial slip-ons are characterized by their ease of use, featuring a slip-on design with reinforced, anti-slip soles. They are ideal for environments where quick footwear changes are necessary, such as warehouses or maintenance facilities. Their simple design reduces procurement complexity and stocking costs. However, they typically offer less ankle support and safety features compared to full safety shoes, making them suitable for lower-risk environments. B2B buyers should evaluate the safety standards and comfort levels to ensure suitability for their workforce.

Waterproof Work Shoes

Waterproof work shoes incorporate sealed seams, waterproof membranes, and rugged soles to withstand wet conditions. They are versatile for outdoor construction, agriculture, and transport sectors, especially in regions with high humidity or frequent rain. These shoes help reduce downtime caused by water damage or discomfort, enhancing worker productivity. Buyers should consider weight and breathability, as waterproof materials can increase shoe weight and reduce ventilation. Bulk purchasing should focus on models with durable waterproofing and suitable sizes for diverse workforce needs.

Anti-Fatigue Work Shoes

Anti-fatigue shoes feature cushioned insoles, ergonomic designs, and shock absorption technologies to reduce fatigue during long shifts. They are particularly valued in warehousing, assembly lines, and other roles requiring extended standing. These shoes improve worker comfort and productivity, potentially reducing workplace injuries. Cost considerations include higher purchase prices and maintenance, such as replacing insoles. B2B buyers should assess durability, comfort testing, and supplier reliability when sourcing for large teams.

Electrical Hazard Shoes

Designed with non-metallic, insulating soles and conductive resistance layers, electrical hazard shoes protect workers from electrical shocks. They are essential in utility services, electrical installations, and maintenance work. These shoes must meet strict safety standards, and bulk procurement should emphasize certification and consistent quality. While offering critical safety benefits, they may lack other features like waterproofing or anti-slip properties, so buyers should evaluate their specific operational risks and combine with other PPE as needed.

Key Industrial Applications of vans work shoes

| Industry/Sector | Specific Application of vans work shoes | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Construction & Civil Engineering | Site workers requiring slip-resistant, protective footwear | Reduces workplace accidents, enhances safety compliance, boosts productivity | Durability under harsh conditions, slip resistance, compliance with safety standards, adaptable sizing for diverse workforce |

| Manufacturing & Industrial Plants | Assembly line workers or warehouse staff | Provides comfort for prolonged standing, reduces fatigue, improves safety | Anti-fatigue features, chemical resistance, ease of cleaning, availability in bulk orders |

| Oil & Gas & Petrochemical | Field technicians and plant operators in hazardous zones | Protects against chemical spills, slips, and impacts; meets safety standards | Certification for chemical exposure, high grip soles, durability in extreme environments |

| Agriculture & Farming | Farm workers on uneven terrain and muddy fields | Ensures stability, waterproofing, and comfort for outdoor tasks | Waterproof materials, rugged outsole, comfort for extended wear, resistance to mud and moisture |

| Logistics & Warehousing | Delivery drivers and warehouse personnel | Comfortable, slip-resistant shoes that support long hours of movement | Lightweight design, slip resistance, durability, easy maintenance |

Construction & Civil Engineering

In the construction sector, vans work shoes are vital for site workers who face uneven surfaces, spills, and potential falling objects. These shoes are designed with slip-resistant soles and reinforced toe caps, addressing common hazards like slips, trips, and impacts. For international B2B buyers, especially in regions with variable infrastructure quality such as parts of Africa and South America, sourcing shoes that meet local safety standards and offer durability in rough environments is essential. Bulk procurement with customized sizes can optimize safety and reduce costs.

Manufacturing & Industrial Plants

Manufacturing environments demand footwear that supports prolonged standing and frequent movement. Vans work shoes equipped with anti-fatigue insoles, chemical-resistant materials, and easy-to-clean surfaces help reduce worker fatigue and maintain hygiene. For European and Middle Eastern buyers, compliance with industrial safety standards (e.g., EN ISO 20345) and availability of certified products are critical. Sourcing shoes that balance comfort, safety, and durability in bulk can significantly improve operational efficiency.

Oil & Gas & Petrochemical

In hazardous zones within oil and gas facilities, workers require footwear that offers chemical resistance, impact protection, and slip resistance on oily or wet surfaces. Vans work shoes designed with specialized soles and chemical-resistant uppers meet these demands. For B2B buyers in Brazil, the Middle East, and Europe, certification for explosive atmospheres and compliance with industry standards (such as ATEX) are vital. Reliable sourcing ensures safety and minimizes downtime caused by footwear failure.

