Your Ultimate Guide to Sourcing Shoe Palace Careers

Guide to Shoe Palace Careers

- Introduction: Navigating the Global Market for shoe palace careers

- Understanding shoe palace careers Types and Variations

- Key Industrial Applications of shoe palace careers

- Strategic Material Selection Guide for shoe palace careers

- In-depth Look: Manufacturing Processes and Quality Assurance for shoe palace careers

- Comprehensive Cost and Pricing Analysis for shoe palace careers Sourcing

- Spotlight on Potential shoe palace careers Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for shoe palace careers

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the shoe palace careers Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of shoe palace careers

- Strategic Sourcing Conclusion and Outlook for shoe palace careers

Introduction: Navigating the Global Market for shoe palace careers

In today’s interconnected global economy, understanding the intricacies of shoe palace careers is crucial for B2B buyers seeking sustainable and profitable sourcing strategies. As the footwear industry continues to evolve, the importance of sourcing high-quality, innovative, and cost-effective products from diverse markets has never been greater. Shoe palace careers—encompassing manufacturing, design, and supply chain roles—are central to delivering competitive advantage in a crowded marketplace.

This comprehensive guide aims to equip international B2B buyers, particularly from Africa, South America, the Middle East, and Europe (including key markets like Brazil and Spain), with the insights needed to navigate this complex landscape confidently. It covers critical aspects such as types of shoe palace careers, materials used, manufacturing and quality control processes, supplier selection, and cost considerations. Additionally, it addresses market trends, sourcing challenges, and frequently asked questions, providing a 360-degree view of the industry.

By leveraging this knowledge, buyers can make informed decisions, optimize supply chain efficiency, and foster strategic partnerships tailored to their regional needs. Whether sourcing innovative designs from Europe, cost-effective manufacturing from South America, or sustainable materials from Africa, this guide empowers you to unlock new opportunities and mitigate risks in the dynamic world of shoe palace careers.

Understanding shoe palace careers Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Retail Store Careers | Frontline roles in physical stores, including sales and management | Direct consumer engagement, brand representation | Pros: Immediate customer feedback, brand visibility; Cons: Limited scalability, high overhead costs |

| E-commerce & Digital Roles | Online sales, digital marketing, logistics, and customer service | Online sales channels, digital marketing | Pros: Broader reach, scalable; Cons: High competition, cybersecurity risks |

| Supply Chain & Logistics | Procurement, warehousing, distribution, and inventory management | Distribution networks, inventory management | Pros: Cost efficiency, streamlined operations; Cons: Complex coordination, geopolitical risks |

| Product Development & Design | Innovation, product sourcing, quality assurance | R&D partnerships, OEM collaborations | Pros: Differentiation, premium offerings; Cons: Longer lead times, higher R&D costs |

| Corporate & Administrative | HR, finance, compliance, and strategic planning | Corporate partnerships, licensing agreements | Pros: Stability, strategic growth; Cons: Less direct sales impact, regulatory complexity |

Retail Store Careers

Retail store careers encompass roles directly involved in the physical presentation and sale of footwear, including store managers, sales associates, and visual merchandisers. These careers are ideal for B2B buyers seeking to establish or expand retail outlets in target markets such as Brazil, Spain, or Middle Eastern countries. They require an understanding of local consumer preferences, cultural nuances, and retail regulations. When sourcing for retail careers, focus on partnerships with experienced local managers or franchise operators who can navigate regional market dynamics effectively. This approach minimizes risks related to cultural misalignment and operational inefficiencies.

E-commerce & Digital Roles

This career variation centers on online platforms, digital marketing, and logistics operations. For international B2B buyers, investing in e-commerce talent or partnerships can significantly expand market reach, especially in regions with high internet penetration like Europe or urban centers in Africa and South America. Key considerations include localizing digital content, optimizing logistics for cross-border shipping, and ensuring compliance with regional e-commerce regulations. Prioritizing partnerships with local digital agencies or logistics providers can enhance market penetration and customer satisfaction, reducing barriers to entry and operational costs.

