Your Ultimate Guide to Sourcing Hotter Shoes Shoes

Guide to Hotter Shoes Shoes

- Introduction: Navigating the Global Market for hotter shoes shoes

- Understanding hotter shoes shoes Types and Variations

- Key Industrial Applications of hotter shoes shoes

- Strategic Material Selection Guide for hotter shoes shoes

- In-depth Look: Manufacturing Processes and Quality Assurance for hotter shoes shoes

- Comprehensive Cost and Pricing Analysis for hotter shoes shoes Sourcing

- Spotlight on Potential hotter shoes shoes Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for hotter shoes shoes

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hotter shoes shoes Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of hotter shoes shoes

- Strategic Sourcing Conclusion and Outlook for hotter shoes shoes

Introduction: Navigating the Global Market for hotter shoes shoes

In the highly competitive and dynamic footwear industry, hotter shoes shoes have emerged as a key product segment, blending innovative design with consumer demand for style and comfort. For international B2B buyers—particularly from regions like Africa, South America, the Middle East, and Europe—understanding the nuances of this market is essential for successful sourcing and strategic growth. As consumer preferences evolve rapidly, suppliers who can deliver quality, trend-aligned products at competitive prices hold a significant advantage.

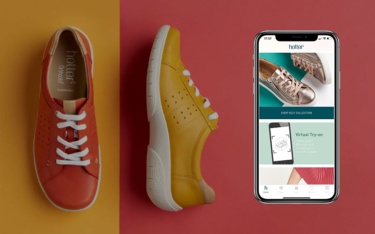

Illustrative Image (Source: Google Search)

This comprehensive guide is designed to empower you with actionable insights across critical areas including product varieties, materials, manufacturing processes, quality control, supplier selection, and cost considerations. Additionally, it addresses market trends, regulatory considerations, and frequently asked questions to streamline your decision-making process. Whether you’re seeking innovative designs from Asia, reliable manufacturing partners in Europe, or cost-effective options from emerging markets, this guide provides the tools necessary to navigate the complex global supply chain effectively.

By leveraging this knowledge, B2B buyers can make informed sourcing decisions, mitigate risks, and capitalize on emerging opportunities within the hotter shoes shoes market. Tailored to the needs of buyers from diverse regions, this resource aims to optimize your procurement strategy and foster long-term partnerships that align with your business goals in an increasingly interconnected global marketplace.

Understanding hotter shoes shoes Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Traditional Leather Shoes | Made from genuine leather, classic design, often hand-crafted | Footwear manufacturing, wholesale, retail | Pros: Durable, premium feel; Cons: Higher cost, longer lead times |

| Synthetic Material Shoes | Constructed from synthetic fibers or plastics, lightweight | Mass production, fast fashion, promotional items | Pros: Cost-effective, versatile; Cons: Less durable, environmental concerns |

| Athletic/Performance Shoes | Designed with specialized cushioning and support, often with mesh uppers | Sportswear, corporate wellness programs | Pros: High performance, innovation-driven; Cons: Niche market, higher price |

| Eco-Friendly/ Sustainable Shoes | Made from recycled or organic materials, focus on sustainability | Niche eco-conscious markets, premium retail | Pros: Growing market segment, brand differentiation; Cons: Higher production costs |

| Custom/Private Label Shoes | Customized designs, branding options, private label manufacturing | Brand partnerships, retail chains | Pros: Brand control, higher margins; Cons: Requires MOQ, longer setup time |

Traditional Leather Shoes

Traditional leather shoes are characterized by their high-quality genuine leather upper and often handcrafted construction. They are highly valued in formal and luxury markets, making them suitable for premium retail and wholesale distribution. B2B buyers should consider the quality of leather, production lead times, and compliance with regional import standards, especially for markets like Europe and Argentina. While they command higher prices, their durability and classic appeal support long-term branding strategies. Sourcing from reputable suppliers ensures consistent quality and helps mitigate risks related to counterfeit or substandard products.

Synthetic Material Shoes

Synthetic shoes utilize advanced plastics and fibers, making them lightweight and cost-efficient. These shoes are ideal for mass-market applications, promotional giveaways, or fast fashion segments in Africa and South America where affordability is critical. B2B buyers benefit from lower production costs and rapid turnaround times, enabling quick inventory replenishment. However, synthetic shoes often face scrutiny over environmental impacts and durability concerns. Buyers should evaluate supplier transparency regarding sustainable practices and consider the end-use environment to ensure product longevity.

Athletic/Performance Shoes

Designed with a focus on comfort, support, and innovative materials such as gel inserts and breathable mesh, athletic shoes target sportswear and active lifestyle markets. These shoes are suitable for wholesale to sports retailers or corporate wellness programs across Europe and the Middle East. B2B buyers should prioritize suppliers with proven R&D capabilities and quality control processes to ensure product performance and safety standards. While typically priced higher, these shoes can command premium margins in niche markets, especially if aligned with emerging health and fitness trends.

