Master Global Sourcing of Track and Shoes for Competitive

Guide to Track And Shoes

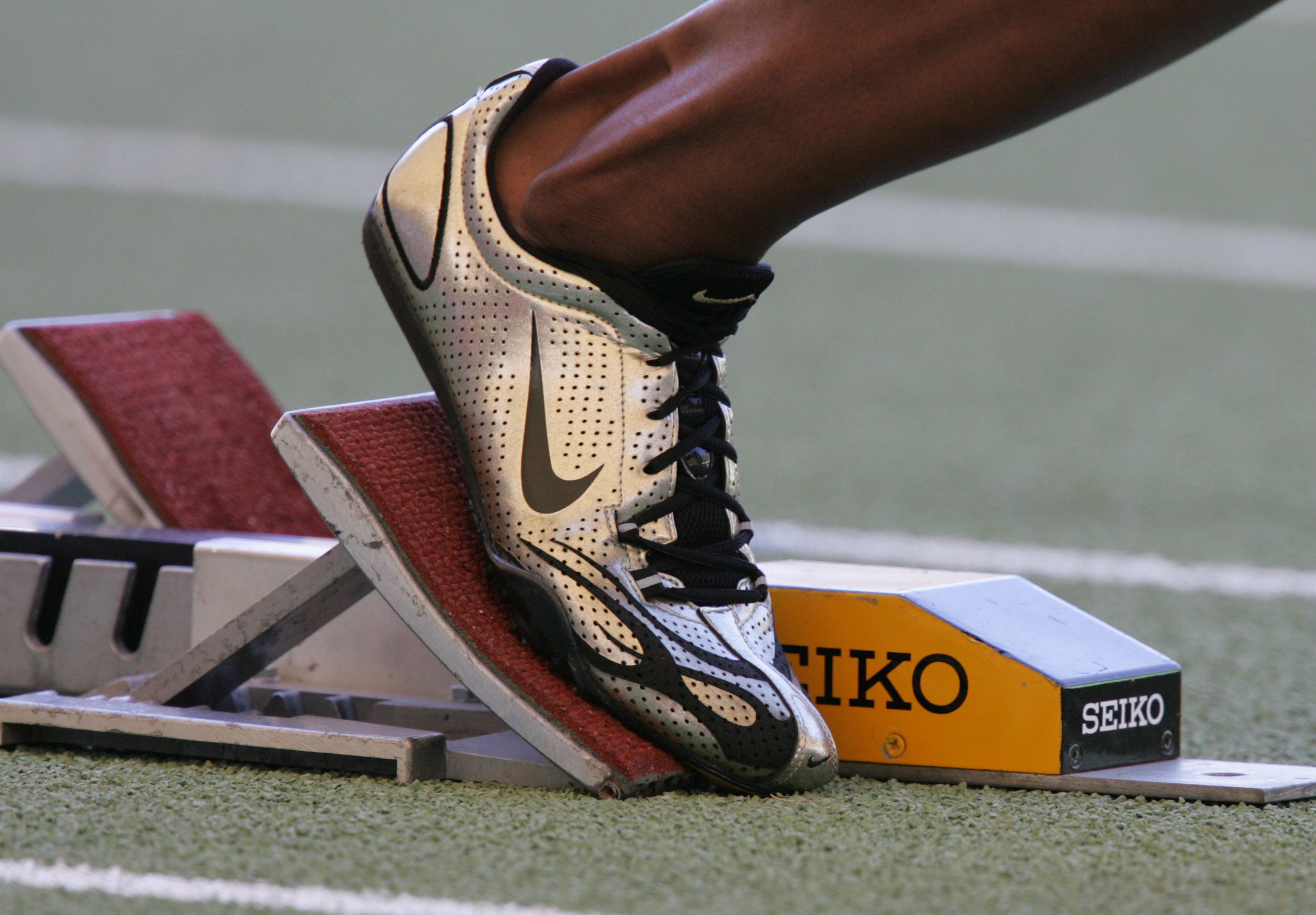

- Introduction: Navigating the Global Market for track and shoes

- Understanding track and shoes Types and Variations

- Key Industrial Applications of track and shoes

- Strategic Material Selection Guide for track and shoes

- In-depth Look: Manufacturing Processes and Quality Assurance for track and shoes

- Comprehensive Cost and Pricing Analysis for track and shoes Sourcing

- Spotlight on Potential track and shoes Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for track and shoes

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the track and shoes Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of track and shoes

- Strategic Sourcing Conclusion and Outlook for track and shoes

Introduction: Navigating the Global Market for track and shoes

In the highly competitive world of athletic footwear, track shoes represent a vital segment with significant growth potential across global markets. For B2B buyers, understanding the nuances of this industry—from key product types to sourcing strategies—is essential for gaining a competitive edge. The right partnerships can lead to superior product quality, cost efficiencies, and a stronger market presence, especially for buyers from regions like Africa, South America, the Middle East, and Europe, including Turkey and the UK.