Supply Chain & Logistics

Careers in supply chain and logistics focus on procurement, warehousing, and distribution networks. These are critical for ensuring timely delivery and inventory management across borders. For B2B buyers, establishing robust supply chain partnerships in regions like the Middle East or South America can optimize costs and reduce lead times. Consider geopolitical stability, customs procedures, and regional infrastructure quality when selecting logistics partners. Developing local warehousing solutions or partnering with regional logistics firms can also mitigate risks associated with international shipping delays and tariffs.

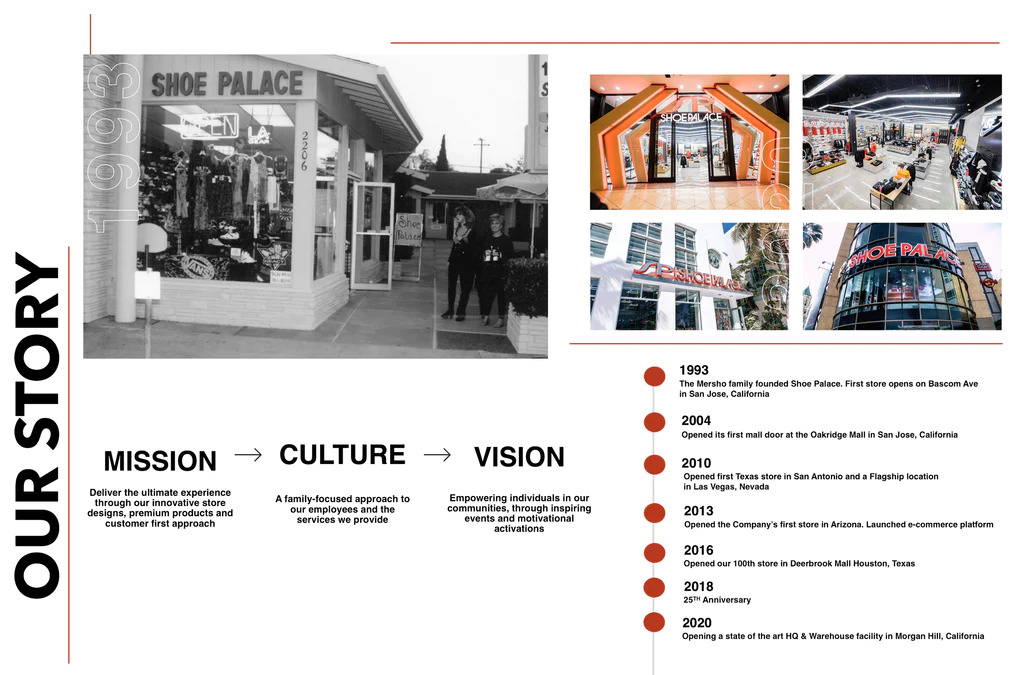

Illustrative Image (Source: Google Search)

Product Development & Design

This category involves careers related to footwear innovation, sourcing materials, and quality assurance. For international buyers, collaborating with local designers or OEM manufacturers in countries like Spain or Brazil can lead to differentiated products tailored to regional tastes. Key considerations include intellectual property protection, lead times, and cost structures. Establishing strong relationships with regional R&D centers or design studios can accelerate product development cycles and ensure cultural relevance, giving your offerings a competitive edge in local markets.

Corporate & Administrative

Roles in HR, finance, compliance, and strategic planning underpin the operational stability of shoe businesses. These careers are essential for building local expertise, managing regulatory requirements, and ensuring sustainable growth. For B2B buyers, partnering with local corporate service providers can streamline compliance with regional labor laws, tax regulations, and corporate governance standards. Such collaborations reduce legal risks and facilitate smoother market entry, especially in complex regulatory environments like the Middle East or certain European markets.