Eco-Friendly/Sustainable Shoes

This category emphasizes environmentally conscious manufacturing using recycled plastics, organic textiles, and biodegradable materials. Growing demand in Europe, South America, and Middle East markets for sustainable products makes these shoes attractive for premium retail and eco-focused distributors. B2B buyers should assess supplier certifications, material traceability, and compliance with international environmental standards. While production costs are higher, the differentiation and positive brand association can justify premium pricing, appealing to increasingly eco-aware consumers.

Custom/Private Label Shoes

Offering tailored designs and branding options, private label shoes enable brands and retailers to expand their product portfolios with minimal investment in manufacturing infrastructure. Suitable for retail chains and brand partnerships in all target regions, these shoes provide control over design, packaging, and pricing. Buyers should consider minimum order quantities, lead times, and supplier capabilities in customization. Establishing strong supplier relationships ensures consistent quality and timely delivery, vital for maintaining brand reputation and customer satisfaction.

Key Industrial Applications of hotter shoes shoes

| Industry/Sector | Specific Application of hotter shoes shoes | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Oil & Gas | Pipeline sealing and maintenance | Ensures high-pressure, leak-proof seals in corrosive environments, reducing downtime and safety risks | Material compatibility with hydrocarbons, API certifications, temperature resistance |

| Chemical Processing | Reactor and vessel insulation or sealing | Maintains containment integrity under aggressive chemical conditions, preventing leaks and contamination | Chemical resistance, compliance with industry standards, durability under thermal cycling |

| Power Generation | Turbine and boiler component protection | Provides reliable thermal insulation and sealing, enhancing efficiency and safety | High-temperature tolerance, corrosion resistance, certifications for industrial use |

| Heavy Machinery & Construction | Sealing solutions for hydraulic systems and heavy equipment | Extends equipment lifespan, prevents fluid leaks, and reduces maintenance costs | Mechanical strength, compatibility with hydraulic media, ease of installation |

| Aerospace & Defense | Sealing and insulation in aerospace components | Supports lightweight, high-performance sealing in critical systems, ensuring safety and reliability | Strict aerospace standards, lightweight materials, high-temperature endurance |

Oil & Gas Industry Applications

Hotter shoes shoes are critical in the oil and gas sector, particularly for pipeline sealing and maintenance. They are used to create high-pressure, leak-proof seals in pipelines transporting hydrocarbons, often in harsh environments with extreme temperatures and corrosive substances. International B2B buyers from Africa, South America, the Middle East, and Europe must prioritize sourcing materials that meet API standards and exhibit excellent chemical and thermal resistance. Proper selection ensures operational safety, reduces costly downtime, and extends the lifespan of pipeline infrastructure.

Chemical Processing Applications

In chemical plants, hotter shoes shoes serve as vital components for reactor and vessel insulation or sealing. They provide a barrier against aggressive chemicals and extreme thermal conditions, maintaining containment integrity and preventing leaks that could lead to safety hazards or environmental contamination. For B2B buyers, especially in regions with diverse chemical industries like Argentina or France, sourcing options should emphasize chemical resistance, compliance with industry standards, and durability under thermal cycling. This ensures continuous operation and regulatory adherence.

Power Generation Applications

Within power plants, hotter shoes shoes are used to insulate turbines and boilers, protecting sensitive components from thermal stress and preventing leaks. They contribute to operational efficiency by maintaining optimal thermal conditions and reducing energy loss. International buyers from the Middle East and Europe should focus on sourcing high-temperature tolerant, corrosion-resistant materials that meet industry certifications. Reliable sealing solutions help mitigate maintenance costs and enhance overall plant safety.

Heavy Machinery & Construction Applications

In heavy machinery and construction, hotter shoes shoes are employed for sealing hydraulic systems and other critical components. They prevent fluid leaks, which can cause machinery failure or safety issues, thereby extending equipment life and reducing downtime. Buyers from Africa and South America should consider sourcing solutions with robust mechanical strength, compatibility with hydraulic media, and ease of installation. These factors ensure reliable performance in demanding operational environments.

Aerospace & Defense Applications

In aerospace and defense sectors, hotter shoes shoes are used for sealing and insulation within lightweight, high-performance systems. They support safety and reliability by providing effective sealing under extreme conditions while minimizing weight. For international B2B buyers, strict adherence to aerospace standards, lightweight material options, and high-temperature endurance are essential. Proper sourcing ensures compliance with regulatory requirements and optimal system performance in critical applications.

Strategic Material Selection Guide for hotter shoes shoes

Material Analysis for Hotter Shoes Shoes

Selecting appropriate materials for hotter shoes shoes requires a careful balance of performance, durability, cost, and compliance with international standards. Below, we analyze four common materials used in the manufacturing of components for hotter shoes shoes, emphasizing their properties, advantages, limitations, and considerations for international B2B buyers from diverse regions such as Africa, South America, the Middle East, and Europe.