This comprehensive guide offers invaluable insights into the entire ecosystem of track and shoes manufacturing and sourcing. It covers a wide spectrum—from the various types of track shoes suited for different athletic disciplines to the innovative materials driving performance and durability. The guide also delves into manufacturing best practices, quality control standards, and how to evaluate reliable suppliers globally.

By understanding market dynamics, cost considerations, and common challenges faced in sourcing, B2B buyers can make informed decisions that align with their strategic goals. Whether you’re seeking to establish new supplier relationships, optimize existing supply chains, or navigate regional trade regulations, this guide equips you with the knowledge to succeed.

Empowering you with actionable insights, this resource aims to streamline your sourcing process, minimize risks, and maximize value—ultimately helping you thrive in the global track and shoes market.

Understanding track and shoes Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Steel Track & Shoes | Heavy-duty, corrosion-resistant steel components | Heavy machinery, mining, industrial use | Durable and reliable; higher initial cost but long lifespan; heavy weight may increase transportation costs. |

| Rubber Track & Shoes | Flexible, lightweight rubber with embedded reinforcements | Construction, agriculture, forestry | Cost-effective and easy to install; less durable under extreme loads; suitable for moderate use. |

| Composite Track & Shoes | Mix of metal and synthetic materials for optimized performance | Urban construction, specialized equipment | Reduced weight and noise; higher manufacturing cost; excellent for applications requiring lower vibration. |

| Track & Shoes for Track-Type Equipment | Designed specifically for tracked vehicles like excavators and bulldozers | Construction, mining, forestry | High compatibility and performance; premium pricing; requires OEM-specific sourcing. |

| Custom-Designed Track & Shoes | Tailored specifications to match unique operational needs | Niche industries, bespoke machinery | Precise fit and performance; longer lead times; higher costs but optimized for specific tasks. |

Steel Track & Shoes

Steel tracks and shoes are the most robust and durable option, often used in heavy-duty applications such as mining, quarrying, and large-scale industrial machinery. They are designed to withstand extreme wear, corrosion, and harsh environments. For B2B buyers, sourcing high-quality steel components involves evaluating supplier certifications, material grades, and manufacturing standards. While they entail higher upfront costs, their longevity and minimal maintenance requirements make them cost-effective over the lifecycle. Logistics considerations include handling weight and ensuring compatibility with existing machinery.

Rubber Track & Shoes

Rubber tracks and shoes are favored in industries like construction, agriculture, and forestry, where moderate load-bearing capacity and mobility are essential. They are lightweight, easier to install, and cause less surface damage, making them ideal for sensitive terrains. Buyers should consider the load capacity, track width, and environmental conditions to select suitable rubber tracks. Cost-wise, they are more affordable than steel options but may require more frequent replacement in heavy-duty applications. Sourcing from reputable manufacturers ensures quality and consistent performance.

Composite Track & Shoes

Composite tracks combine metal and synthetic materials, offering a balanced mix of durability, weight reduction, and noise suppression. They are suitable for urban construction sites and applications where vibration and noise reduction are priorities. B2B buyers should assess the compatibility with existing equipment and the specific operational environment. Although they tend to have higher initial costs, their lower weight reduces transportation and installation expenses. They also tend to have better environmental resistance, making them a sustainable choice in certain markets.

Track & Shoes for Track-Type Equipment

Designed specifically for tracked vehicles like excavators, bulldozers, and loaders, these tracks are engineered for high performance under demanding conditions. They feature OEM-specific designs that ensure optimal fit and functionality. For buyers, establishing relationships with certified suppliers or OEM channels is crucial to guarantee quality and compatibility. While they are typically more expensive, their performance benefits and reduced downtime can justify the investment, especially in large-scale operations.

Custom-Designed Track & Shoes

Custom tracks and shoes are tailored to meet unique operational requirements, such as specialized terrain, load conditions, or machinery constraints. They are ideal for niche industries or bespoke equipment. B2B buyers should work closely with manufacturers to define specifications, quality standards, and lead times. Although they involve higher costs and longer lead times, the resulting performance optimization can significantly enhance operational efficiency and reduce overall lifecycle costs. Sourcing from experienced custom manufacturers ensures reliability and adherence to industry standards.

Key Industrial Applications of track and shoes

| Industry/Sector | Specific Application of track and shoes | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Mining and Quarries | Track systems for excavators, loaders, and haul trucks | Enhanced durability and stability in harsh environments, reducing downtime and maintenance costs | Material resistance to abrasive conditions, custom sizing, and availability of OEM-certified products |

| Construction & Heavy Machinery | Track shoes for bulldozers, graders, and cranes | Improved traction and load distribution, ensuring operational efficiency and safety | Compatibility with machinery models, weight capacity, and supplier support for customization |

| Agriculture | Track systems for agricultural machinery like harvesters and tractors | Reduced soil compaction, increased traction, and operational longevity | Adaptability to varying soil conditions, corrosion resistance, and regional supply options |

| Material Handling & Logistics | Track-driven conveyor systems and mobile platforms | Precise movement control, minimal wear, and low maintenance requirements | Precision engineering, compatibility with existing systems, and supply chain reliability |

| Oil & Gas Exploration | Track systems for drilling rigs and offshore equipment | High load capacity, resistance to extreme conditions, and reliable operation | Material certifications (e.g., API), corrosion resistance, and availability in remote locations |

Mining and Quarries

Track and shoes are vital in the mining sector, powering excavators, loaders, and haul trucks designed to operate in extreme conditions. These components must withstand abrasive materials, heavy loads, and continuous operation, making durability and high wear resistance crucial. International buyers, especially from Africa and South America, should prioritize sourcing from manufacturers with proven track records and OEM certifications to ensure compatibility and longevity. Custom sizing and material specifications may be necessary to meet specific operational demands, reducing downtime and maintenance costs.