Key Industrial Applications of shoe palace careers

| Industry/Sector | Specific Application of shoe palace careers | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive & Transportation | Custom footwear for ergonomic support and safety gear | Enhances driver comfort, reduces fatigue, and improves safety compliance | Durability standards, material quality, compliance with safety regulations |

| Healthcare & Medical | Specialized footwear for healthcare professionals | Provides comfort during long shifts, reduces foot fatigue, and maintains hygiene | Antimicrobial properties, slip resistance, ergonomic design considerations |

| Sports & Recreation | Performance footwear for athletes and trainers | Boosts athletic performance, reduces injury risk, and enhances durability | High-performance materials, lightweight design, moisture management |

| Industrial & Manufacturing | Safety shoes for workers in hazardous environments | Protects against impacts, punctures, and chemical exposure | Certification (e.g., ASTM, EN standards), slip resistance, chemical resistance |

| Fashion & Retail | Trend-focused footwear for mass-market distribution | Meets consumer demand for stylish, comfortable, and affordable shoes | Trend responsiveness, material sourcing, cost efficiency |

Automotive & Transportation

In the automotive industry, shoe palace careers are integrated into ergonomic and safety footwear designed for drivers and maintenance personnel. These shoes often feature slip-resistant soles, reinforced toe caps, and ergonomic insoles to support long hours of standing and driving. For international B2B buyers from regions like South America or Africa, sourcing durable, compliant safety footwear helps reduce workplace accidents and fatigue-related issues, enhancing overall operational efficiency. Ensuring products meet local safety standards and certifications is critical for seamless market entry and compliance.

Healthcare & Medical

Healthcare professionals require specialized footwear that balances comfort, hygiene, and safety. Shoe palace careers in this sector include antimicrobial, slip-resistant, and supportive shoes tailored for nurses, doctors, and support staff. For B2B buyers in Europe or the Middle East, sourcing high-quality, compliant footwear minimizes foot fatigue during long shifts and reduces infection risks. Emphasizing materials that meet medical standards and hygiene regulations ensures product acceptance in hospitals and clinics, facilitating smoother international procurement processes.

Sports & Recreation

Performance footwear produced by shoe palace careers plays a vital role in the sports industry, providing athletes with lightweight, durable, and moisture-wicking shoes. These products help improve athletic performance and prevent injuries such as sprains or strains. B2B buyers from Brazil, Spain, or Africa should focus on sourcing innovative materials like high-tech foams and breathable fabrics, ensuring the footwear meets international standards for quality and performance. Responsiveness to evolving sports trends and sustainability considerations can also be key differentiators.

Industrial & Manufacturing

In hazardous work environments, shoe palace careers are essential components of safety footwear designed to protect workers from impacts, punctures, and chemical hazards. Sourcing certified safety shoes with features like steel toes, slip-resistant soles, and chemical resistance is crucial for B2B buyers in sectors such as construction, oil & gas, and manufacturing across regions like the Middle East and South America. Ensuring compliance with international safety standards (e.g., ASTM, EN) and sourcing from reliable manufacturers reduces liability and enhances workforce safety.

Fashion & Retail

In the fashion and retail sectors, shoe palace careers are developed into trendy, affordable footwear appealing to mass markets. These shoes combine style with comfort, catering to consumer preferences across Europe, Africa, and South America. B2B buyers should prioritize sourcing from manufacturers that can rapidly adapt to fashion trends, ensure consistent quality, and optimize costs. Establishing reliable supply chains and emphasizing sustainable materials can provide a competitive edge in fast-paced retail environments.

Strategic Material Selection Guide for shoe palace careers

Material Analysis for Shoe Palace Careers

Selecting the appropriate materials for shoe manufacturing is critical for ensuring product quality, durability, and compliance with international standards. For B2B buyers from Africa, South America, the Middle East, and Europe, understanding the properties and implications of common materials helps optimize sourcing strategies and meet regional market demands.

