Your Ultimate Guide to Sourcing Navy Shoes

Guide to Navy Shoes

- Introduction: Navigating the Global Market for navy shoes

- Understanding navy shoes Types and Variations

- Key Industrial Applications of navy shoes

- Strategic Material Selection Guide for navy shoes

- In-depth Look: Manufacturing Processes and Quality Assurance for navy shoes

- Comprehensive Cost and Pricing Analysis for navy shoes Sourcing

- Spotlight on Potential navy shoes Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for navy shoes

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the navy shoes Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of navy shoes

- Strategic Sourcing Conclusion and Outlook for navy shoes

Introduction: Navigating the Global Market for navy shoes

In the highly competitive and dynamic landscape of global footwear sourcing, navy shoes have emerged as a strategic product for numerous industries, from uniforms and corporate apparel to military and maritime applications. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding the nuances of this niche market is essential to making informed procurement decisions that balance quality, cost, and reliability.

This comprehensive guide is designed to serve as a critical resource, equipping international buyers with in-depth insights into the diverse range of navy shoes—covering styles, materials, manufacturing standards, quality control processes, and supplier landscapes. It also provides actionable advice on evaluating cost structures, navigating import/export regulations, and identifying reputable manufacturers across key sourcing regions.

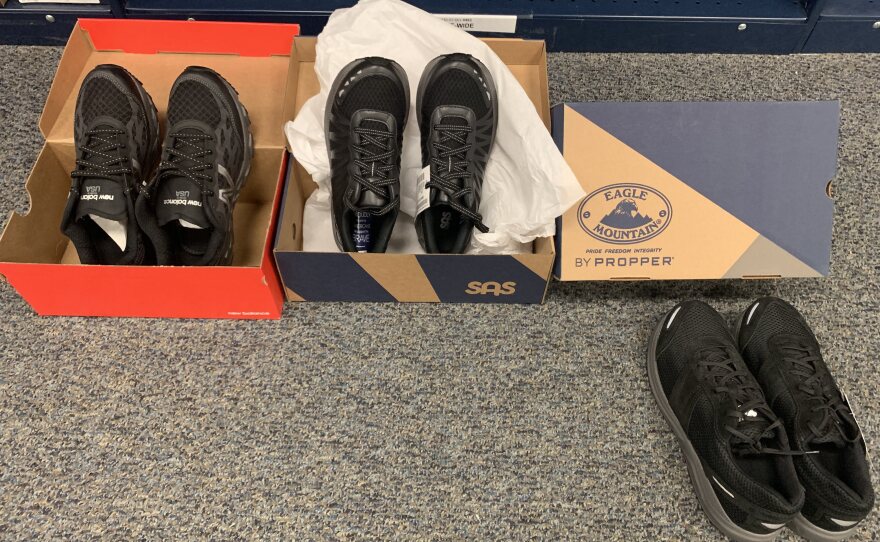

Illustrative Image (Source: Google Search)

By leveraging this guide, buyers will be empowered to optimize their supply chain strategies, mitigate risks, and secure consistent product quality that meets industry standards. Whether sourcing from established manufacturing hubs in Europe or emerging suppliers in Africa and South America, understanding regional market dynamics and supplier capabilities is key to achieving competitive advantage.

Ultimately, this guide aims to streamline your sourcing process, helping you build trusted supplier relationships and make data-driven decisions that align with your business goals. Navigating the global navy shoes market has never been more accessible—arming you with the knowledge to succeed in a complex international environment.

Understanding navy shoes Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Classic Navy Oxford | Sleek, formal design with closed lacing system | Corporate uniforms, formal events | Pros: Widely accepted, versatile; Cons: May lack durability in rough environments |

| Tactical Navy Boot | Heavy-duty construction, waterproof, reinforced soles | Military, security, outdoor operations | Pros: High durability, excellent traction; Cons: Heavier, higher cost |

| Casual Navy Sneaker | Lightweight, flexible materials, minimalistic design | Casual wear, promotional giveaways | Pros: Comfortable, trendy; Cons: Limited formal appeal, less durable |

| Dress Navy Loafer | Slip-on style, polished finish, minimal stitching | Business casual, hospitality industries | Pros: Easy to wear, stylish; Cons: Less supportive for extended wear |

| Industrial Navy Work Shoe | Steel toe, slip-resistant outsole, rugged build | Industrial, construction, manufacturing | Pros: Safety compliant, sturdy; Cons: Heavier, limited aesthetic options |

Classic Navy Oxford

The navy Oxford is characterized by its polished leather finish, closed lacing system, and minimalist design. Its formal appearance makes it ideal for corporate uniforms, official events, and professional settings. For B2B buyers, sourcing high-quality Oxfords involves assessing leather quality, sole durability, and manufacturing standards. They are suitable for bulk orders where consistency and brand presentation are critical. While versatile, Oxfords may not withstand rugged environments, so buyers should consider the intended use and durability requirements.