Construction & Heavy Machinery

Heavy construction equipment relies heavily on robust track systems to ensure stability, traction, and operational efficiency on diverse terrains. Track shoes in this sector must handle heavy loads while providing excellent grip and reducing ground damage. For European and Middle Eastern markets, sourcing high-quality, customizable track components is essential to meet diverse project requirements and environmental conditions. Buyers should consider compatibility with existing machinery and supplier support for modifications or repairs to optimize lifecycle costs.

Agriculture

In agriculture, track systems enable machinery such as harvesters and tractors to operate efficiently across various soil types. These systems help minimize soil compaction, which is critical for crop yields, while providing superior traction in muddy or uneven fields. International buyers from regions with diverse soil conditions should seek track shoes with corrosion resistance and adaptable designs. Ensuring regional supply availability and compatibility with different machinery brands enhances operational uptime and reduces logistical challenges.

Material Handling & Logistics

Track-driven conveyor systems and mobile platforms depend on precise, low-wear track components to facilitate smooth, reliable movement of goods within warehouses and distribution centers. These applications demand high engineering precision, minimal maintenance, and compatibility with existing infrastructure. B2B buyers should focus on sourcing from suppliers with proven expertise in manufacturing custom track shoes that meet exact system specifications. Reliability in supply chains, especially for regional markets like Europe and the Middle East, is critical to avoiding operational disruptions.

Oil & Gas Exploration

In the oil and gas industry, especially for offshore drilling rigs and exploration equipment, track systems must endure extreme conditions including high pressure, corrosion, and heavy loads. These components need to be built from specialized materials, often API-certified, to ensure safety and durability in remote or harsh environments. International buyers from the Middle East and Africa should prioritize sourcing from suppliers with proven certifications, local support capabilities, and the ability to deliver custom solutions that meet strict industry standards. This approach minimizes operational risks and ensures continuous project progress.

Strategic Material Selection Guide for track and shoes

Material Analysis for Track and Shoes

Selecting appropriate materials for track and shoes is critical for ensuring product performance, durability, and compliance with international standards. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding the properties, advantages, and limitations of common materials helps optimize procurement decisions and manufacturing processes.

Steel Alloys (e.g., Carbon Steel, Stainless Steel)

Steel alloys are widely used in track and shoe components such as fasteners, structural frames, and reinforcement elements due to their high strength and durability. Carbon steel offers excellent mechanical properties at a relatively low cost, making it suitable for structural parts that require high load-bearing capacity. Stainless steel, with its corrosion-resistant properties, is ideal for applications exposed to moisture or aggressive environments, such as coastal regions or humid climates.

Illustrative Image (Source: Google Search)

Pros:

– High strength and toughness

– Good corrosion resistance (stainless steel)

– Widely available and standardized (e.g., ASTM, DIN)

Cons:

– Heavier than alternative materials, impacting weight-sensitive applications

– Manufacturing complexity increases with alloy grade, especially for stainless variants

– Cost varies significantly, with stainless steel being more expensive

Impact on Application:

Steel components are suitable for structural and load-bearing parts, especially where durability and safety are priorities. They are compatible with various media, including water and chemicals, provided corrosion resistance is considered.

International Considerations:

Buyers from Africa and South America should consider local steel standards and import tariffs. European and Middle Eastern markets often require compliance with strict standards like ASTM or EN, influencing material choice and certification requirements.

Aluminum Alloys

Aluminum alloys are favored for their lightweight properties, making them ideal for shoe frames, support structures, and certain track components where reducing weight enhances performance, especially in high-speed or portable applications. Aluminum also exhibits good corrosion resistance, particularly when alloyed with elements like magnesium or silicon.

Pros:

– Lightweight, improving overall product performance

– Good corrosion resistance, especially in marine or humid environments

– Easier to machine and assemble than steel

Cons:

– Lower strength compared to steel, limiting use in high-stress areas

– More expensive than basic steel alloys

– Susceptible to fatigue and wear over time

Impact on Application:

Aluminum is suitable for components where weight reduction is critical, such as in portable or high-speed track systems. It performs well in environments with exposure to moisture but may require surface treatments for enhanced durability.

International Considerations:

Buyers should verify alloy grades and compliance with regional standards like JIS or EN. Cost considerations are vital for markets with limited manufacturing budgets, and sourcing from regions with established aluminum industries can reduce lead times.