Leather (Full-Grain, Top-Grain, or Genuine Leather)

Key Properties:

Leather remains a primary material in high-end shoe production due to its breathability, flexibility, and aesthetic appeal. It offers moderate water resistance when properly treated and has good tensile strength. Leather’s thermal regulation properties make it suitable for various climates.

Pros & Cons:

Advantages include excellent durability, a premium feel, and ease of customization. However, leather production involves significant environmental considerations, and sourcing quality leather can be costly. Manufacturing requires skilled labor, which may increase production complexity.

Impact on Application:

Leather performs well in casual and formal footwear, especially where comfort and appearance are priorities. It is compatible with various dyes and finishes, allowing for customization.

International Buyer Considerations:

Buyers from regions like Brazil and Spain, with established leather industries, benefit from local sourcing, reducing costs and ensuring quality. Compliance with standards such as the EU REACH regulation and ASTM leather safety standards is essential. Transparency in sourcing (e.g., animal welfare and environmental impact) is increasingly demanded, especially in European markets.

Thermoplastic Polyurethane (TPU)

Key Properties:

TPU is a versatile polymer known for its elasticity, abrasion resistance, and flexibility. It withstands a broad temperature range (-40°C to +80°C) and offers excellent chemical resistance, including oils and greases.

Pros & Cons:

TPU provides high durability at a relatively moderate cost, making it suitable for soles and decorative elements. Manufacturing involves injection molding, which can be complex but scalable. It is lightweight, contributing to comfortable footwear.

Impact on Application:

Ideal for sole components, overlays, and decorative trims. Its resistance to cracking and UV exposure enhances product lifespan, especially in harsh climates.

International Buyer Considerations:

Buyers from Africa and South America benefit from TPU’s resistance to humid and tropical conditions. Compliance with international standards like ISO and ASTM for chemical safety and environmental impact is crucial. TPU’s recyclability aligns with sustainability trends in Europe and the Middle East.

Rubber (Natural and Synthetic)

Key Properties:

Rubber offers excellent elasticity, shock absorption, and water resistance. Natural rubber provides high resilience, while synthetic variants like SBR (Styrene-Butadiene Rubber) are tailored for specific performance needs.

Pros & Cons:

Rubber is cost-effective and widely available, making it a popular choice for soles and waterproof components. However, natural rubber can be susceptible to UV degradation and may have supply chain variability. Synthetic rubbers offer consistent quality but can be more costly.

Impact on Application:

Primarily used in soles, waterproof membranes, and flexible components. Compatibility with various adhesives and finishes is generally good, but chemical resistance varies.

International Buyer Considerations:

Regions like Brazil are major natural rubber producers, ensuring supply stability. European and Middle Eastern markets emphasize compliance with environmental standards, such as REACH, and prefer synthetic options for consistency. Durability standards and eco-labeling influence material selection.

Summary Table

| Material | Typical Use Case for shoe palace careers | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Leather (Full/Top-Grain) | Upper material, premium footwear | Breathability, aesthetic appeal, durability | High cost, environmental concerns, requires skilled labor | High |

| Thermoplastic Polyurethane (TPU) | Soles, overlays, decorative trims | Flexibility, abrasion resistance, lightweight | Manufacturing complexity, environmental impact concerns | Med |

| Rubber (Natural/Synthetic) | Soles, waterproof components | Cost-effective, water resistance, shock absorption | UV degradation (natural rubber), supply variability | Low |

This comprehensive understanding of material properties and regional considerations enables international buyers to make informed sourcing decisions, optimize costs, and ensure compliance with regional standards while delivering high-quality footwear products.

In-depth Look: Manufacturing Processes and Quality Assurance for shoe palace careers

Manufacturing Processes in Shoe Production

Effective manufacturing of shoes involves a series of interconnected stages, each critical to ensuring product quality and consistency. For international B2B buyers, understanding these stages enables better supplier evaluation and quality control planning.