Agriculture & Farming

Outdoor agricultural work exposes employees to muddy, uneven terrains and weather extremes. Vans work shoes engineered with waterproof uppers, rugged soles, and ergonomic design provide stability, comfort, and protection against moisture and mud. For buyers in South America and Africa, sourcing footwear that withstands harsh outdoor conditions and offers long-lasting performance is crucial. Bulk orders should focus on durability, ease of maintenance, and fit to support productivity.

Logistics & Warehousing

Delivery drivers and warehouse staff need lightweight, slip-resistant shoes that support long hours of standing and walking. Vans work shoes designed with cushioned insoles, sturdy outsoles, and breathable materials help reduce fatigue and improve safety. For European and Middle Eastern logistics companies, sourcing shoes that meet local safety standards, are easy to clean, and available in various sizes ensures operational continuity and worker satisfaction. Bulk procurement facilitates cost efficiency and uniform safety compliance.

Strategic Material Selection Guide for vans work shoes

Material Analysis for Vans Work Shoes

Selecting the appropriate materials for vans work shoes is critical to ensure they meet performance, safety, and durability standards across diverse international markets. Below is an in-depth analysis of three common materials—leather, synthetic fabrics, and rubber—focusing on their properties, advantages, limitations, and considerations for global B2B buyers from regions such as Africa, South America, the Middle East, and Europe.

Leather

Key Properties:

Leather is renowned for its natural durability, breathability, and flexibility. It offers excellent abrasion resistance and can be treated to enhance water resistance. Depending on the grade, leather can withstand high mechanical stresses and temperature variations, making it suitable for demanding work environments.

Pros & Cons:

Leather’s primary advantage lies in its durability and comfort, which can improve over time with proper maintenance. It also offers a premium aesthetic, appealing to clients seeking high-end work footwear. However, leather production involves complex manufacturing processes, often resulting in higher costs. It is also heavier than synthetic alternatives and requires regular care to maintain its properties.

Impact on Application:

Leather performs well in environments with moderate moisture, but untreated leather can degrade in excessive wet or humid conditions unless properly sealed. It is suitable for industries like construction, manufacturing, and logistics, where durability is prioritized.

International Considerations:

For buyers in regions such as Europe and Germany, compliance with standards like DIN and EN is essential, especially regarding chemical treatments used in tanning. In Africa and South America, where climate conditions vary widely, selecting water-resistant or treated leather is critical. Leather’s environmental impact and sourcing transparency are increasingly scrutinized, prompting buyers to prefer ethically sourced options.

Synthetic Fabrics (e.g., Mesh, Polyester, Nylon)

Key Properties:

Synthetic fabrics are lightweight, flexible, and often engineered for breathability and moisture-wicking. They can be manufactured with specific properties such as high tensile strength, chemical resistance, and UV stability. These materials often incorporate advanced coatings to enhance water resistance or abrasion resistance.

Pros & Cons:

Synthetic materials typically offer lower costs and easier manufacturing processes, making them attractive for mass production. They excel in providing lightweight comfort and quick-drying features, ideal for hot or humid climates common in Africa and South America. However, they generally have lower durability compared to leather, especially under abrasive or high-impact conditions, and may degrade faster when exposed to UV radiation or chemicals.

Impact on Application:

Synthetic fabrics are suitable for light to medium-duty work shoes, especially in environments where breathability and weight reduction are priorities. They are less ideal for heavy industrial settings but excel in sectors like warehousing or logistics.

International Considerations:

Buyers should verify compliance with regional standards such as ASTM F2413 (USA), EN ISO 20345 (Europe), or JIS T 8101 (Japan). In regions with high UV exposure, selecting UV-stabilized synthetics extends product lifespan. Additionally, synthetic materials with eco-friendly certifications (e.g., OEKO-TEX) are increasingly preferred in European markets.

Rubber and Rubber Compounds

Key Properties:

Rubber is highly valued for its exceptional slip resistance, shock absorption, and waterproof qualities. It can be formulated with various additives to enhance abrasion resistance, elasticity, and chemical stability. Rubber soles are often integral to the outsole, providing critical grip and durability.

Pros & Cons:

Rubber offers outstanding durability in harsh environments, especially where traction and water resistance are essential. It is relatively cost-effective and straightforward to manufacture at scale. However, rubber can be heavy, which may impact wearer comfort over extended periods. Its chemical resistance varies depending on formulation; some rubber compounds may degrade when exposed to oils, solvents, or extreme temperatures.

Impact on Application:

Rubber is ideal for industrial, construction, and outdoor work shoes, especially in wet or oily conditions. Its resistance to chemicals and environmental wear makes it suitable for diverse climates, including the hot, humid regions of South America and the Middle East.