Elastomers and Polymers (e.g., Rubber, Polyurethane)

Elastomers and polymers are integral to the footwear portion of track and shoes, providing cushioning, flexibility, and grip. Rubber and polyurethane are common choices, with properties tailored to specific media and usage conditions.

Pros:

– Excellent shock absorption and flexibility

– Good grip and slip resistance

– Resistant to many chemicals and environmental factors

Cons:

– Wear over time, especially under heavy or abrasive use

– Susceptible to temperature extremes, affecting performance

– Manufacturing complexity varies with formulation

Impact on Application:

These materials are essential for the sole and tread areas, where comfort and grip are paramount. Compatibility with different media, such as oils or water, depends on formulation specifics.

International Considerations:

Buyers should ensure compliance with safety and environmental standards like REACH or RoHS. Variations in quality and formulation across regions can impact product lifespan and performance, so sourcing from reputable suppliers is advisable.

Summary Table

| Material | Typical Use Case for track and shoes | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel Alloys (e.g., Carbon Steel, Stainless Steel) | Structural frames, fasteners, reinforcement components | High strength, durability, corrosion resistance (stainless) | Heavier, manufacturing complexity, variable cost | Low to High (depending on grade) |

| Aluminum Alloys | Lightweight structural parts, support frames | Light weight, corrosion resistance, ease of machining | Lower strength, higher cost, fatigue susceptibility | Medium |

| Elastomers and Polymers | Shoe soles, tread, cushioning components | Shock absorption, grip, flexibility | Wear over time, temperature sensitivity | Low to Medium |

This comprehensive understanding of material properties and their international considerations equips B2B buyers to make informed procurement decisions, ensuring their products meet performance, compliance, and cost expectations across diverse markets.

In-depth Look: Manufacturing Processes and Quality Assurance for track and shoes

Manufacturing Processes for Track and Shoes

The manufacturing of tracks and shoes involves a complex sequence of carefully controlled stages, each crucial to ensuring product performance, durability, and safety. For B2B buyers, understanding these stages helps in assessing supplier capabilities and quality consistency.

Material Preparation

The process begins with sourcing high-quality raw materials tailored to the specific demands of tracks and shoes. Common materials include rubber compounds, thermoplastics, textiles, and specialized adhesives. Suppliers often utilize proprietary formulations to optimize properties like elasticity, wear resistance, and weatherability. Verification of material quality is essential; B2B buyers should request material certifications, test reports, and supplier declarations aligned with international standards such as ISO 9001.

Forming and Molding

Forming involves shaping raw materials into the desired component forms. Techniques include injection molding, compression molding, extrusion, and calendaring, depending on the product part. For tracks, rubber and thermoplastic elastomers are processed through extrusion and vulcanization, while shoe soles often undergo injection molding for precise dimensions and surface textures.

This stage demands tight control over parameters like temperature, pressure, and curing time. Advanced manufacturing facilities utilize computer-aided design (CAD) and computer-aided manufacturing (CAM) systems to ensure precision and repeatability. For critical components, suppliers should employ ISO 9001-compliant procedures and document process controls meticulously.

Assembly

Assembly integrates various components—such as soles, uppers, reinforcement layers, and fastening elements—into the final product. Automated assembly lines, robotic systems, and manual labor are combined to ensure accuracy and efficiency. For footwear, stitching, adhesive bonding, and heat sealing are common techniques, while for tracks, vulcanization and bonding are key.

B2B buyers should verify whether suppliers follow standardized assembly protocols, maintain traceability, and implement lean manufacturing principles to minimize defects. Documentation of assembly processes, including process flowcharts and control plans, is vital for quality assurance.

Finishing and Packaging

The final stages involve surface finishing, quality inspection, and packaging. Finishing processes may include surface cleaning, painting, texturing, or applying protective coatings. Quality checks at this stage ensure dimensional accuracy, surface integrity, and functional performance.

Illustrative Image (Source: Google Search)

Proper packaging is critical to prevent damage during international shipping. Suppliers should adhere to packaging standards that comply with international freight regulations, including appropriate cushioning, moisture barriers, and labeling.

Quality Control (QC) in Manufacturing

Effective QC is fundamental to ensuring that track and shoe products meet both industry standards and client specifications. B2B buyers should understand the layers of inspection and testing involved, as well as how to verify supplier compliance.

International and Industry Standards

- ISO 9001: Most reputable manufacturers operate under ISO 9001, which emphasizes a systematic approach to quality management, process consistency, and continuous improvement.

- CE Marking: For European markets, CE certification indicates compliance with health, safety, and environmental directives.

- Industry-specific certifications: For example, API standards for industrial footwear or specialized testing for sports tracks.

Understanding these certifications helps B2B buyers gauge supplier credibility and adherence to global benchmarks.

Inspection Points and Testing Methods

- Incoming Quality Control (IQC): Raw materials are inspected upon receipt for conformity to specifications, including physical, chemical, and mechanical properties. Techniques include spectroscopy, hardness testing, and batch sampling.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing ensures process stability. Techniques involve dimensional checks, visual inspections, and functional tests like adhesion strength or flexibility.