1. Stainless Steel (e.g., 304, 316 grades)

Key Properties:

Stainless steel offers excellent corrosion resistance, high strength, and temperature stability, making it ideal for components exposed to heat and moisture. Its corrosion resistance is particularly valuable in humid or saline environments, common in coastal regions of South America and Africa.

Pros & Cons:

Advantages include durability, ease of fabrication, and compliance with international standards like ASTM and DIN. However, stainless steel can be relatively costly and heavier than alternative materials, potentially impacting shipping costs and product weight. Manufacturing complexity is moderate, requiring specialized equipment for welding and shaping.

Impact on Application:

Its corrosion resistance makes it suitable for parts exposed to sweat or environmental moisture, ensuring longevity. It also withstands high temperatures without deformation, critical for hotter shoes shoes.

International Buyer Considerations:

European markets often demand high-grade stainless steel with certifications such as ISO 9001. Buyers in Africa and South America should verify supplier compliance with local standards and import regulations, including RoHS and REACH, especially if the shoes are marketed in regions with strict environmental laws.

2. Aluminum Alloys (e.g., 6061, 7075)

Key Properties:

Aluminum alloys are lightweight, corrosion-resistant, and possess good thermal conductivity. They are suitable for structural components that require a balance of strength and weight reduction, which is advantageous for consumer comfort and transportation efficiency.

Illustrative Image (Source: Google Search)

Pros & Cons:

Aluminum is easier to machine and weld than steel, reducing manufacturing complexity and costs. Its lower density contributes to lighter shoes, appealing in markets emphasizing comfort. However, aluminum is less resistant to high-impact stresses compared to steel and may deform under extreme conditions, limiting its use in high-stress areas.

Impact on Application:

Ideal for structural frames or decorative elements. Aluminum’s thermal properties help dissipate heat, preventing overheating of components during prolonged use, which is crucial for hotter shoes shoes.

International Buyer Considerations:

European standards often require traceability and certification for aluminum alloys, especially for safety-critical parts. Buyers from Middle Eastern regions should consider corrosion protection treatments like anodizing, especially in humid or saline environments.

3. High-Performance Plastics (e.g., PEEK, PTFE)

Key Properties:

High-performance plastics such as PEEK and PTFE offer excellent chemical resistance, low friction, and high-temperature stability. They are non-corrosive and lightweight, suitable for specialized parts like insulators or flexible connectors.

Pros & Cons:

Plastics are generally easier and cheaper to mold, allowing for complex geometries. They resist corrosion and chemical attack, making them suitable for media-rich environments. However, their mechanical strength is lower than metals, and they can degrade under prolonged UV exposure or extreme heat if not properly formulated.

Impact on Application:

Best suited for internal components or parts exposed to aggressive media or requiring electrical insulation. Their chemical inertness ensures compatibility with various lubricants, adhesives, and environmental conditions.

International Buyer Considerations:

Buyers should ensure compliance with international standards such as JIS or ASTM for plastics. Proper sourcing from certified suppliers guarantees material consistency, especially critical for markets with strict safety and environmental regulations like Europe and the Middle East.

4. Copper and Copper Alloys (e.g., Brass, Bronze)

Key Properties:

Copper alloys provide excellent thermal and electrical conductivity, along with good corrosion resistance, especially in saline environments. Brass and bronze are often used for fittings, connectors, or heat dissipation components.

Pros & Cons:

Copper alloys are relatively easy to machine and form, with good wear resistance. They are cost-effective for certain applications but can be heavier than plastics or aluminum. Copper’s susceptibility to dezincification and corrosion in certain environments necessitates protective coatings or alloy selection.

Impact on Application:

Useful in heat exchange or electrical components within hotter shoes shoes. Their thermal conductivity helps manage heat buildup, improving product safety and performance.

International Buyer Considerations:

Compliance with standards such as ASTM B16 or DIN 1744 is essential. Buyers should verify supplier certifications for purity and alloy composition, especially when importing into regions with strict metal import standards like Europe and Argentina.

Summary Table

| Material | Typical Use Case for Hotter Shoes Shoes | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel (e.g., 304, 316) | Structural frames, heat-resistant components | Excellent corrosion resistance, high strength | Heavy, higher cost, manufacturing complexity | High |

| Aluminum Alloys (e.g., 6061, 7075) | Lightweight structural parts, decorative elements | Lightweight, good thermal conductivity, corrosion-resistant | Less impact-resistant, deformation under extreme stress | Medium |

| High-Performance Plastics (PEEK, PTFE) | Insulators, flexible connectors, internal parts | Chemical resistance, lightweight, low friction | Lower mechanical strength, UV and heat sensitivity | Medium |

| Copper and Copper Alloys (Brass, Bronze) | Heat exchangers, electrical contacts | Good thermal/electrical conductivity, corrosion resistance | Heavier, susceptible to dezincification | Medium |

This comprehensive analysis aims to guide international B2B buyers in selecting optimal materials tailored to their regional needs, environmental conditions, and compliance standards, ensuring product performance and market readiness.