Tactical Navy Boot

Designed for demanding environments, tactical navy boots feature heavy-duty materials, waterproof membranes, reinforced soles, and ankle support. They are primarily used in military, security, and outdoor operations. B2B procurement should focus on certifications (e.g., ASTM, ISO), material sourcing, and customization options such as branding or specific features. These boots are highly durable and offer excellent traction but tend to be heavier and more expensive, which should be balanced against operational needs.

Casual Navy Sneaker

Casual navy sneakers are made from lightweight fabrics, rubber soles, and minimalistic designs. They appeal to brands targeting promotional events, casual uniforms, or leisure markets. For bulk procurement, buyers should evaluate material quality, comfort, and colorfastness to ensure they meet end-user expectations. While they are comfortable and trendy, their limited formality and lower durability make them less suitable for industrial or formal settings.

Dress Navy Loafer

Loafers combine ease of wear with a polished appearance, often featuring slip-on design and minimal stitching. They are ideal for business casual environments, hospitality, and retail sectors. B2B buyers should prioritize leather sourcing, manufacturing consistency, and size availability. Loafers offer convenience and style but may lack the support needed for prolonged wear or physically demanding tasks, making them better suited for office or light-duty applications.

Industrial Navy Work Shoe

Engineered for safety and rugged use, industrial navy work shoes include features like steel toes, slip-resistant soles, and reinforced uppers. They are essential for industrial, construction, and manufacturing sectors. When sourcing these shoes, buyers must verify safety certifications, material strength, and compliance with local safety standards. While they excel in protection and durability, their weight and limited aesthetic appeal can impact worker acceptance and overall cost considerations.

Key Industrial Applications of navy shoes

| Industry/Sector | Specific Application of navy shoes | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Maritime & Naval | Deck footwear for naval personnel and maritime workers | Enhanced safety through slip-resistant soles, durability in harsh environments | Certification for maritime safety standards, slip resistance, waterproof features |

| Oil & Gas | Protective footwear for offshore platform workers | Superior protection against chemical spills, oil, and high-pressure environments | Chemical resistance, compliance with offshore safety standards, durability in corrosive conditions |

| Construction & Heavy Industry | Safety boots for construction sites and heavy machinery operators | Improved foot protection, stability, and comfort during prolonged shifts | Impact resistance, anti-slip soles, comfort for extended wear, compliance with industrial safety regulations |

| Agriculture & Rural Industries | Work shoes for farmers and agricultural laborers | Durable, comfortable footwear suitable for muddy, uneven terrains | Resistance to mud, water, and abrasion; lightweight design; cost-effectiveness |

| Hospitality & Emergency Services | Uniform footwear for security personnel, emergency responders | Reliable grip, comfort for long hours, quick-drying materials | Slip resistance, comfort, ease of cleaning, compliance with uniform standards |

Maritime & Naval Industry

Navy shoes are essential in the maritime sector, especially for naval personnel and dockyard workers. These shoes are designed to withstand wet conditions, offering slip resistance and durability on wet decks and slippery surfaces. For international B2B buyers in regions like South Africa or Europe, sourcing shoes that meet maritime safety standards (such as SOLAS or ISO certifications) is critical. High-quality navy shoes reduce accidents, enhance operational efficiency, and comply with stringent safety regulations, making them indispensable for maritime operations.

Oil & Gas Sector

Offshore oil and gas platforms demand footwear that can endure extreme conditions, including exposure to chemicals, oil, and high-pressure environments. Navy shoes tailored for this industry often feature chemical-resistant materials and non-slip soles to prevent accidents in hazardous zones. For international buyers in the Middle East or South America, sourcing navy shoes that meet offshore safety standards (like API certifications) ensures worker safety and regulatory compliance. Durable, resistant footwear minimizes downtime and long-term costs.

Construction & Heavy Industry

Construction sites and heavy industry environments require navy shoes that combine impact resistance, slip resistance, and comfort. These shoes protect workers from falling objects, uneven surfaces, and slippery conditions common on job sites. For European or African buyers, selecting navy shoes with certified impact protection and anti-slip soles aligned with OSHA or local standards guarantees worker safety, reduces liability, and enhances productivity during extended work shifts.

Agriculture & Rural Industries

In agriculture, footwear must handle muddy, uneven terrains while providing comfort and durability. Navy shoes suitable for this sector are often waterproof, abrasion-resistant, and lightweight, facilitating mobility and reducing fatigue for farmers and rural workers. For buyers in South America or Africa, sourcing cost-effective yet durable navy shoes that resist mud and water is vital to maintaining operational efficiency and worker safety in challenging environments.