- Final Quality Control (FQC): Before shipment, products undergo comprehensive testing—such as tensile strength, wear resistance, UV stability, and slip resistance—to verify compliance with standards like ASTM, ISO, or industry-specific benchmarks.

Common testing methods include durometer hardness tests, tensile testing, abrasion resistance tests, and environmental aging simulations. For tracks, additional testing for impact resistance and surface uniformity is vital.

Verifying Supplier QC Processes

B2B buyers should request detailed QC documentation, including test reports, inspection records, and certification copies. Conducting third-party audits and inspections is highly recommended, especially when dealing with new or unfamiliar suppliers. Engaging reputable inspection agencies—such as SGS, Bureau Veritas, or Intertek—can provide unbiased assessments of manufacturing facilities and product quality.

QC Nuances for International Buyers

Buyers from Africa, South America, the Middle East, and Europe must consider logistical and regulatory differences that influence QC practices. For example:

- Documentation language and standards: Ensure reports are available in accessible languages and align with local regulations.

- Certification recognition: Verify that certifications like ISO 9001 or CE are valid and recognized within the target market.

- Traceability and batch control: International buyers should insist on comprehensive traceability for each batch, facilitating recalls or investigations if needed.

- Cultural and communication factors: Establish clear communication channels and quality expectations upfront to prevent misunderstandings.

Practical Tips for B2B Buyers

- Conduct supplier audits: Schedule on-site visits or engage third-party inspectors to evaluate manufacturing capabilities, cleanliness, equipment calibration, and QC procedures.

- Request detailed QC reports: Ensure reports include test methods, results, and compliance statements aligned with relevant standards.

- Sample testing: Before bulk orders, request and test samples under your own conditions or through third-party labs to validate quality claims.

- Establish quality agreements: Clearly define quality expectations, inspection rights, and documentation requirements in contractual agreements.

- Monitor ongoing compliance: Implement a system for periodic audits and review of supplier QC reports to maintain consistent quality over time.

By thoroughly understanding the manufacturing and QC landscape, B2B buyers from diverse regions can make informed sourcing decisions, reduce risks, and foster long-term supplier relationships rooted in quality assurance.

Comprehensive Cost and Pricing Analysis for track and shoes Sourcing

Cost Structure Breakdown

Understanding the comprehensive cost structure for track and shoes is vital for international B2B buyers aiming to optimize procurement and negotiate effectively. The primary cost components include:

-

Materials: High-quality synthetic leathers, mesh fabrics, rubber, and specialized foam are standard. Material costs can fluctuate based on quality, origin, and certifications (e.g., eco-labels, safety standards). For instance, premium materials or eco-friendly options tend to increase costs but can justify higher retail pricing or meet specific market demands.

-

Labor: Manufacturing labor costs vary significantly across regions. Turkey, for example, offers competitive yet skilled labor, often at lower wages than Europe. In contrast, Asian factories might offer even lower wages but with varying quality levels. It’s essential to evaluate the balance between cost and quality when selecting suppliers.

-

Manufacturing Overheads: These include machinery depreciation, energy, and factory expenses. Well-established factories with advanced automation may have higher overheads but often deliver more consistent quality.

-

Tooling & Setup Costs: Initial moldings and tooling for customized designs or specific sole units can be substantial, especially for low-volume orders. These costs are typically amortized over the order volume, making larger quantities more cost-effective.

-

Quality Control (QC): Rigorous QC processes are crucial for international shipments to ensure compliance with standards and reduce returns or rework costs. Engaging third-party inspectors or leveraging supplier QC certifications can influence overall costs.

-

Logistics & Freight: Shipping costs depend on order volume, destination, and chosen Incoterms. Bulk shipments via sea are generally more economical but longer in transit, while air freight offers speed at a premium. Customs duties and import taxes further impact total landed costs.

-

Profit Margin & Markup: Suppliers typically incorporate a margin to cover risks and ensure profitability. Negotiating volume discounts or favorable payment terms can help reduce effective costs.

Price Influencers and Variability

Several factors significantly influence the final pricing of track and shoes:

-

Order Volume & MOQ: Larger orders benefit from economies of scale, reducing per-unit costs. Many suppliers offer tiered pricing, with discounts for orders exceeding certain quantities.

-

Specifications & Customization: Unique designs, specialized materials, or custom branding increase costs. High customization often entails higher tooling expenses and longer lead times.

-

Material Choices: Premium or imported materials cost more but can enhance product appeal and compliance with certifications, which is particularly relevant for markets demanding sustainability or safety standards.

-

Quality & Certifications: Meeting international standards (e.g., ISO, REACH, ASTM) may involve additional testing and certification costs but can open access to premium markets.

-

Supplier Factors: Established suppliers with reliable quality records may charge higher prices but reduce risks associated with delays or defective products. New entrants might offer lower prices but with increased uncertainty.

-

Incoterms & Logistics: Terms like FOB (Free On Board) or CIF (Cost, Insurance, Freight) influence who bears shipping costs and risks. Buyers should consider total landed cost rather than just unit price.