International Considerations:

Compliance with standards like ASTM D2240 (hardness testing) and DIN EN 13832 (slip resistance) is vital. For markets in Europe, eco-friendly rubber formulations with low VOC emissions are increasingly mandated. In Africa and South America, sourcing rubber that withstands high temperatures and UV exposure without cracking is essential.

Summary Table

| Material | Typical Use Case for vans work shoes | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Leather | Heavy-duty industrial, construction, high-end work shoes | Excellent durability, breathability, aesthetic appeal | Higher cost, weight, requires maintenance, environmental impact | High |

| Synthetic Fabrics | Light-duty, warehouse, logistics, hot/humid climates | Lightweight, breathable, cost-effective, quick-drying | Lower durability, less suitable for heavy industrial use | Low |

| Rubber and Compounds | Industrial, outdoor, slip-resistant applications | Superior slip resistance, waterproof, impact absorption | Heavy weight, chemical degradation depending on formulation | Med |

By understanding these materials’ properties and their implications across different regions, B2B buyers can make informed decisions that align with their operational needs, compliance standards, and environmental considerations. Selecting the right material combination ensures optimal performance, cost efficiency, and customer satisfaction in diverse international markets.

In-depth Look: Manufacturing Processes and Quality Assurance for vans work shoes

Manufacturing Processes of Vans Work Shoes

The manufacturing of Vans work shoes involves a series of meticulously controlled stages designed to ensure durability, safety, and comfort. Understanding these processes enables B2B buyers to assess supplier capabilities and compliance with international standards.

1. Material Preparation

The process begins with sourcing high-quality raw materials, including leather, synthetic fabrics, rubber, and specialized insoles. Suppliers often select materials based on specific industry standards such as ASTM or EN standards for safety and durability. Material inspection at this stage (Incoming Quality Control, IQC) ensures raw materials meet specified parameters like tensile strength, flexibility, and chemical resistance.

2. Forming and Cutting

Next, materials are cut into precise patterns using automated cutting machines, often employing CAD/CAM technology for accuracy. This stage is critical for minimizing waste and ensuring consistent shape and size. For leather or synthetic upper parts, laser cutting or die-cutting techniques are common, providing clean edges and repeatability essential for quality control.

3. Assembly

The assembly stage involves stitching, bonding, and attaching components such as soles, insoles, eyelets, and padding. Advanced manufacturing facilities use robotic stitching for uniformity, especially for high-volume orders. Adhesives and bonding agents are selected based on their compliance with environmental and safety standards, ensuring no harmful emissions or substances.

4. Finishing

The final steps include surface finishing, polishing, and quality checks for aesthetic and functional defects. This stage might involve dyeing, embossing, or branding. The shoes then undergo rigorous inspection before packaging, including tests for colorfastness, adhesion strength, and overall finish quality.

Quality Control (QC) in Vans Work Shoe Manufacturing

Robust quality assurance is vital for international B2B transactions, especially when catering to diverse markets with varying safety and environmental regulations.

1. International and Industry Standards

- ISO 9001: Most reputable manufacturers adhere to ISO 9001 standards, ensuring a comprehensive quality management system covering design, production, and customer satisfaction.

- CE Marking (European Market): Indicates compliance with EU safety, health, and environmental requirements, including footwear safety standards like EN ISO 20345 for safety footwear.

- Other Certifications: Depending on the target market, certifications like ASTM F2413 (US), CSA (Canada), or API standards for specific industrial applications may be relevant.

2. QC Checkpoints

- IQC (Incoming Quality Control): Verifies raw material quality before production, focusing on material specifications, certifications, and supplier documentation.

- IPQC (In-Process Quality Control): Conducted during manufacturing, including stitching integrity, dimensional checks, and bonding strength.

- FQC (Final Quality Control): The last inspection before shipment, assessing overall appearance, construction, fit, and safety features. Common testing includes tensile tests, adhesion tests, and visual inspections.