Hospitality & Emergency Services

Uniform navy shoes are critical for security personnel, emergency responders, and hospital staff, where comfort and safety are paramount. These shoes need slip resistance, quick-drying features, and ease of cleaning to meet the demands of long shifts and diverse environments. International buyers from Europe or the Middle East should prioritize shoes that comply with uniform standards and provide reliable grip to prevent slips and falls, ensuring personnel safety and operational readiness.

Strategic Material Selection Guide for navy shoes

Analysis of Common Materials for Navy Shoes from a B2B Perspective

Leather

Leather remains the most traditional and widely used material in navy shoes, especially for formal and semi-formal applications. Its key properties include excellent durability, breathability, and a premium appearance. High-quality leather offers good resistance to wear and tear, making it suitable for daily use in demanding environments. However, leather can be sensitive to moisture and requires proper treatment to enhance water resistance, which is crucial for maritime or humid climates.

From a manufacturing perspective, leather involves complex processing, including tanning and finishing, which can influence lead times and costs. For international buyers, compliance with standards like ISO 9001 for quality management and adherence to environmental regulations (e.g., REACH in Europe) are essential. Leather’s aesthetic appeal aligns well with European and Middle Eastern markets, but in regions with high humidity or heavy rainfall—such as parts of Africa and South America—additional waterproofing treatments are recommended.

Rubber

Rubber is a versatile material favored for its excellent grip, flexibility, and water resistance. It is particularly suitable for casual, work, or safety-oriented navy shoes where slip resistance and waterproofing are priorities. Rubber’s properties include high elasticity, resistance to corrosion, and the ability to withstand harsh environmental conditions. It performs well in wet, muddy, or oily media, making it ideal for maritime or industrial settings.

On the downside, rubber can be less breathable, potentially leading to discomfort during prolonged wear. Manufacturing rubber shoes can be more straightforward and cost-effective, especially with synthetic variants like thermoplastic rubber (TPR). For international buyers, sourcing high-quality rubber that complies with standards such as ASTM D2000 (for rubber properties) or JIS standards is critical. Buyers in regions with strict environmental regulations should verify that rubber materials are free from harmful chemicals like phthalates or heavy metals.

Polyurethane (PU)

Polyurethane is increasingly popular in navy footwear due to its lightweight nature and excellent shock absorption. It offers good resistance to abrasion, oils, and some chemicals, making it suitable for both casual and work environments. PU can be produced in various forms—rigid or flexible—allowing customization based on specific application needs. Its ease of molding and finishing can reduce manufacturing complexity and costs.

However, PU’s environmental resistance is not as robust as rubber or leather; it can degrade under prolonged UV exposure or extreme heat, which might limit its use in outdoor or high-temperature settings. For international buyers, selecting environmentally friendly, low-VOC PU formulations aligns with global sustainability standards. In regions like Europe and the Middle East, compliance with REACH and other chemical safety standards is essential, while buyers in Africa and South America should ensure supply chain transparency regarding chemical content.

Summary

Choosing the right material for navy shoes depends heavily on the intended application, environmental conditions, and compliance requirements. Leather offers a premium look and durability but requires maintenance and environmental consideration. Rubber provides waterproofing and slip resistance suitable for rugged conditions but may compromise breathability. PU offers a lightweight, versatile alternative with good shock absorption but less environmental resistance. International buyers should prioritize suppliers who adhere to regional standards and certifications to ensure product quality, safety, and sustainability.

Material Selection Summary Table

| Material | Typical Use Case for navy shoes | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Leather | Formal, semi-formal, daily wear in dry/mild climates | Premium appearance, durability, breathability | Sensitive to moisture, requires maintenance, higher cost | High |

| Rubber | Casual, safety, industrial, maritime environments | Waterproof, slip-resistant, flexible | Less breathable, comfort issues in prolonged wear | Low |

| Polyurethane (PU) | Casual, work shoes, lightweight applications | Lightweight, shock absorption, easy manufacturing | Less resistant to UV and heat, environmental degradation | Med |

| Synthetic Fabrics (e.g., Nylon, Mesh) | Sports, outdoor, ventilated designs | Breathability, lightweight, quick-drying | Lower durability, less formal appearance | Low |

This comprehensive analysis equips international B2B buyers with actionable insights to select the most suitable materials for navy shoes, considering regional standards, environmental conditions, and market preferences.

In-depth Look: Manufacturing Processes and Quality Assurance for navy shoes

Manufacturing Processes for Navy Shoes

The production of navy shoes involves a series of carefully orchestrated stages, each critical to ensuring durability, comfort, and compliance with international standards.