Strategic Buyer Tips

-

Negotiate for Volume Discounts & Flexible Terms: Building long-term relationships can unlock better pricing, especially for recurring large orders. Don’t shy away from requesting discounts or favorable payment terms, particularly when sourcing from regions like Turkey or Eastern Europe.

-

Focus on Total Cost of Ownership: Beyond unit price, consider shipping, customs, inspection, and potential rework costs. A cheaper product upfront might incur higher logistics or compliance expenses, eroding savings.

-

Leverage Multiple Suppliers & Competitive Bidding: Diversify sourcing to avoid dependency on a single supplier and foster competitive pricing. Request detailed quotes with clear specifications for comparison.

-

Understand Pricing Nuances: Be aware that low initial quotes may exclude certain costs like tooling or certifications. Clarify what is included to avoid surprises later.

-

Market-Specific Considerations: For buyers from Africa, South America, or the Middle East, factor in import duties and regional standards. European buyers should prioritize compliance with EU regulations, which might influence material and process choices.

Price Range Indicators (Indicative)

- Basic Track and Shoes (standard quality, bulk order): $15–$30 per pair

- Mid-range (better materials, branding options): $30–$50 per pair

-

Premium (custom designs, high-performance materials): $50–$80+ per pair

-

Note:* These ranges are approximate and subject to fluctuations based on order volume, specifications, and supplier region. Always request detailed quotes tailored to your specific needs.

By thoroughly analyzing these components and factors, international B2B buyers can make more informed sourcing decisions, negotiate better terms, and optimize the total cost for track and shoes procurement.

Spotlight on Potential track and shoes Manufacturers and Suppliers

- (No specific manufacturer data was available or requested for detailed profiling in this section for track and shoes.)*

Essential Technical Properties and Trade Terminology for track and shoes

Critical Technical Properties for Track and Shoes

1. Material Grade and Composition

The selection of materials—such as steel, aluminum, or specialized alloys—directly impacts durability, weight, and corrosion resistance. Higher-grade materials typically offer better performance and longevity, which is crucial for heavy-duty industrial applications. B2B buyers should specify material standards (e.g., ASTM, ISO) to ensure supplier consistency and quality compliance across international markets.

2. Load Capacity and Tolerance

This property defines the maximum weight the track or shoes can support without deformation or failure. Precise tolerance levels—such as ±0.1 mm—are vital to ensure compatibility with machinery and prevent operational issues. Buyers must verify these specifications align with their equipment requirements to avoid costly modifications or replacements.

3. Wear Resistance and Coatings

Durability is key for components subjected to continuous movement and friction. Wear-resistant coatings, such as hard chrome or ceramic layers, extend service life and reduce maintenance costs. Understanding the expected operational environment helps buyers select appropriate coatings, especially when operating in corrosive or abrasive conditions.

4. Dimensional Accuracy and Fit

Exact dimensions ensure seamless integration with existing machinery, minimizing downtime and assembly issues. Tolerance levels for width, height, and hole placements must be specified clearly. Accurate dimensions facilitate easier procurement, reduce rework, and ensure reliable performance over time.

5. Surface Finish Quality

A smooth, defect-free surface finish reduces friction and wear, improving efficiency and lifespan. Surface roughness standards (e.g., Ra values) should be specified based on operational demands. Buyers should confirm that suppliers adhere to these standards to prevent premature failure.

6. Temperature and Environmental Resistance

Depending on application environments, components may need resistance to extreme temperatures, moisture, or chemicals. Material and coating choices should reflect these conditions to maintain integrity and performance, especially in harsh climates common in Africa, South America, and the Middle East.

Common Trade Terms for Track and Shoes

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce components or products for branding and resale by other firms. Understanding OEM relationships helps buyers identify reliable manufacturers and avoid counterfeit or substandard parts, especially when sourcing internationally.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell in a single order. Recognizing MOQ is essential for planning procurement budgets and inventory levels, particularly when entering new markets or establishing long-term supply agreements.

3. RFQ (Request for Quotation)

A formal process where buyers solicit price and lead-time estimates from multiple suppliers. An RFQ helps compare offers accurately, ensuring competitive pricing and terms—key for international buyers managing currency fluctuations and import costs.

4. Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, DDP) that specify responsibilities for shipping, insurance, and customs clearance. Clear understanding of Incoterms minimizes misunderstandings, delays, and unexpected costs during cross-border transactions.

5. Lead Time

The period between order placement and product delivery. Knowing lead times helps buyers coordinate production schedules and inventory management, especially critical in markets with logistical challenges like remote regions in Africa or South America.

6. Certification and Compliance Standards

International standards (ISO, ASTM, CE) ensure products meet safety, quality, and environmental requirements. Verifying supplier compliance reduces risks associated with non-conformance and facilitates smoother customs clearance in different regions.

Actionable Insights for B2B Buyers:

– Prioritize clear communication of technical specifications, especially material quality and dimensional tolerances, to avoid costly rework.

– Use RFQs and detailed specifications to compare suppliers effectively, considering lead times and MOQ constraints for planning.