In-depth Look: Manufacturing Processes and Quality Assurance for hotter shoes shoes

Manufacturing Processes for Hotter Shoes Shoes

The manufacturing of Hotter Shoes involves a series of carefully controlled stages designed to ensure product quality, durability, and comfort. For B2B buyers, understanding these stages is essential to assess supplier capabilities and compliance with industry standards.

1. Material Preparation

Material selection is foundational, focusing on high-quality, durable components such as leather, synthetic fabrics, rubber, and specialized insoles. Suppliers often source materials from certified vendors adhering to environmental and safety standards, especially for international markets. Quality assurance begins at this stage, with incoming raw materials subjected to rigorous Inspection and Quality Control (IQC) to verify specifications, such as tensile strength, flexibility, and chemical safety.

Key Considerations for Buyers:

– Verify supplier certifications for raw materials (e.g., REACH, OEKO-TEX).

– Request detailed material test reports and certificates of conformity.

– Prefer suppliers with transparent supply chain traceability.

2. Forming and Component Manufacturing

Once materials pass IQC, they are cut, shaped, and molded into components. Techniques such as computer-aided design (CAD) and computer-aided manufacturing (CAM) are employed to ensure precision. For the upper parts, methods like stitching, bonding, or thermoforming are common, depending on the material. The insole and outsole components are often molded using injection or compression molding techniques.

Key Techniques:

– Use of automated cutting machines for consistency.

– Thermoforming for seamless upper structures.

– Injection molding for durable outsoles.

Quality Checks:

– Dimensional accuracy and fit are verified through in-process checks (IPQC).

– Material adhesion and bonding strength are tested to prevent delamination.

3. Assembly and Finishing

In the assembly phase, components are joined with adhesives, stitching, or mechanical fasteners. Hotter Shoes often feature specialized assembly techniques that enhance flexibility and comfort, such as flexible bonding or multi-layer lamination. Finishing involves trimming excess material, applying coatings or dyes, and adding aesthetic details like logos.

Key Aspects for B2B Buyers:

– Emphasis on ergonomic assembly to maintain product consistency.

– Use of eco-friendly and low-VOC adhesives and finishes.

– Incorporation of branding and packaging specifications aligned with buyer requirements.

Quality Assurance Protocols and Industry Standards

Ensuring consistent quality in Hotter Shoes production requires adherence to internationally recognized standards and industry-specific certifications. B2B buyers should evaluate suppliers’ quality systems and verify compliance through rigorous testing and audits.

1. International Standards and Certifications

-

ISO 9001:

The cornerstone of quality management systems, ISO 9001 certification demonstrates a supplier’s commitment to continuous improvement and customer satisfaction. Suppliers adhering to ISO 9001 establish documented procedures for manufacturing, inspection, and corrective actions. -

CE Marking (European Market):

Indicates compliance with EU safety, health, and environmental requirements. For footwear, this includes safety standards related to chemical content and physical safety tests. -

Other Industry Certifications:

- ASTM Standards: For durability and safety testing.

- OEKO-TEX Standard 100: Ensures textiles are free from harmful substances.

- REACH Compliance: For chemical safety in European markets.

Tip for Buyers:

– Request valid certification documents and review scope and validity periods.

2. Quality Control Checkpoints

a. Incoming Quality Control (IQC):

– Verifies raw materials meet specified standards before entering production.

– Tests include tensile strength, colorfastness, chemical safety, and physical defects.

b. In-Process Quality Control (IPQC):

– Monitors each manufacturing stage, including cutting, molding, stitching, and bonding.

– Uses statistical process control (SPC) to detect deviations early.

c. Final Quality Control (FQC):

– Conducts comprehensive inspections of finished shoes, including visual checks for defects, dimensional accuracy, and functional tests such as flexibility, slip resistance, and durability.

Common Testing Methods:

– Tensile and peel tests for bonding strength.

– Accelerated wear testing to simulate long-term usage.

– Chemical testing for harmful substances (e.g., formaldehyde, phthalates).

Verifying Supplier QC for International B2B Engagements

For buyers from Africa, South America, the Middle East, and Europe, verifying supplier quality systems is critical to mitigate risks. Several approaches can be adopted:

-

Third-Party Inspections and Audits:

Engage reputable inspection agencies (e.g., SGS, BV, Intertek) to conduct pre-shipment inspections, process audits, and factory assessments. These audits evaluate compliance with ISO standards, manufacturing practices, and social responsibility. -

Review of Inspection and Test Reports:

Request detailed QC reports, test certificates, and batch documentation for transparency. Cross-reference these with recognized standards to ensure validity. -

Factory Visits and Continuous Monitoring:

When feasible, conduct on-site visits to observe manufacturing practices, employee conditions, and quality control processes firsthand. Establish ongoing communication channels for quality updates.