Material Preparation

The process begins with sourcing high-quality raw materials, primarily leather, synthetic fabrics, rubber, and specialized insoles. Leather selection is crucial; suppliers often use full-grain or corrected-grain leather for durability and aesthetic appeal. Material prep includes cleaning, cutting, and treating the leather or synthetic components to optimize flexibility and weather resistance. For B2B buyers, verifying suppliers’ material certifications—such as REACH compliance for Europe or environmental standards for South America—is essential.

Forming and Cutting

In this stage, patterns are cut from prepared materials using automated or manual cutting techniques. Computer Numerical Control (CNC) cutting machines are preferred for precision, reducing waste and ensuring consistent sizing. B2B buyers should request detailed process documentation and sample consistency reports to confirm manufacturing precision.

Assembly and Stitching

The assembled components—uppers, linings, insoles, and outsoles—are stitched together using industrial sewing machines. Techniques like Goodyear welt, cementing, or direct injection are employed based on the shoe design and intended durability. For navy shoes, especially those used in demanding environments, robust stitching and bonding methods are critical. Suppliers should demonstrate adherence to industry standards such as ISO 9001 to ensure process consistency.

Finishing and Quality Control

The final stage involves finishing touches such as polishing, attaching eyelets, and adding branding elements. Outsoles are bonded or stitched onto the uppers, and the shoes undergo thorough inspection. Finishing also includes testing for water resistance, colorfastness, and comfort.

Quality Assurance (QA) and Control in Navy Shoe Manufacturing

Quality assurance is integral to delivering products that meet both international and specific client standards.

International Standards and Certifications

Manufacturers often align with ISO 9001 for quality management systems, ensuring systematic control over processes. For military or industrial-grade navy shoes, compliance with standards such as CE marking (European Conformity) or API (American Petroleum Institute) for specialized applications might be required. Suppliers should possess valid certifications and be able to provide documentation during audits.

Industry-Specific Certifications and Testing

Depending on the shoe’s end-use, additional certifications like ISO 20345 (safety footwear) or ASTM standards may be pertinent. Testing methods include:

- Mechanical Testing: Tensile, shear, and flex testing for durability.

- Environmental Testing: Water resistance, temperature endurance, and UV stability.

- Chemical Testing: Ensuring no harmful substances are present, especially for leather and adhesives.

- Comfort and Fit Testing: Ensuring ergonomic design and proper sizing.

QC Checkpoints and Methodologies

A robust QC system involves multiple inspection points:

- Incoming Quality Control (IQC): Raw materials are inspected upon arrival for defects, conformity, and compliance. B2B buyers should request detailed reports and third-party test results.

- In-Process Quality Control (IPQC): Continuous inspection during manufacturing, focusing on stitching integrity, material consistency, and assembly accuracy.

- Final Quality Control (FQC): Post-production inspection covering visual defects, measurement accuracy, and functionality testing. This stage often includes sampling based on standards like AQL (Acceptable Quality Level).

Testing Methods

Common testing procedures include:

- Visual Inspection: Checking for surface defects, color uniformity, and workmanship.

- Dimensional Checks: Ensuring size and shape accuracy.

- Pull Tests: Assessing the strength of seams and adhesives.

- Waterproofing Tests: Simulating wet conditions to verify water resistance.

- Slip Resistance Tests: Ensuring outsole grip meets safety standards.

How B2B Buyers Can Verify Supplier QC

Supplier Audits

Conduct on-site audits or engage third-party inspection firms to evaluate manufacturing facilities, quality systems, and compliance documentation. For buyers in Africa, South America, the Middle East, and Europe, audits help verify that suppliers meet local and international regulations, including labor standards and environmental policies.

Review Certification and Test Reports

Request recent ISO 9001 certificates, industry-specific certifications, and third-party testing reports. These documents provide assurance that the manufacturer adheres to quality protocols.

Third-Party Inspection Services

Leverage independent inspection agencies such as SGS, Bureau Veritas, or Intertek to perform pre-shipment inspections. These inspections include sampling, functional testing, and verification of certifications, offering an unbiased assessment of product quality.

Sample Verification and Pilot Orders

Order sample batches for detailed evaluation before large-scale procurement. This allows buyers to assess manufacturing consistency, material quality, and compliance with specifications firsthand.

Nuances for International B2B Buyers from Africa, South America, the Middle East, and Europe

International buyers must navigate varying standards, logistics, and communication challenges.

-

Standards Alignment: Buyers in Europe and the UK should prioritize suppliers with CE certification and ISO 9001 compliance, ensuring adherence to strict safety and environmental regulations. Conversely, buyers from Africa or South America may need to verify compliance with local import standards or specific military specifications.

-

Certification Verification: Due to potential language barriers or differing certification bodies, engage local or regional third-party inspectors familiar with the relevant standards to validate documentation.