– Understand Incoterms thoroughly to manage shipping responsibilities and costs, particularly when dealing with multiple countries with varying customs procedures.

– Verify certifications early in the procurement process to ensure compliance with local regulations and quality expectations, reducing the risk of delays or penalties.

By mastering these technical properties and trade terms, international buyers can streamline procurement processes, ensure product reliability, and foster successful supplier relationships across diverse markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the track and shoes Sector

Market Overview & Key Trends

The global track and shoes sector is experiencing dynamic shifts driven by technological innovation, consumer demand for performance and sustainability, and evolving supply chain strategies. Key drivers include the rise of e-commerce platforms facilitating international B2B transactions, increased focus on product customization, and the integration of smart materials and wearable technology. Emerging sourcing trends emphasize nearshoring and regional supply chains, especially as geopolitical uncertainties and tariffs impact traditional manufacturing hubs.

For international B2B buyers from Africa, South America, the Middle East, and Europe—particularly Turkey and the UK—understanding these trends is crucial. These regions are witnessing increased investment in local manufacturing capabilities, driven by government incentives and consumer preferences for locally sourced products. Additionally, digital platforms and data analytics are enabling more efficient sourcing, inventory management, and demand forecasting, reducing lead times and costs.

Market dynamics are also shaped by the demand for high-performance, durable, and lightweight materials suited for competitive sports and casual wear. The adoption of innovative materials such as recycled fibers, bio-based synthetics, and advanced cushioning technologies is on the rise, aligning with consumer preferences for eco-friendly products. Moreover, transparency and traceability are becoming vital, with B2B buyers seeking suppliers that can demonstrate compliance with quality standards and ethical practices.

Overall, successful market navigation requires staying abreast of technological advancements, regional manufacturing capabilities, and shifting consumer expectations. Building strong relationships with local suppliers and leveraging digital sourcing tools can provide competitive advantages in this evolving landscape.

Illustrative Image (Source: Google Search)

Sustainability & Ethical Sourcing in B2B

Sustainability has become a central pillar in the track and shoes industry, influencing procurement strategies and supplier evaluations. Environmental impacts such as high water consumption, chemical use, and waste generation are prompting brands and buyers to prioritize eco-friendly materials and processes. The shift towards circular economy principles—recycling, reusing, and designing for disassembly—is gaining momentum, reducing the sector’s ecological footprint.

For B2B buyers from regions like Africa, South America, the Middle East, and Europe, sourcing from suppliers with strong sustainability credentials offers multiple benefits. Certified materials such as recycled polyester, organic cotton, and bio-based synthetics not only meet environmental standards but also appeal to increasingly conscious consumers. Additionally, certifications like Global Organic Textile Standard (GOTS), OEKO-TEX, and Bluesign provide assurance of ethical manufacturing and chemical safety, fostering transparency and trust in supply chains.

Implementing ethical sourcing practices is equally critical. This includes ensuring fair labor conditions, preventing child labor, and supporting local communities. Establishing supplier audits and engaging with partners committed to social responsibility can mitigate risks and enhance brand reputation. Green logistics—such as optimizing transportation routes and using low-emission shipping methods—further reduces environmental impact.

In summary, integrating sustainability and ethical considerations into sourcing strategies is no longer optional but essential. It can differentiate products in competitive markets, meet regulatory requirements, and align with global consumer values, ultimately supporting long-term business resilience.

Brief Evolution/History (Optional)

Historically, the track and shoes sector was predominantly driven by manufacturing cost advantages, with many brands outsourcing production to low-cost regions. Over time, there has been a significant shift towards innovation, performance enhancement, and sustainability. The adoption of advanced materials and manufacturing techniques—such as 3D printing and smart textiles—has transformed product development and sourcing strategies.

This evolution reflects a broader industry trend where B2B buyers now prioritize transparency, sustainability, and technological integration. Countries like Turkey, which has developed a robust textile and footwear manufacturing ecosystem, have become key regional hubs, balancing cost efficiency with quality and sustainability standards. Meanwhile, European markets are leading in adopting eco-friendly materials and ethical sourcing certifications.

Understanding this historical trajectory helps B2B buyers appreciate the importance of aligning with suppliers who have evolved alongside market demands. It also underscores the value of investing in supplier development and fostering partnerships rooted in innovation and shared sustainability goals, ensuring competitiveness in a rapidly changing sector.

Frequently Asked Questions (FAQs) for B2B Buyers of track and shoes

1. How can I effectively vet and select reliable suppliers for track and shoes internationally?

To ensure supplier reliability, start with comprehensive background checks: verify business licenses, certifications, and references from previous clients. Request samples to assess quality firsthand and ask for detailed product catalogs and compliance documents. Use third-party verification platforms or trade associations to confirm supplier legitimacy. Engage in transparent communication to gauge responsiveness and professionalism. Conduct virtual factory audits or consider visiting suppliers if feasible. Establish clear criteria for quality, lead times, and payment terms upfront. Building strong supplier relationships based on transparency and trust minimizes risks and ensures consistent product quality.