Nuances for International B2B Buyers

Buyers should be aware of regional variations in quality expectations and certification recognition. For example:

-

European Buyers (e.g., France):

Emphasize compliance with REACH, CE marking, and environmental sustainability. Preference for suppliers with ISO 14001 (Environmental Management) and social compliance certifications like SA8000. -

South American Buyers (e.g., Argentina):

Focus on local certification recognition, chemical safety, and durability standards. Suppliers familiar with local regulations and logistics are preferred. -

Middle Eastern Buyers:

Prioritize suppliers with certifications aligned with Gulf Standards (GSO) and chemical safety compliance, considering climate-specific performance requirements like heat resistance. -

African Buyers:

Emphasize durability under tropical conditions, supply chain transparency, and certifications that demonstrate chemical safety and environmental responsibility.

Final Recommendations for B2B Buyers

-

Establish Clear Specifications:

Define quality standards, certifications, and testing requirements upfront. Include these in purchase agreements. -

Implement Rigorous Supplier Evaluation:

Use a combination of certification verification, sample testing, and third-party audits to assess supplier reliability. -

Leverage Digital Tools:

Utilize platforms that facilitate document verification, real-time quality monitoring, and communication with suppliers. -

Build Long-Term Partnerships:

Collaborate with suppliers committed to continuous improvement and transparency to ensure consistent quality over time.

By understanding the detailed manufacturing processes and integrating comprehensive quality assurance measures, international B2B buyers can confidently source Hotter Shoes that meet their market-specific demands and standards, ensuring customer satisfaction and brand integrity across global markets.

Comprehensive Cost and Pricing Analysis for hotter shoes shoes Sourcing

Cost Structure Breakdown for Hotter Shoes Shoes

Understanding the detailed cost components involved in sourcing hotter shoes shoes is crucial for international B2B buyers aiming to optimize procurement strategies. The primary cost drivers include raw materials, labor, manufacturing overhead, tooling, quality control, logistics, and profit margins.

Materials typically account for 40-60% of the total cost, depending on the quality and specifications. Common materials such as synthetic leathers, textiles, and rubber vary significantly in price based on sourcing country and quality standards. Premium or eco-friendly materials will naturally elevate costs but may also command higher retail prices and consumer appeal.

Labor costs are highly variable, influenced by the sourcing country. For instance, suppliers in Southeast Asia or parts of Africa may offer lower wages, reducing overall costs, whereas European or Middle Eastern manufacturers might have higher labor rates but often provide stricter compliance with labor standards.

Manufacturing overhead includes factory utilities, equipment depreciation, and indirect labor. These costs are relatively stable but can fluctuate based on factory efficiency and scale of production.

Tooling and setup costs are upfront expenses for molds, dies, and production line adjustments. These are usually amortized over large production volumes but can be a significant initial investment, impacting small or custom orders.

Quality control (QC) costs ensure product standards meet specifications, especially critical for international markets where certifications (ISO, CE, etc.) influence acceptance. Higher QC standards may increase upfront costs but reduce returns and rework.

Logistics and shipping costs are highly dependent on shipment volume, mode (air, sea, land), and destination port. Buyers from Africa or South America should anticipate higher freight costs due to distance and infrastructural factors, while European buyers might benefit from more developed logistics networks.

Profit margins vary by supplier but typically range from 10-25%, reflecting the value addition, brand positioning, and market competitiveness.

Price Influencers and Market Dynamics

Several factors influence the final FOB (Free On Board) or CIF (Cost, Insurance, Freight) prices:

- Order volume and MOQ (Minimum Order Quantity): Larger volumes often attract discounts, reducing per-unit costs. Buyers should negotiate volume-based discounts, especially for bulk orders exceeding 10,000 pairs.

- Customization and specifications: Customized designs, unique materials, or special features (e.g., waterproofing, branding) increase costs due to additional tooling, materials, and QC requirements.

- Materials and quality certifications: Higher-grade materials and compliance with international standards (e.g., REACH, ISO) add to the cost but are essential for accessing premium markets.

- Supplier factors: Factory reputation, production capacity, and geographic location influence pricing. Established suppliers with robust quality records may charge a premium but offer reliability.

- Incoterms: The choice of Incoterm (e.g., FOB, CIF, DDP) affects who bears transportation and customs costs. Buyers should negotiate to balance cost control with supply chain risk management.

Strategic Tips for International B2B Buyers

- Negotiate for volume discounts: Leverage larger orders to reduce unit prices, but also consider long-term partnerships for better terms.

- Focus on total cost of ownership (TCO): Beyond unit price, account for shipping, customs duties, taxes, and potential rework costs. A cheaper initial quote might incur higher TCO due to delays or quality issues.