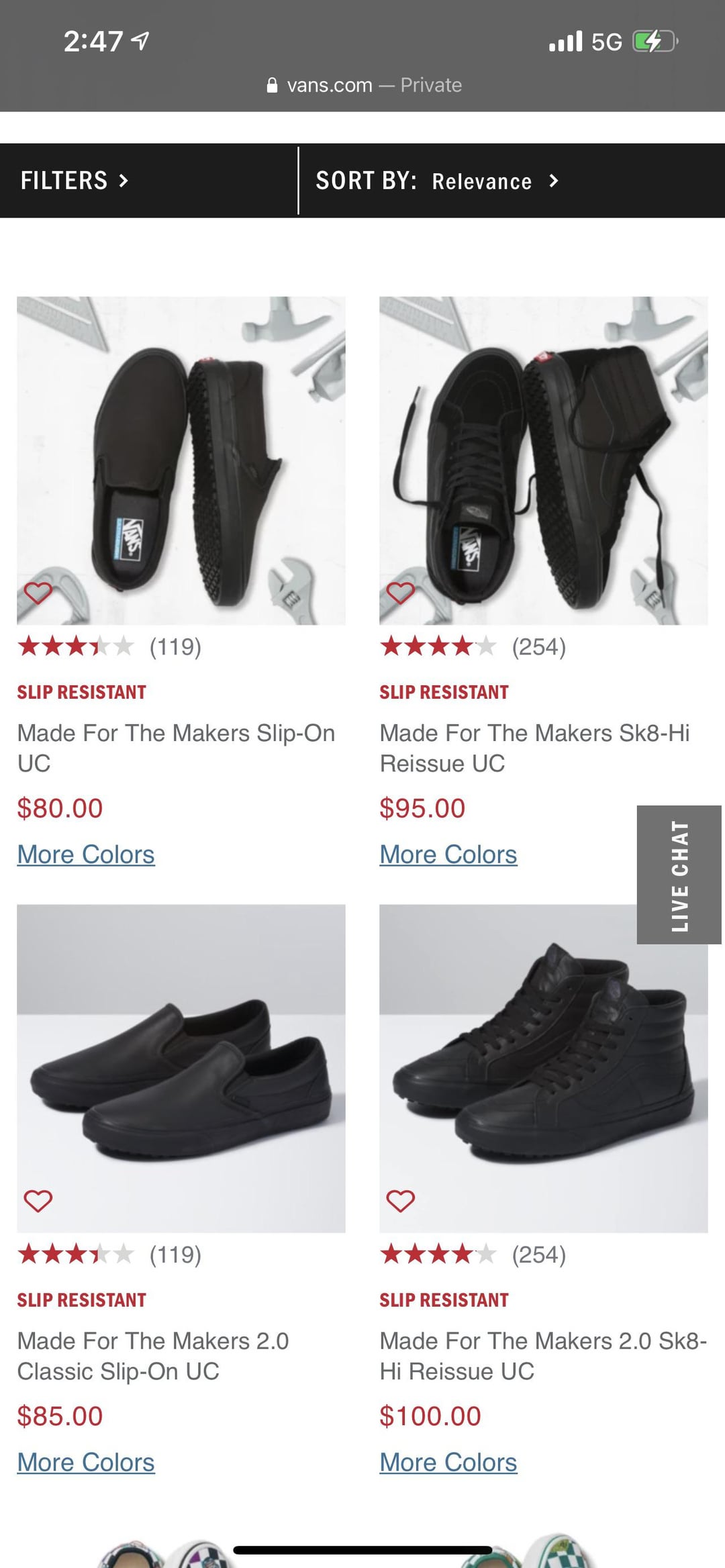

Illustrative Image (Source: Google Search)

3. Testing Methods

- Mechanical Testing: Tensile, shear, and peel tests to evaluate bonding and stitching strength.

- Environmental Testing: Accelerated aging, water resistance, and temperature cycling to simulate real-world conditions.

- Safety and Compliance Testing: Testing for slip resistance (ASTM F2913), impact resistance, and electrical hazard protection, where applicable.

Verifying Supplier QC for International Buyers

International B2B buyers must adopt rigorous verification practices to ensure quality consistency and compliance:

- Supplier Audits: Conduct on-site audits focusing on manufacturing processes, QC procedures, and environmental practices. Use internationally recognized audit standards like ISO 19011.

- Review of QC Reports: Request detailed inspection and testing reports, including third-party laboratory results where applicable.

- Third-Party Inspections: Engage accredited inspection agencies (e.g., SGS, Bureau Veritas, Intertek) for pre-shipment quality audits, especially when dealing with suppliers from regions with variable quality standards.

Nuances for B2B Buyers from Africa, South America, the Middle East, and Europe

Buyers from diverse regions face unique challenges and opportunities related to manufacturing and QC:

- Regional Standards and Regulations: Buyers should verify that suppliers comply with local regulations such as Brazil’s INMETRO standards, EU CE requirements, or Middle Eastern safety standards. This may involve additional testing or certification.

- Supply Chain Transparency: Due to varying levels of regulatory enforcement, buyers from regions like Africa or South America should prioritize suppliers with transparent QC documentation and certifications.