2. What customization options are typically available, and how do they impact lead times and costs?

Most suppliers offer customization options such as branding (logos, labels), color schemes, materials, and design modifications. These options allow you to tailor products to your market needs, boosting brand differentiation. However, customization usually extends lead times by 2-4 weeks and may incur additional costs, especially for complex designs or small order quantities. To optimize costs and timelines, specify your requirements clearly early in negotiations and request detailed quotes. Working with suppliers experienced in customization can help streamline the process and avoid unexpected delays or expenses.

3. What are typical MOQ (Minimum Order Quantities), lead times, and payment terms for international trade?

MOQ varies widely depending on supplier size and product complexity but generally ranges from 500 to 5,000 pairs for shoes and a similar range for track components. Lead times typically span 4-12 weeks, factoring in production and shipping. Payment terms often include a 30-50% upfront deposit with the balance payable before shipment or upon receipt. Some suppliers may offer flexible arrangements for repeat orders or larger volumes. Negotiating payment terms that include letters of credit or escrow services can enhance security, especially for first-time transactions.

4. What certifications and quality assurance standards should I verify before placing an order?

Key certifications include ISO standards, CE marking (for European markets), and specific safety standards relevant to athletic footwear and track equipment. Verify that suppliers adhere to recognized quality management systems like ISO 9001. Request quality control reports, factory audits, or third-party inspection certificates before finalizing deals. Establish clear quality benchmarks and include inspection clauses in contracts. Ensuring compliance with international safety and environmental standards reduces the risk of customs delays, product recalls, and reputational damage.

5. How can I optimize logistics and shipping when importing track and shoes to my country?

Start by selecting suppliers experienced in international logistics and familiar with your destination country’s import regulations. Choose shipping methods based on cost, speed, and volume—air freight for urgent shipments or sea freight for larger, less time-sensitive orders. Negotiate Incoterms (e.g., FOB, CIF) that clearly define responsibilities and costs. Partner with reliable freight forwarders who handle customs clearance, documentation, and warehousing. Consider consolidating shipments to reduce costs and ensure proper packaging to prevent damages. Staying updated on import tariffs and duties ensures smoother clearance and cost management.

6. How should I handle disputes or quality issues with international suppliers?

Establish clear dispute resolution clauses in contracts, preferably specifying arbitration in a neutral jurisdiction or international trade bodies. Maintain detailed documentation of all communications, inspections, and quality reports to support claims. If issues arise, communicate promptly and professionally with suppliers, providing evidence of discrepancies. Negotiate corrective actions such as replacements, refunds, or discounts. Building strong, transparent relationships can facilitate amicable resolutions. Consider engaging legal or trade consultants experienced in international commerce to navigate complex disputes effectively.

7. What are the critical factors to consider when sourcing track and shoes from regions like Africa, South America, the Middle East, or Europe?

Key factors include regional manufacturing capabilities, cost competitiveness, and quality standards. Regions like Turkey and Europe often offer high-quality products with reliable certifications, while Africa and South America may provide cost advantages but require thorough vetting. Assess infrastructure, supplier experience with international markets, and compliance with your target markets’ standards. Be mindful of potential logistical challenges, such as port congestion or customs delays, and plan accordingly. Establishing local partnerships or agents can improve communication and oversight in regions with language or cultural differences.

8. How can I ensure ongoing supplier compliance with international standards and sustainability practices?

Integrate compliance requirements into your supplier agreements, emphasizing adherence to environmental, social, and safety standards. Conduct periodic audits, either directly or via third-party inspectors, to verify ongoing compliance. Request sustainability certifications like SA8000 or BSCI audits, especially if eco-friendly or ethical sourcing is a priority. Foster transparent communication channels and provide feedback to encourage continuous improvement. Building long-term relationships based on shared values and compliance reduces risks of violations, enhances brand reputation, and meets increasingly strict import regulations across your markets.

Strategic Sourcing Conclusion and Outlook for track and shoes

Conclusion and Future Outlook

Effective strategic sourcing in the track and shoes industry is essential for international B2B buyers seeking competitive advantage, quality assurance, and supply chain resilience. By diversifying sourcing regions, fostering strong supplier relationships, and prioritizing innovation, buyers can mitigate risks associated with geopolitical shifts, tariffs, and fluctuating raw material costs. Emphasizing transparency and sustainability also enhances brand reputation and aligns with global market expectations.

Looking ahead, the industry is poised for continued technological integration, such as automation and smart manufacturing, which can improve efficiency and product customization. Emerging markets in Africa, South America, the Middle East, and parts of Europe like Turkey and the UK present valuable opportunities for strategic partnerships, offering both cost advantages and access to unique materials or craftsmanship.

International B2B buyers should leverage comprehensive market intelligence and build flexible, resilient supply networks to capitalize on these opportunities. Proactively engaging with innovative suppliers and staying informed about industry trends will be critical for maintaining a competitive edge. Embrace strategic sourcing as a dynamic tool to navigate future challenges and unlock sustained growth in the global track and shoes market.