- Assess supplier reliability: Opt for suppliers with proven track records, certifications, and capacity to meet quality standards—especially crucial for markets with stringent regulations like Europe or Argentina.

- Understand pricing nuances: Prices can vary based on market conditions, raw material fluctuations, and currency exchange rates. Regularly monitor these factors to time your procurement optimally.

- Leverage local sourcing: When possible, sourcing from nearby regions can reduce shipping costs and lead times, providing a competitive edge in quick-turnaround markets.

Disclaimer

Indicative prices for hotter shoes shoes from typical manufacturing regions range broadly, approximately $10-$25 per pair FOB depending on volume, specifications, and supplier standards. Buyers should conduct due diligence and request detailed quotations tailored to their specific needs to obtain accurate pricing.

By systematically analyzing these cost and pricing factors, international B2B buyers from Africa, South America, the Middle East, and Europe can make informed sourcing decisions that balance quality, cost-efficiency, and supply chain reliability—ultimately enhancing their competitive positioning in global markets.

Spotlight on Potential hotter shoes shoes Manufacturers and Suppliers

- (No specific manufacturer data was available or requested for detailed profiling in this section for hotter shoes shoes.)*

Essential Technical Properties and Trade Terminology for hotter shoes shoes

Critical Technical Properties

1. Material Grade and Composition

The quality and durability of hotter shoes are heavily influenced by the materials used. Common materials include rubber, thermoplastics, or specialized composites. Higher-grade materials offer superior wear resistance, flexibility, and thermal stability, essential for products exposed to high temperatures or heavy use. B2B buyers should specify material grades aligned with international standards (e.g., ASTM, ISO) to ensure consistency and performance.

2. Thermal Tolerance and Heat Resistance

Hotter shoes must withstand specific temperature ranges without deformation or degradation. Thermal tolerance is typically measured in degrees Celsius or Fahrenheit. For industrial or specialized applications, shoes might need heat resistance up to 200°C or more. Understanding this property helps buyers select products suitable for their operational environments, reducing the risk of failure and ensuring safety.

3. Mechanical Strength and Flexibility

This property indicates how well the shoe can endure physical stresses like stretching, bending, or compression. High tensile strength and flexibility are crucial for ensuring longevity and comfort, especially in demanding applications. Suppliers often provide test reports detailing these properties, which help buyers assess suitability for specific use cases.

4. Dimensional Tolerance and Precision

Dimensional tolerance refers to the allowable deviation from specified measurements, impacting fit and compatibility with other components. Tight tolerances (e.g., ±0.1 mm) are often necessary for applications requiring precise assembly or performance. Clear specifications help prevent issues during manufacturing or installation, saving costs and time.

5. Chemical Resistance

Depending on the environment, hotter shoes may need resistance to oils, solvents, or other chemicals. Chemical resistance prolongs product lifespan and maintains performance under adverse conditions. B2B buyers should verify chemical compatibility through standardized testing data or supplier certifications.

6. Wear and Abrasion Resistance

This property indicates how well the shoe withstands surface wear over time. High abrasion resistance reduces replacement frequency and operational costs. Suppliers often provide abrasion testing results, which are critical for decision-making in high-traffic or industrial environments.

Essential Industry and Trade Terms

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce products or components that are branded and sold by other firms. Understanding OEM relationships helps buyers negotiate pricing, customization options, and intellectual property rights, especially when sourcing unique or branded hotter shoes.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell. Knowing the MOQ helps buyers plan procurement budgets and inventory levels, especially when entering new markets or testing products. Negotiating MOQs can be crucial for small or emerging buyers.

3. RFQ (Request for Quotation)

A formal request sent to suppliers asking for price, lead times, and terms for specific products. RFQs are standard in B2B procurement, enabling buyers to compare offers and make informed purchasing decisions efficiently.

4. Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce (ICC) defining responsibilities of buyers and sellers for delivery, risk transfer, and costs. Common Incoterms include FOB (Free on Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Understanding Incoterms ensures clarity and reduces disputes during transactions.

5. Lead Time

The period from order placement to product delivery. Recognizing lead times helps buyers plan inventory and production schedules, especially critical when sourcing hotter shoes for time-sensitive projects or seasonal demand.

6. Certification and Compliance Terms

Includes standards such as ISO, CE, or ASTM certifications that verify product safety, quality, and environmental compliance. Ensuring products meet relevant certifications is vital for legal compliance and market acceptance across different regions.

Summary:

Mastery of these technical properties and trade terms enables international B2B buyers from Africa, South America, the Middle East, and Europe to make informed, strategic purchasing decisions. Clear specifications reduce risks, ensure product suitability, and facilitate smooth international transactions, fostering long-term supplier relationships and operational success.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hotter shoes shoes Sector

Market Overview & Key Trends

The global hotter shoes shoes sector is experiencing rapid evolution driven by technological innovation, shifting consumer preferences, and supply chain restructuring. Increasing demand from markets in Africa, South America, the Middle East, and Europe is shaping the landscape, creating significant opportunities for international B2B buyers. Emerging trends such as the integration of advanced manufacturing techniques—like 3D printing and automation—are enhancing production efficiency and customization capabilities, which are particularly attractive to buyers seeking differentiated products.