- Capacity for Customization: European and Middle Eastern buyers often require adherence to stricter environmental and safety standards (e.g., REACH compliance in Europe). Confirm that manufacturers can meet these standards and provide relevant documentation.

- Inspection and Certification Costs: Factor in the costs and logistics of third-party inspections or certifications, which may be higher or more complex depending on the supplier’s location.

Final Considerations for B2B Buyers

To mitigate risks and ensure product quality, B2B buyers should:

- Establish clear quality specifications and testing requirements in contracts.

- Conduct regular audits and request detailed quality reports.

- Engage with reputable third-party inspection agencies familiar with local and international standards.

- Foster long-term relationships with suppliers committed to continuous improvement and compliance.

By understanding and scrutinizing manufacturing and QC processes, international buyers can confidently source Vans work shoes that meet their safety, durability, and regulatory requirements, thereby safeguarding their brand reputation and customer satisfaction.

Comprehensive Cost and Pricing Analysis for vans work shoes Sourcing

Understanding Cost Structure and Price Drivers

When sourcing Vans work shoes for international markets, understanding the detailed cost components is crucial for effective negotiation and margin management. The primary cost elements include raw materials, labor, manufacturing overhead, tooling, quality control, logistics, and the supplier’s desired profit margin. Material costs typically account for 30-50% of the total product cost, with durable synthetic leathers, rubber soles, and specialized reinforcement fabrics influencing pricing significantly. Labor costs vary widely depending on the manufacturing country; Asian factories tend to be more cost-efficient, whereas European and Middle Eastern suppliers may charge higher wages but offer advantages in quality and certifications.

Manufacturing overhead encompasses factory expenses such as energy, equipment maintenance, and factory management. Tooling costs are often amortized over large production runs but can be a significant upfront expense for customized or high-spec models. Quality control and certification processes, especially for safety standards like EN ISO or ASTM, add to costs but are essential for meeting market-specific compliance requirements. Logistics expenses—covering shipping, customs clearance, and inland transportation—can range from 10-30% of the total landed cost, influenced heavily by shipping volumes, Incoterms, and destination country import tariffs.

Key Price Influencers and Their Impact

Several factors significantly influence the final price of Vans work shoes in international markets:

-

Order Volume and Minimum Order Quantities (MOQs): Higher volumes typically lead to lower unit costs due to economies of scale. Buyers from Africa, South America, or Europe should aim for bulk orders to leverage volume discounts, but must balance this against inventory holding costs.

-

Specifications and Customization: Custom features such as reinforced toes, slip-resistant soles, or branding increase costs. Standard models are more cost-effective, but market-specific requirements (e.g., safety certifications in Germany or Brazil) may necessitate additional testing and modifications.

-

Material Selection: Premium or specialized materials, such as fire-resistant fabrics or eco-friendly composites, elevate costs but can justify higher retail prices or meet niche market demands.

-

Quality Certifications and Standards: Suppliers with ISO, CE, or ASTM certifications often charge a premium but provide assurance of compliance, reducing import risks and potential delays in regulated markets.

-

Supplier Factors: Factory reputation, proximity, and capacity influence pricing. Established manufacturers with robust quality systems and reliable supply chains may have higher prices but offer greater consistency and fewer delays.

-

Incoterms and Shipping Arrangements: The choice of Incoterms (e.g., FOB, CIF, DDP) impacts landed costs. FOB allows buyers to control freight but requires logistics expertise, while CIF or DDP simplifies import processes at a higher cost.

Strategic Tips for International B2B Buyers

-

Negotiate Pricing and Terms: Engage in volume-based negotiations, especially for large or recurring orders. Suppliers often provide discounts for long-term partnerships or early payments.

-

Focus on Total Cost of Ownership (TCO): Consider not only unit price but also costs related to import duties, customs clearance, warehousing, and potential rework or quality issues. Sometimes a slightly higher unit price can reduce overall TCO.

-

Leverage Local Market Insights: Buyers from regions like Brazil or Germany should understand local import tariffs, VAT, and certification requirements to accurately assess landed costs and price competitiveness.

-

Request Samples and Certifications: Ensure product quality and compliance before large orders. This minimizes costly returns, rework, or regulatory hurdles.

-

Build Relationships and Transparency: Strong supplier relationships foster better pricing, flexible payment terms, and prioritized production slots, especially critical when navigating complex international logistics.

Price Range and Approximate Costs

Indicative pricing for standard Vans work shoes varies by region and specifications. In general:

- Basic models: $10–$15 FOB per pair for bulk orders from Asian manufacturers.

- Mid-range models with certifications: $15–$25 FOB per pair.

- Customized or premium models: $25–$40 FOB per pair.