-

Quality Communication: Establish clear specifications and quality expectations upfront. Use detailed quality agreements and require regular updates through photos, inspection reports, and factory audits.

-

Supply Chain Transparency: Given logistical complexities, request detailed supply chain documentation, including raw material sources and manufacturing process descriptions, to mitigate risks related to counterfeit or substandard materials.

-

Cultural and Regulatory Considerations: Be aware of local labor laws, environmental regulations, and trade policies that may impact manufacturing practices. Engaging local consultants or agents can facilitate compliance and quality assurance.

In summary, a thorough understanding of the manufacturing stages and rigorous quality assurance protocols is vital for B2B buyers to secure high-quality navy shoes. Combining supplier certifications, third-party inspections, and proactive communication enables buyers from diverse regions to mitigate risks and establish reliable sourcing partnerships.

Comprehensive Cost and Pricing Analysis for navy shoes Sourcing

Cost Structure Breakdown for Navy Shoes

Understanding the detailed cost components is essential for effective pricing negotiations and sourcing strategies. The primary cost drivers include:

-

Materials: High-quality leather, synthetic alternatives, or specialized textiles used in navy shoes can significantly influence costs. Premium materials with certifications (e.g., eco-labels, safety standards) tend to command higher prices but can enhance market appeal, especially in Europe and the Middle East.

-

Labor: Manufacturing costs vary based on the country of production. Countries like China, Vietnam, and India offer competitive labor rates, whereas European producers may have higher wages but often provide superior craftsmanship and quality assurance.

-

Manufacturing Overhead: Includes factory utilities, machinery maintenance, and administrative expenses. Overhead costs are typically embedded within the unit price and vary depending on factory location and scale.

-

Tooling & Development: Initial costs for molds, dies, and design development can be substantial but are usually amortized over large production runs. Customization or unique design features increase tooling expenses.

-

Quality Control & Certifications: Ensuring compliance with international standards (ISO, REACH, ASTM) incurs additional costs but is often non-negotiable for exports to Europe and the Middle East, where standards are strict.

-

Logistics & Shipping: Freight costs depend on order volume, destination, and shipping method (air vs. sea). Bulk shipments reduce per-unit logistics costs but require larger initial investments.

-

Margins: Markup varies by supplier, order size, and market segment. Typically, margins range from 10% to 30% but can be higher for niche, premium, or highly customized products.

Key Price Influencers for Navy Shoes Sourcing

Several factors can significantly impact the final price:

-

Order Volume & MOQ: Larger orders generally lead to lower unit costs due to economies of scale. Suppliers may offer discounts or better terms for volumes exceeding 1,000 pairs.

-

Specifications & Customization: Custom features such as branding, color, sole design, or special materials increase costs. Clear communication of specifications upfront can prevent unexpected charges.

-

Material Choices: Opting for synthetic or less expensive materials can reduce costs but may affect quality perception. Conversely, premium leathers and eco-friendly materials increase prices but can enhance market competitiveness.

-

Quality Certifications & Standards: Products meeting international standards (e.g., CE marking, ISO certifications) often command higher prices but are necessary for accessing regulated markets like Europe and the Middle East.

-

Supplier Factors: Supplier reputation, production capacity, and proximity influence pricing. Established manufacturers with advanced quality systems might charge more but offer better reliability.

-

Incoterms & Shipping Terms: FOB (Free On Board) pricing is common, allowing buyers to control logistics. DDP (Delivered Duty Paid) includes all costs, simplifying import procedures but often at a premium.

Buyer Tips for Cost Optimization & Negotiation

-

Leverage Volume & Long-term Relationships: Negotiating for better prices based on larger or repeat orders can yield substantial savings. Establishing trust with suppliers often results in more flexible terms.

-

Focus on Total Cost of Ownership (TCO): Consider not just the unit price but also shipping, customs, tariffs, and potential rework costs. For buyers in Africa and South America, understanding import duties and taxes is crucial for accurate budgeting.

-

Negotiate Flexibility & Payment Terms: Extended payment periods or discounts for upfront payments can improve cash flow and reduce overall costs.

-

Prioritize Quality & Certifications: While lower-cost options may be tempting, investing in quality assurance can reduce return rates and rework, ultimately saving money.

-

Understand Pricing Nuances: Prices can fluctuate based on raw material costs, currency exchange rates, and geopolitical factors. Regular market intelligence helps anticipate price changes and plan procurement cycles accordingly.

Disclaimer

Indicative pricing for navy shoes can range from $10 to $30 per pair for standard models in large volumes, with premium or customized products exceeding this range. Prices vary significantly based on specifications, country of origin, and order size. Always conduct detailed supplier negotiations and request formal quotations tailored to your specific needs.