1. Material Preparation

This initial phase involves sourcing and processing raw materials such as leather, synthetic fabrics, rubber, foam, and adhesives. Suppliers often utilize specialized techniques like tanning for leather, polymer extrusion for plastics, and textile finishing processes to enhance durability and aesthetics. For buyers from regions like Brazil or Spain, verifying the authenticity and quality certifications of these materials is vital, as it influences the final product’s performance.

2. Forming

In this stage, upper components are shaped using molds or templates. Techniques such as injection molding for synthetic parts, or manual molding for leather uppers, are common. Modern manufacturers increasingly adopt computer-aided design (CAD) and computer-aided manufacturing (CAM) to ensure precision and repeatability. B2B buyers should inquire whether suppliers employ digital modeling and whether they have certifications like ISO 9001 to ensure process consistency.

3. Assembly

The assembled components—uppers, insoles, outsoles, and decorative elements—are stitched, glued, or heat-pressed together. Automated sewing machines and robotic assembly lines are prevalent in high-volume factories, improving efficiency and reducing errors. Manual craftsmanship remains significant for premium or bespoke shoes, especially in regions emphasizing artisanal quality. Buyers should assess the level of automation versus manual work, as it impacts production speed and uniformity.

4. Finishing

This phase includes quality checks, surface treatments, polishing, and packaging. Techniques like buffing, dyeing, and coating are used to enhance appearance and weather resistance. Finishing directly affects the shoe’s market appeal and durability, making stringent QC essential. Suppliers often perform final inspections to meet specific aesthetic and functional standards before shipment.

Quality Control (QC) in Shoe Manufacturing

Robust QC processes are fundamental to delivering footwear that meets international standards and customer expectations. For B2B buyers, especially from diverse regions, understanding QC frameworks and checkpoints is essential for mitigating risks.

1. International Standards and Industry Certifications

– ISO 9001: The cornerstone for quality management systems globally, ensuring consistent product quality through process control, documentation, and continual improvement.

– CE Marking (European Compliance): Indicates conformity with EU safety, health, and environmental protection standards, crucial for footwear intended for European markets.

– API and Other Industry-Specific Standards: For specialized footwear (e.g., safety shoes), certifications like API (American Petroleum Institute) or ASTM standards may apply, emphasizing safety and performance.

2. QC Checkpoints and Techniques

– Incoming Quality Control (IQC): Inspection of raw materials upon receipt, including visual assessments, dimensional checks, and testing for defects or contamination.

– In-Process Quality Control (IPQC): Continuous monitoring during manufacturing, employing techniques like sampling, gauging, and functional testing to detect issues early.

– Final Quality Control (FQC): Comprehensive inspection before packaging, including visual quality checks, measurement verification, and functional testing such as flexibility, adhesion, and slip resistance.

3. Testing Methods

– Visual Inspection: Identifies surface defects, color inconsistencies, and stitching quality.

– Dimensional Testing: Ensures size accuracy and uniformity across batches.

– Durability Testing: Simulates wear conditions, including abrasion resistance, flex testing, and sole adhesion.

– Environmental Testing: Assesses resistance to water, UV exposure, and temperature extremes, vital for shoes marketed in varied climates.

4. Verification and Supplier Audits

B2B buyers can verify supplier QC through multiple approaches:

– Third-party Inspections: Engaging agencies like SGS, Bureau Veritas, or Intertek to conduct audits, sample testing, and process reviews, providing unbiased assessments.

– Factory Audits: Performing on-site evaluations focusing on quality management systems, production capacity, and compliance with social and environmental standards.

– Review of QC Reports: Requesting detailed inspection and testing reports, including test results, non-conformance records, and corrective actions.

Nuances for International B2B Buyers from Africa, South America, the Middle East, and Europe

1. Regulatory Compliance and Certification Expectations

Buyers from regions with strict standards—such as the EU or Spain—must prioritize suppliers with CE certification and adherence to REACH regulations for chemical safety. Conversely, buyers from Africa or South America should verify compliance with local import regulations and ensure suppliers can meet these requirements to avoid delays or rejection.