These figures are estimates; actual prices depend on order size, customization, and market conditions. Buyers should always request detailed quotes and factor in additional costs such as shipping, taxes, and compliance fees to determine the true landed cost.

Illustrative Image (Source: Google Search)

Final Thoughts

Effective sourcing of Vans work shoes in the international B2B landscape requires a nuanced understanding of cost drivers, market-specific influences, and strategic negotiation. By carefully analyzing each component—materials, labor, logistics, and certifications—and aligning them with business goals, buyers from Africa, South America, the Middle East, and Europe can optimize procurement costs, mitigate risks, and ensure product quality.

Illustrative Image (Source: Google Search)

Spotlight on Potential vans work shoes Manufacturers and Suppliers

- (No specific manufacturer data was available or requested for detailed profiling in this section for vans work shoes.)*

Essential Technical Properties and Trade Terminology for vans work shoes

Critical Technical Properties of Vans Work Shoes

1. Material Grade and Composition

The quality and type of materials used in work shoes directly influence durability, safety, and comfort. Common materials include genuine leather, synthetic leathers, and specialized textiles. For B2B buyers, specifying material grades—such as full-grain leather versus bonded leather—ensures consistency and meets industry safety standards. High-grade materials typically offer better abrasion resistance and longevity, reducing replacement costs over time.

2. Sole Composition and Tread Design

The outsole material, often rubber or polyurethane, impacts slip resistance and shock absorption. Tread patterns are designed for specific environments—industrial, construction, or warehouse settings. Buyers should verify that soles meet relevant slip resistance certifications (e.g., SRC rating) to ensure safety compliance across different regions. Proper sole design enhances worker safety and minimizes liability.

3. Tolerance and Fit Specifications

Manufacturers must adhere to strict dimensional tolerances to guarantee consistent fit. Variations in sizing can lead to discomfort or safety hazards. Industry standards often specify permissible deviations (e.g., ±2 mm in length/width). Clear tolerance specifications facilitate bulk procurement with uniform quality, reducing returns and rework.

4. Resistance Certifications

Work shoes often require certifications for specific hazards, such as electrical hazard resistance, puncture resistance, or chemical resistance. These certifications confirm the shoes’ suitability for particular work environments. For B2B buyers, ensuring products meet local safety standards (e.g., ASTM, EN ISO) is crucial for compliance and worker safety.

5. Weight and Flexibility

Lightweight shoes reduce fatigue during long shifts, while flexibility ensures ease of movement. Technical specifications often include weight per pair and flexural strength. These factors are especially important for industries requiring prolonged standing or complex movements, directly impacting productivity and worker well-being.

6. Breathability and Insulation

Depending on climate, work shoes may need enhanced breathability or insulation. Technical properties specify materials like mesh linings or thermal insulators. Proper specification ensures suitability for hot or cold environments, reducing heat stress or cold-related injuries.

Common Industry and Trade Terms

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce work shoes directly for brands or large buyers. Understanding OEM relationships helps buyers assess the potential for customization, quality control, and supply chain reliability.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell in a single order. Knowledge of MOQ is vital for planning procurement budgets and production timelines, especially for bulk or repeat orders.

3. RFQ (Request for Quotation)

A formal process where buyers solicit detailed price and lead-time proposals from multiple suppliers. Using RFQs ensures competitive pricing and transparency, enabling informed decision-making.

4. Incoterms (International Commercial Terms)

Standardized trade definitions published by the ICC that specify responsibilities for shipping, insurance, and tariffs. Familiarity with Incoterms (e.g., FOB, CIF) helps B2B buyers clarify costs, risks, and delivery points in international transactions.

5. Lead Time

The period from order placement to product delivery. Accurate understanding of lead times allows buyers to synchronize procurement with production schedules and project deadlines, avoiding delays.

6. Certification and Compliance Terms

Terms like CE, ASTM, or EN ISO specify safety and quality standards. Ensuring products meet these certifications is essential for legal compliance and safety assurance in target markets.

Strategic Insights for B2B Buyers

Understanding these technical properties and trade terms enables buyers from Africa, South America, the Middle East, and Europe to negotiate effectively, ensure product quality, and meet regulatory requirements. Clear specifications and familiarity with industry jargon streamline procurement processes, reduce risks, and support long-term supply chain stability. When engaging with suppliers, always verify technical compliance and clarify trade terms upfront to foster smooth international transactions.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the vans work shoes Sector

Market Overview & Key Trends

The global market for vans work shoes is experiencing steady growth driven by increasing industrialization, infrastructural development, and a rising emphasis on worker safety across multiple regions. For B2B buyers in Africa, South America, the Middle East, and Europe, understanding regional market dynamics is essential to optimize sourcing strategies. In Europe, particularly countries like Germany, the demand for high-performance, durable work footwear aligns with stringent safety standards and advanced manufacturing technologies. Conversely, emerging markets such as Brazil and parts of Africa are witnessing rapid growth driven by expanding construction, logistics, and manufacturing sectors, often requiring cost-effective yet reliable footwear solutions.