By thoroughly analyzing these cost components and influencing factors, international buyers from Africa, South America, the Middle East, and Europe can develop effective sourcing strategies, negotiate better terms, and optimize their total procurement costs.

Spotlight on Potential navy shoes Manufacturers and Suppliers

- (No specific manufacturer data was available or requested for detailed profiling in this section for navy shoes.)*

Essential Technical Properties and Trade Terminology for navy shoes

Key Technical Properties of Navy Shoes

Understanding the technical specifications of navy shoes is crucial for international B2B buyers to ensure quality, compliance, and fit for purpose. Here are the essential properties to consider:

1. Material Grade and Composition

The quality of materials used in navy shoes—such as leather, synthetic fibers, and rubber—directly impacts durability, comfort, and appearance. High-grade leather (e.g., full-grain or top-grain) offers superior durability and a professional finish, making it preferred for formal or military-style footwear. Synthetic materials should meet industry standards for breathability and resilience. Buyers should specify the required material grade to ensure consistency across batches.

2. Sole Material and Tolerance

The sole material (rubber, polyurethane, or composite) determines slip resistance, shock absorption, and longevity. Precise specifications about hardness, flexibility, and tread pattern are vital. Tolerance levels—acceptable deviations in thickness, hardness, or grip—must be agreed upon to maintain uniformity, especially for footwear used in demanding environments like naval operations.

3. Stitching and Finish Quality

Strong, even stitching ensures the shoe’s structural integrity and resistance to wear. Specifications should include thread type, stitch density, and finishing standards. High-quality stitching reduces the risk of seams splitting, which is critical for safety and longevity.

4. Fit and Sizing Tolerance

Standardized sizing with strict tolerance ranges (e.g., ±1mm) ensures consistent fit across production runs. For international buyers, specifying sizing standards aligned with regional measurements (e.g., UK, US, EU sizes) is essential to prevent returns and dissatisfaction.

5. Weight and Flexibility

Lightweight shoes enhance comfort during prolonged wear, especially in military or industrial settings. Flexibility specifications, such as bend radius and stiffness, should align with the intended use—rigid for formal dress shoes, more flexible for active or operational footwear.

6. Color and Finish Specifications

For navy shoes, consistent color matching (e.g., navy blue Pantone reference) and finish quality (matte, gloss) are vital for branding and uniformity. Suppliers should provide color fastness standards and finishing details to meet industry or military specifications.

Industry and Trade Terminology

Familiarity with key trade terms enables smoother negotiations and clearer communication between international buyers and suppliers:

1. OEM (Original Equipment Manufacturer)

Refers to manufacturers that produce navy shoes based on the buyer’s design and specifications. OEM agreements often involve customized branding, specific materials, and technical requirements, making them ideal for buyers seeking unique or proprietary products.

2. MOQ (Minimum Order Quantity)

The smallest quantity of navy shoes a supplier is willing to produce per order. Understanding MOQ helps buyers plan procurement budgets and inventory levels, especially when entering new markets or testing product acceptance.

3. RFQ (Request for Quotation)

A formal request sent by buyers to suppliers to obtain pricing, lead times, and technical details. RFQs are essential for comparing supplier offerings, especially when sourcing from different regions.

4. Incoterms (International Commercial Terms)

Standardized trade definitions published by the ICC that specify responsibilities for shipping, insurance, and tariffs. Common Incoterms like FOB (Free on Board) and CIF (Cost, Insurance, and Freight) clarify costs and risk transfer points, vital for international transactions.

5. Lead Time

The period between placing an order and receiving the shipment. Accurate lead time estimates enable buyers to plan inventory and avoid shortages, especially critical for large or time-sensitive orders.

6. Quality Certification Standards

References to standards such as ISO, ASTM, or military specifications (e.g., MIL-SPEC) assure buyers of consistent quality and compliance. Verifying certifications before procurement reduces risks related to non-compliance or substandard products.

Summary:

A thorough understanding of these technical properties and trade terms empowers international B2B buyers to make informed decisions, negotiate effectively, and establish reliable supply chains for navy shoes. Clear specifications and familiarity with industry jargon streamline communication, reduce misunderstandings, and facilitate long-term partnerships across diverse markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the navy shoes Sector

Market Overview & Key Trends

The global navy shoes market is influenced by a combination of fashion, functionality, and sustainability trends, with key drivers including increased demand for durable, versatile footwear suitable for maritime and casual wear. Emerging B2B sourcing trends are increasingly centered around digital platforms, which facilitate transparent supplier verification, streamlined ordering, and real-time inventory management—crucial for buyers in Africa, South America, the Middle East, and Europe seeking reliable supply chains.

Market dynamics are shaped by fluctuating raw material costs, notably for leather, rubber, and eco-friendly textiles, which impact pricing and product development. For international B2B buyers, understanding regional sourcing capabilities is vital; for example, European suppliers often emphasize quality and sustainability, while African and South American manufacturers may offer cost advantages and flexible manufacturing options.