Supply chain resilience has become a focal point, especially amid disruptions caused by geopolitical tensions and the COVID-19 pandemic. Diversification of sourcing regions is now a strategic priority, with many buyers exploring partnerships beyond traditional manufacturing hubs to mitigate risks. For instance, African manufacturers are gaining prominence due to their competitive labor costs and proximity to emerging markets, while South American producers benefit from unique raw materials and lower transportation costs within the continent.

Technological adoption is also reshaping sourcing trends. Digital platforms and B2B marketplaces facilitate real-time communication, streamlined procurement, and transparent supplier vetting processes. For European and Middle Eastern buyers, there is an increasing emphasis on integrating supply chain data analytics to improve forecasting and inventory management. Additionally, sustainability-focused innovations—such as eco-friendly materials and circular manufacturing practices—are becoming standard expectations, influencing sourcing decisions across regions.

Illustrative Image (Source: Google Search)

Market dynamics are further driven by evolving consumer preferences emphasizing style, comfort, and sustainability. Buyers should stay attuned to regional trends—such as the growing demand for eco-conscious footwear in Europe and the Middle East—while leveraging technological tools to identify reliable suppliers and optimize sourcing strategies. Building strong, transparent relationships with regional manufacturers can also enhance supply chain agility and product quality, ultimately providing a competitive advantage.

Sustainability & Ethical Sourcing in B2B

Sustainability is now a cornerstone of strategic sourcing in the hotter shoes shoes sector. Environmental impacts from manufacturing—such as water consumption, chemical usage, and waste generation—are under increased scrutiny from both regulators and consumers. B2B buyers from Africa, South America, the Middle East, and Europe are prioritizing suppliers who demonstrate a commitment to reducing their ecological footprint through sustainable practices.

Ethical sourcing extends beyond environmental concerns, encompassing fair labor practices, safe working conditions, and transparent supply chains. Buyers are increasingly demanding suppliers with verifiable certifications such as Fair Trade, SA8000, or ISO 14001, which attest to responsible manufacturing standards. These certifications not only mitigate reputational risks but also open access to markets with strict compliance requirements, such as the European Union.

In terms of materials, there is a rising shift towards ‘green’ inputs—such as recycled plastics, organic textiles, and plant-based dyes. Innovative manufacturers are adopting circular economy principles, designing products for durability and recyclability to extend lifecycle and reduce waste. For instance, using biodegradable or recycled components aligns with global sustainability goals and appeals to environmentally conscious consumers.

B2B buyers should actively seek partnerships with suppliers committed to sustainability, leveraging audits, certifications, and supplier transparency reports. Investing in eco-friendly supply chains not only enhances brand reputation but also aligns with future regulatory trends and consumer expectations. Collaborating with regional suppliers who prioritize sustainable practices can also foster local economic development and strengthen supply chain resilience.

Brief Evolution/History (Optional)

The hotter shoes shoes sector has seen a notable transformation over recent decades, moving from traditional manufacturing methods to highly innovative, sustainable, and technology-driven processes. Initially dominated by mass production in low-cost regions, the industry now emphasizes customization, rapid prototyping, and eco-conscious design. This evolution reflects broader shifts in consumer demand, regulatory standards, and technological capabilities.

For B2B buyers, understanding this historical context highlights the importance of agility and innovation in sourcing strategies. Early reliance on low-cost manufacturing has given way to a more nuanced approach that balances cost, quality, speed, and sustainability. Recognizing the sector’s trajectory helps buyers identify future-proof partners and adapt to ongoing market shifts, ensuring sustained competitiveness and compliance in a rapidly evolving global landscape.

Frequently Asked Questions (FAQs) for B2B Buyers of hotter shoes shoes

-

How can I effectively vet suppliers of hotter shoes shoes to ensure product quality and reliability?

To vet suppliers thoroughly, start with comprehensive background checks, including verifying business licenses, certifications, and industry reputation. Request samples for quality assessment and review their compliance with international standards such as ISO or CE. Conduct virtual or on-site audits if possible, and ask for references from previous international clients. Additionally, evaluate their communication responsiveness, production capacity, and ability to meet deadlines. Establish clear contractual terms covering quality standards, inspection procedures, and after-sales support. A rigorous vetting process minimizes risks and ensures consistent product quality for your market. -

What customization options are typically available for hotter shoes shoes, and how do they impact production timelines?