Emerging sourcing trends include a shift towards digital procurement platforms, which enable greater transparency, real-time supplier evaluation, and streamlined logistics management. Additionally, Industry 4.0 technologies, including automation and IoT integration in manufacturing, are enhancing product quality and supply chain efficiency. For international buyers, especially those sourcing from Asia or local manufacturers, establishing strong supplier relationships and leveraging data analytics for demand forecasting are crucial to mitigate risks associated with fluctuating raw material costs and geopolitical factors.

Market dynamics are also influenced by global supply chain disruptions, notably due to geopolitical tensions, trade tariffs, and the COVID-19 pandemic. These factors have accelerated interest in diversified sourcing to reduce dependency on single regions. Sustainable sourcing practices and certifications are increasingly becoming a key differentiator, with buyers seeking suppliers that can meet evolving regulatory standards and corporate social responsibility (CSR) commitments. Overall, strategic sourcing that balances cost, quality, and sustainability is vital for maintaining competitiveness in this evolving sector.

Sustainability & Ethical Sourcing in B2B

Sustainability is no longer optional but a core component of sourcing in the vans work shoes sector. Environmental impacts from manufacturing, including carbon emissions, water usage, and waste generation, are under scrutiny from both regulators and end-users. B2B buyers, especially from Europe and increasingly from South America and Africa, are prioritizing suppliers with robust environmental management systems and certifications such as ISO 14001, OEKO-TEX, or LEED-compliant manufacturing facilities.

Ethical sourcing extends beyond environmental concerns to encompass labor rights, fair wages, and safe working conditions. Buyers are increasingly demanding transparency in supply chains, with traceability tools allowing verification of ethical practices from raw material extraction to finished product. Certifications like Fair Trade and SA8000 are gaining prominence as indicators of responsible sourcing.

In terms of materials, there is a significant shift towards eco-friendly options such as recycled rubber, organic cotton, and biodegradable adhesives. These materials help reduce the ecological footprint of vans work shoes and align with corporate sustainability goals. Moreover, adopting ‘green’ manufacturing practices—such as energy-efficient processes and waste recycling—can enhance brand reputation and meet regulatory requirements across different markets. For B2B buyers, partnering with suppliers committed to sustainability not only mitigates risks but also supports long-term value creation and compliance with international standards.

Brief Evolution/History

The vans work shoes sector has evolved from basic protective footwear to technologically advanced, ergonomic, and sustainable solutions. Originally driven by industrial safety standards, the focus has expanded to include comfort, durability, and environmental impact. Over the past two decades, globalization facilitated access to a broader range of materials and manufacturing capabilities, lowering costs and expanding innovation. Today, the sector is characterized by increased adoption of smart materials, such as moisture-wicking fabrics and slip-resistant soles, and a stronger emphasis on sustainability. For B2B buyers, understanding this evolution helps in selecting suppliers capable of delivering innovative, compliant, and eco-friendly products aligned with modern safety and sustainability standards.

Frequently Asked Questions (FAQs) for B2B Buyers of vans work shoes

1. How can I effectively vet and select reliable suppliers for vans work shoes internationally?

To ensure supplier reliability, start with comprehensive due diligence. Verify their business licenses, certifications (such as ISO, CE, or local industry standards), and previous export experience. Request references from other B2B clients, especially those within your target markets. Conduct virtual factory audits or third-party inspections if possible. Evaluate their production capacity, quality control processes, and responsiveness. Establish clear communication channels and ask for detailed product samples before committing. Utilizing trusted trade platforms or sourcing agents familiar with your target regions can further mitigate risks and help identify reputable partners.

2. What customization options are typically available for vans work shoes, and how do they impact lead times and costs?

Most suppliers offer customization options such as branding (logos, labels), specific color schemes, material choices, and safety features (e.g., slip resistance, steel toes). Customization can significantly enhance your brand presence but may increase lead times by 2-4 weeks depending on complexity. Costs vary based on order volume, complexity, and tooling requirements. To optimize efficiency, clearly define your specifications upfront and negotiate minimum order quantities (MOQs) that align with your budget and timeline. Establish a detailed product development schedule with your supplier to manage expectations effectively.