Additionally, technological advancements such as 3D design, AI-driven demand forecasting, and blockchain for traceability are transforming procurement processes. Buyers should leverage these innovations to mitigate risks and enhance supply chain resilience, especially amid geopolitical uncertainties and pandemic-related disruptions.

Regional market preferences also influence sourcing strategies. European markets prioritize eco-certifications and ethical production, often demanding compliance with strict environmental standards. Meanwhile, Middle Eastern buyers focus on luxury branding and high-performance features, and African and South American markets are increasingly adopting sustainable practices to meet global standards. Staying attuned to these trends enables B2B buyers to negotiate better terms, ensure compliance, and access premium or cost-effective products aligned with regional demand.

Sustainability & Ethical Sourcing in B2B

Sustainability is rapidly becoming a non-negotiable aspect of sourcing navy shoes, driven by both consumer demand and regulatory pressures. Environmentally conscious buyers in Europe and the Middle East are increasingly prioritizing suppliers who adhere to rigorous environmental standards, such as reducing carbon footprints and minimizing waste during manufacturing. Certifications like ISO 14001, OEKO-TEX, and B Corp are valuable indicators of a supplier’s commitment to sustainability.

Ethical sourcing practices are equally critical, encompassing fair labor conditions, transparent supply chains, and responsible material sourcing. B2B buyers should seek suppliers who demonstrate compliance with international labor standards, such as Fair Trade and SA8000 certifications, especially when sourcing from regions with complex labor environments. This not only mitigates reputational risks but also aligns with the growing global emphasis on corporate social responsibility.

The use of ‘green’ materials—such as recycled plastics, organic cotton linings, and vegetable-tanned leather—is increasingly common in navy shoe manufacturing. These materials reduce environmental impact and appeal to eco-conscious markets. Implementing a sustainable sourcing strategy requires rigorous supplier audits, clear contractual sustainability clauses, and ongoing monitoring to ensure compliance. Digital tools like blockchain can enhance transparency, enabling buyers to verify the authenticity of sustainability claims throughout the supply chain.

By integrating sustainability and ethics into procurement processes, B2B buyers can differentiate their offerings, meet regulatory standards, and appeal to environmentally aware consumers, ultimately fostering long-term supplier relationships rooted in shared values.

Brief Evolution/History (Optional)

The navy shoes sector has evolved from primarily utilitarian maritime footwear to a diverse segment encompassing fashion, performance, and sustainability. Historically, the focus was on durability and functionality, often with limited attention to aesthetics or environmental impact. Over the past two decades, rising consumer awareness and regulatory pressures have driven manufacturers to innovate with sustainable materials and ethical production methods.

This evolution has been accelerated by technological advancements, such as computerized design and supply chain traceability, enabling brands to meet rigorous quality and sustainability standards. For B2B buyers, understanding this trajectory highlights the importance of partnering with forward-thinking suppliers committed to continuous improvement and innovation. Recognizing the sector’s shift towards sustainability and transparency can inform sourcing decisions, ensuring long-term competitiveness in a rapidly changing global marketplace.

Illustrative Image (Source: Google Search)

Frequently Asked Questions (FAQs) for B2B Buyers of navy shoes

1. How can I effectively vet and verify navy shoe suppliers to ensure quality and reliability?

To vet suppliers effectively, start by requesting comprehensive company credentials, including business licenses, export licenses, and third-party certifications (ISO, ethical sourcing). Review their product catalogs and request samples to assess material quality, craftsmanship, and fit. Conduct background checks through trade associations, online marketplaces, and references from other international buyers. Additionally, consider visiting their manufacturing facilities or hiring third-party inspection agencies for on-site audits. Establish clear communication channels to gauge responsiveness and transparency. A reliable supplier will be open to sharing documentation, providing consistent updates, and accommodating quality assurance procedures.

2. What are the best ways to customize navy shoes to meet specific market or branding requirements?

Customization options include material choices (leather, synthetic, eco-friendly options), color shades, branding (logos, embossing), and design elements (embellishments, sole patterns). Clearly communicate your specifications and preferred standards upfront. Many manufacturers offer OEM and ODM services—review their portfolios to ensure they can meet your design needs. Request detailed prototypes or samples before bulk production. Negotiate minimum order quantities (MOQs) for customized products, and clarify lead times for design approval and production. Establish a quality control plan to ensure the final product aligns with your branding and quality expectations, reducing costly revisions.