2. Cultural and Market-Specific Quality Expectations

Different regions may have varying tolerances for aesthetic imperfections or functional features. For example, European buyers often demand high precision and eco-friendly materials, while Middle Eastern buyers might prioritize durability against harsh climates. Suppliers should tailor their QC processes to meet these regional expectations and provide transparent documentation.

3. Language and Communication

Ensuring clear communication about QC standards and expectations is critical. B2B buyers should engage with suppliers who provide documentation in multiple languages or employ local inspectors familiar with regional standards to facilitate effective quality assurance.

4. Building Long-term Quality Partnerships

Establishing ongoing relationships with suppliers that demonstrate consistent QC performance fosters trust and minimizes supply chain disruptions. Regular audits, shared quality improvement initiatives, and collaborative problem-solving are recommended strategies.

Final Recommendations for B2B Buyers

- Conduct Rigorous Supplier Assessments: Prioritize suppliers with ISO 9001 certification, proven track records, and third-party audit reports.

- Specify Clear Quality Standards: Incorporate detailed quality specifications and testing requirements into contracts, aligned with international standards and regional market expectations.

- Implement Regular Monitoring: Establish routine inspections, sampling plans, and performance reviews to ensure ongoing compliance.

- Leverage Technology: Use digital tools for real-time quality monitoring, supplier dashboards, and documentation management to streamline QC processes.

- Foster Supplier Development: Collaborate with suppliers on quality improvement initiatives, especially in emerging markets, to build resilient and quality-focused partnerships.

By understanding and actively managing manufacturing and quality assurance processes, international B2B buyers can secure reliable, high-quality footwear supply chains that meet diverse regional standards and consumer expectations.

Comprehensive Cost and Pricing Analysis for shoe palace careers Sourcing

Cost Structure Breakdown for Shoe Palace Careers Sourcing

Understanding the comprehensive cost structure is vital for international B2B buyers aiming to negotiate effectively and optimize their procurement strategies. The primary components include raw materials, labor, manufacturing overhead, tooling, quality control, logistics, and profit margins.

Materials constitute a significant portion of the cost, especially for premium or custom footwear. Prices fluctuate based on material type—leather, synthetic, textiles—and origin. For instance, genuine leather sourced from Europe or South America may carry higher costs but often meet stricter quality standards, whereas synthetic alternatives might be more budget-friendly.

Labor costs vary substantially by region. Countries in South America and parts of Eastern Europe tend to have lower labor rates, which can translate into competitive pricing. However, buyers should consider the implications of labor standards and certifications, especially for markets with stringent import regulations.

Manufacturing overhead encompasses factory expenses, machinery depreciation, and utilities. These are influenced by factory location, size, and automation levels. Higher automation can reduce labor dependency but may increase upfront tooling costs.

Tooling and setup costs are typically one-time investments for molds and production fixtures. These costs are amortized over larger order volumes, making bulk orders more cost-effective. Custom designs or complex styles will incur higher tooling expenses.

Quality control (QC) processes ensure product compliance with safety, durability, and branding standards. Quality certifications (e.g., ISO, BSCI) may add to costs but are often necessary for export markets, especially in Europe and the Middle East.

Logistics and shipping costs are influenced by order volume, destination port, Incoterms, and transportation mode. Buyers from Africa and South America should factor in customs duties, import taxes, and potential delays, which can inflate overall costs.

Profit margins vary depending on supplier relationships, order volume, and market positioning. Negotiating favorable terms and establishing long-term partnerships can significantly reduce costs over time.

Key Price Influencers

Several factors influence the final pricing and should be carefully considered:

- Order volume and MOQ: Larger orders benefit from economies of scale, lowering per-unit costs. Suppliers often offer discounts for high-volume commitments.