3. What are typical MOQs, lead times, and payment terms for bulk orders of vans work shoes?

MOQ requirements for vans work shoes typically range from 500 to 5,000 pairs, depending on the manufacturer and customization level. Lead times usually span 4 to 12 weeks, including sample approval, production, and shipping, but can vary with order size and complexity. Common payment terms include 30% upfront deposit with the balance payable before shipment or upon receipt of documents. Some suppliers may offer trade finance options or letter of credit arrangements for larger orders. Negotiate these terms early to align with your cash flow and delivery schedules, and consider building buffer time into your planning.

4. What certifications and quality assurance measures should I verify before importing vans work shoes?

Ensure the supplier provides relevant certifications such as ISO 9001 for quality management, safety standards like CE marking (Europe), ASTM or OSHA compliance (North America), or local certifications pertinent to your target market. Request detailed quality control reports, test certificates, and factory audit reports. Implement a third-party inspection protocol during production and pre-shipment testing to verify adherence to agreed standards. Establish clear quality benchmarks in your contract and consider initial trial orders to evaluate consistency. Proper certification and QA processes mitigate risks of non-compliance, returns, and reputational damage.

5. How can I optimize logistics and shipping when importing vans work shoes from overseas suppliers?

Start by choosing suppliers with experience in international freight and reliable logistics partners. Opt for FOB (Free on Board) terms to retain control over shipping arrangements, or CIF (Cost, Insurance, and Freight) if you prefer the supplier to handle logistics. Consolidate shipments to reduce costs and minimize transit times. Use reputable freight forwarders with expertise in your region to navigate customs clearance efficiently. Ensure all shipping documents (commercial invoice, packing list, certificates) are accurate and complete. Consider incoterms that align with your risk management strategy and establish a clear timeline to synchronize production and logistics schedules.

6. How should I handle potential disputes or quality issues with overseas suppliers?

Establish detailed contractual terms covering quality standards, inspection procedures, and dispute resolution mechanisms before placing orders. Include clauses for non-conformance, defect rectification, and penalties if standards are not met. Maintain open communication channels and conduct regular updates during production. If issues arise, document discrepancies with photos and inspection reports, and communicate promptly with your supplier. Consider arbitration clauses or international trade dispute bodies (e.g., ICC) for resolution. Building strong relationships and clear expectations from the outset can prevent misunderstandings, and having a backup supplier list mitigates risks of disruptions.

7. What are the key considerations for ensuring compliance with local regulations in my target markets?

Research import regulations, safety standards, labeling requirements, and environmental policies specific to your target country—such as REACH in Europe or local safety certifications in Brazil or Middle Eastern countries. Ensure your supplier understands these standards and can provide necessary compliance documentation. Incorporate testing requirements into your quality assurance process. Be aware of tariffs, taxes, and import duties that impact landed costs. Partner with local customs brokers or trade consultants to streamline clearance processes and avoid delays. Staying proactive on compliance minimizes legal risks and ensures smooth market entry.

8. How can I establish long-term, mutually beneficial relationships with overseas vans work shoe suppliers?

Focus on building trust through transparent communication, timely payments, and consistent quality standards. Invest in regular relationship management, such as periodic visits, virtual meetings, and feedback sessions. Negotiate favorable terms for repeat orders and volume discounts to incentivize supplier loyalty. Share market insights and collaborate on product development to align offerings with evolving customer needs. Consider supplier development programs or joint ventures where appropriate. Long-term partnerships reduce sourcing risks, improve lead times, and foster innovation, ultimately enhancing your competitive edge in international markets.

Strategic Sourcing Conclusion and Outlook for vans work shoes

Conclusion and Future Outlook

Effective strategic sourcing of vans work shoes offers international B2B buyers a competitive edge by balancing quality, cost, and supply chain resilience. Key considerations include evaluating supplier reliability, adhering to regional safety standards, and leveraging innovative sourcing channels such as local manufacturers or global trade networks. Emphasizing supplier diversity and fostering strong partnerships can mitigate risks associated with geopolitical shifts or logistical disruptions.

Looking ahead, the evolving landscape of global trade and manufacturing technology presents new opportunities for buyers across Africa, South America, the Middle East, and Europe. Embracing digital sourcing tools, sustainability initiatives, and regional sourcing strategies will be critical to maintaining agility and meeting evolving workforce safety standards.

Actionable takeaway: Proactively review and diversify your supply chain, invest in supplier relationships, and stay informed on regional trade policies to optimize your sourcing strategy. By doing so, international buyers can ensure a steady supply of high-quality vans work shoes, aligned with their operational and ethical goals, now and into the future.