Suppliers often offer a range of customization options, including branding (logos, packaging), colorways, material choices, and design modifications to meet regional preferences. Customization can enhance market appeal but may extend lead times by 2-4 weeks depending on complexity and order volume. To optimize timelines, specify your requirements early, provide detailed design files, and confirm supplier capabilities upfront. Establish a clear approval process for prototypes or samples to avoid delays. Balancing customization with realistic production schedules ensures timely delivery while meeting your market’s unique demands. -

What are typical minimum order quantities (MOQs), lead times, and payment terms for importing hotter shoes shoes?

Most suppliers set MOQs ranging from 500 to 2,000 pairs, though this varies based on design complexity and supplier size. Lead times generally span 4-8 weeks from order confirmation to shipment, depending on production capacity and logistics. Payment terms commonly include 30% upfront with the balance payable before shipment or upon delivery, with some suppliers offering letters of credit or bank transfers for trusted partners. Clarify these terms early to align with your cash flow and inventory planning, and negotiate flexible terms where possible for smaller initial orders or trial runs. -

What quality assurance (QA) measures and certifications should I look for when sourcing hotter shoes shoes internationally?

Ensure suppliers adhere to recognized QA protocols such as ISO 9001 and conduct rigorous inspections throughout production. Request documentation of product testing for durability, colorfastness, and safety standards relevant to your target markets (e.g., CE marking for Europe, ASTM for the US). Third-party inspection agencies can perform pre-shipment quality audits, providing reports on product conformity. Certifications like REACH (chemical safety) and environmental compliance are also valuable. Verifying these measures ensures compliance with local regulations, reduces returns, and enhances consumer trust. -

How can I manage logistics effectively when importing hotter shoes shoes across continents?

Partner with experienced freight forwarders familiar with international footwear trade and customs procedures in your region. Decide between air freight for faster delivery or sea freight for cost efficiency, balancing urgency and budget. Ensure proper packaging to prevent damage during transit and clarify Incoterms (e.g., FOB, CIF) to allocate responsibilities clearly. Maintain open communication with suppliers about shipping schedules and tracking updates. Additionally, prepare all customs documentation in advance—such as commercial invoices, packing lists, and certificates—to avoid delays at borders. -

What common disputes arise in international sourcing of hotter shoes shoes, and how can they be avoided or resolved?

Disputes often involve quality discrepancies, late deliveries, payment issues, or intellectual property concerns. To minimize risks, establish detailed contracts covering specifications, inspection rights, penalties for delays, and dispute resolution clauses (preferably arbitration). Maintain transparent communication and document all transactions meticulously. If disputes occur, approach resolution collaboratively, involving third-party mediators if necessary. Having clear documentation and adhering to contractual terms ensures smoother resolution processes and protects your interests. -

How do currency fluctuations and payment methods impact international transactions for hotter shoes shoes?

Currency volatility can affect costs; consider using forward contracts or multi-currency accounts to lock in exchange rates. When negotiating payment terms, opt for secure methods such as letters of credit or escrow accounts to protect against non-performance. Additionally, establish clear currency clauses in contracts to specify which currency is used and how fluctuations are handled. Regularly monitor exchange rates and work with financial advisors to develop strategies that mitigate financial risks, ensuring predictable costs and stable profit margins. -

What are key considerations for building long-term relationships with suppliers of hotter shoes shoes in international markets?

Focus on consistent communication, timely payments, and quality feedback to foster trust. Cultivate mutual understanding by sharing market insights and collaborating on product development. Visit suppliers periodically to strengthen partnerships and verify operations firsthand. Offer volume commitments gradually to secure better pricing and terms. Maintaining transparency, respecting cultural differences, and providing prompt resolution to issues help build loyalty. Long-term relationships can lead to preferential terms, priority production slots, and collaborative innovation, ultimately providing competitive advantage in your target markets.

Strategic Sourcing Conclusion and Outlook for hotter shoes shoes

Conclusion and Future Outlook for Strategic Sourcing of Hotter Shoes Shoes

Effective strategic sourcing remains crucial for international B2B buyers seeking to capitalize on the growing demand for hotter shoes shoes across diverse markets. By establishing strong relationships with reliable suppliers, leveraging regional manufacturing hubs, and prioritizing quality control, buyers can mitigate risks and ensure consistent product availability. Diversifying sourcing channels also enhances resilience against geopolitical or economic disruptions, particularly for buyers in Africa, South America, the Middle East, and Europe.

Looking ahead, technological advancements such as digital procurement platforms and supply chain transparency tools will further empower buyers to make informed, agile decisions. Sustainability considerations are increasingly influencing sourcing strategies, making eco-friendly and ethically produced footwear more attractive to consumers worldwide.

For international buyers, the key to sustained success lies in adopting a proactive, data-driven approach to sourcing. By continuously monitoring market trends and fostering collaborative supplier partnerships, buyers can secure competitive advantages and meet evolving consumer preferences. Now is the time to refine sourcing strategies—embrace innovation, prioritize resilience, and position your business for long-term growth in the hotter shoes shoes market.