3. What are typical minimum order quantities (MOQs), lead times, and payment terms for international navy shoe sourcing?

MOQs vary depending on the manufacturer, but generally range from 500 to 5,000 pairs for standard designs, with higher MOQs for customized orders. Lead times usually span 4-12 weeks, depending on complexity and production capacity. Payment terms often include a 30% deposit upfront, with the balance payable before shipment, or letters of credit for larger orders. Some suppliers may offer flexible terms for repeat buyers or large-volume contracts. To optimize cash flow, negotiate payment terms aligned with your sales cycle, and consider using escrow services or trade finance options to mitigate risks.

4. What certifications and quality assurance documentation should I request from navy shoe suppliers?

Ensure your supplier provides relevant certifications such as ISO 9001 (quality management), environmental standards (e.g., REACH, OEKO-TEX), and safety certifications if applicable. Request detailed QA reports, inspection certificates, and test reports for materials (e.g., sole adhesion, color fastness, toxicology). For markets with strict regulations, such as the EU or UK, compliance documentation like CE marking or UKCA certification is essential. Establish a quality assurance protocol that includes pre-production samples, in-process inspections, and final quality checks before shipment. This reduces the risk of non-compliance and product recalls, safeguarding your brand reputation.

5. How can I coordinate logistics and shipping to ensure timely delivery of navy shoes across different regions?

Start by selecting suppliers experienced in international shipping and familiar with your target markets. Clarify shipping options—sea freight for bulk orders, air freight for urgent needs—and their associated costs. Work with freight forwarders offering consolidated shipping, customs clearance, and door-to-door services. Ensure your supplier provides accurate documentation, including commercial invoices, packing lists, certificates of origin, and import/export licenses. Plan for customs duties, taxes, and import restrictions specific to each region (Africa, South America, Middle East, Europe). Establish clear lead times, track shipments proactively, and maintain open communication with logistics partners to address delays swiftly.

6. What are common dispute resolution mechanisms in international B2B navy shoe transactions?

Disputes often arise over quality, delivery delays, or payment issues. To mitigate risks, include clear terms in your contract, specifying jurisdiction, arbitration clauses, and applicable law. International arbitration through institutions like the ICC or LCIA offers neutral venues for dispute resolution. Alternatively, consider using trade assurance platforms or escrow services that hold funds until contractual obligations are met. Regular communication and documentation throughout the transaction help prevent misunderstandings. If disputes occur, seek resolution through negotiation first, escalating to arbitration if necessary, always referencing your contractual agreements for enforceability.

7. How do tariffs, import duties, and regional trade agreements impact the cost of importing navy shoes?

Tariffs and import duties vary significantly by country and product classification. For example, importing navy shoes into the UK or EU may involve customs duties, VAT, and compliance with trade regulations, while African or South American countries may have different tariffs or preferential trade agreements. Regional trade agreements like the African Continental Free Trade Area (AfCFTA) or Mercosur can reduce tariffs, lowering costs. Always consult with customs brokers or trade consultants to accurately calculate landed costs, including duties, taxes, and compliance fees. Understanding these factors allows you to price your products competitively and avoid unexpected expenses that could erode margins.

8. What strategies can I implement to build long-term relationships with navy shoe suppliers for sustained supply and quality?

Foster transparent communication, clear contractual agreements, and consistent payment practices. Start with smaller orders to build trust, then gradually increase volume as the relationship proves stable. Offer feedback on product quality and lead times to help suppliers improve their processes. Consider establishing long-term contracts with negotiated terms, including pricing, MOQs, and delivery schedules. Regularly visit suppliers or conduct virtual audits to maintain quality standards. Building rapport and mutual understanding encourages suppliers to prioritize your orders and collaborate on innovations or improvements, ensuring a reliable supply chain tailored to your evolving market needs.

Strategic Sourcing Conclusion and Outlook for navy shoes

Conclusion and Future Outlook

Effective strategic sourcing is critical for international B2B buyers seeking to optimize their navy shoe procurement, ensuring quality, cost-efficiency, and reliable supply chains. By prioritizing supplier diversification, leveraging regional manufacturing hubs, and adopting digital sourcing tools, buyers can mitigate risks and adapt to evolving market dynamics.

Illustrative Image (Source: Google Search)

For buyers in Africa, South America, the Middle East, and Europe, building strong supplier relationships and staying informed about emerging trends will provide a competitive edge. Emphasizing sustainability and ethical sourcing not only aligns with global standards but also enhances brand reputation and customer trust.

Looking ahead, the navy shoe market is poised for innovation driven by technological advancements and shifting consumer preferences. Strategic sourcing will remain a vital tool for navigating these changes, enabling buyers to capitalize on new opportunities while maintaining resilience.

Actionable Takeaway: Continuously evaluate and diversify sourcing channels, invest in supplier relationships, and stay abreast of industry developments to secure a sustainable and profitable supply chain in the evolving navy shoe landscape.