- Specifications and customization: Custom designs, special materials, or unique features increase costs due to additional tooling, setup, and QC requirements.

- Material choices: Premium materials elevate costs but can justify higher retail pricing, especially in markets demanding luxury or durability.

- Quality standards and certifications: Meeting international standards adds to costs but enhances marketability and reduces the risk of customs issues.

- Supplier factors: Experience, reputation, and production capacity influence pricing. Established suppliers with reliable quality often command higher prices but offer greater assurance.

- Incoterms and logistics: FOB (Free on Board) or CIF (Cost, Insurance, Freight) terms impact who bears transportation and insurance costs. Buyers should negotiate terms that align with their logistics capabilities.

Strategic Tips for International Buyers

- Negotiate thoroughly: Leverage order volume, long-term relationships, and market intelligence to secure better prices. Don’t hesitate to request detailed quotations breaking down costs.

- Focus on total cost of ownership: Consider all associated costs—shipping, tariffs, customs clearance, warehousing—to avoid surprises.

- Opt for bulk orders: Larger quantities reduce per-unit costs and facilitate better negotiation leverage, especially for markets like Brazil or Spain where import tariffs vary.

- Customize smartly: Balance customization needs with cost implications. Standard styles with minor modifications often strike a good cost-quality balance.

- Understand pricing nuances: Be aware of currency fluctuations, payment terms, and potential hidden costs that can impact overall expenses.

Price Range Estimates (Indicative)

- Basic sneakers: $10–$20 FOB per pair for bulk orders in regions with lower labor costs.

- Mid-range styles: $20–$40 FOB per pair, often including some customization.

- Premium or custom footwear: $40–$70+ FOB per pair, depending on materials and complexity.

Disclaimer: These prices are indicative and can vary significantly based on supplier, order volume, specifications, and regional factors. Buyers should conduct due diligence and request detailed quotations tailored to their specific needs.

By understanding these cost components and influencing factors, B2B buyers from Africa, South America, the Middle East, and Europe can develop more accurate budgets, negotiate effectively, and optimize their sourcing strategies for Shoe Palace Careers products.

Spotlight on Potential shoe palace careers Manufacturers and Suppliers

- (No specific manufacturer data was available or requested for detailed profiling in this section for shoe palace careers.)*

Essential Technical Properties and Trade Terminology for shoe palace careers

Key Technical Properties for Shoe Palace Manufacturing

1. Material Grade

Material grade specifies the quality and purity of raw materials used in shoe production, such as leather, rubber, or synthetics. High-grade materials ensure durability, comfort, and a premium appearance, which are critical for brand reputation. For international buyers, specifying the required grade helps ensure consistency across batches and reduces the risk of returns or dissatisfaction.

2. Tolerance Levels

Tolerance refers to the permissible deviation in dimensions during manufacturing, such as sole thickness or upper length. Tight tolerances (e.g., ±0.2 mm) indicate precision and high-quality standards, essential for product consistency and proper fit. Understanding tolerance levels helps buyers assess manufacturing quality and avoid issues related to sizing mismatches.

3. Waterproofing and Breathability Ratings

These properties indicate how well a shoe resists water ingress and allows moisture vapor to escape. High waterproofing ratings are vital for outdoor or work shoes, while breathability enhances comfort for daily wear. Clear specifications support buyers in selecting products suitable for specific climates and usage scenarios.

4. Stitching and Finish Quality

The durability and aesthetic appeal of shoes depend heavily on the quality of stitching and surface finish. Specifications often include stitch count per inch and finishing techniques. High-quality stitching reduces seam failure and enhances the overall product lifespan, crucial for customer satisfaction and brand integrity.

5. Weight and Flexibility

These properties influence comfort and performance. Lighter shoes are preferred for athletic or casual wear, while flexibility ensures ease of movement. Precise measurements enable buyers to match products with targeted customer needs, especially in competitive markets.

Industry and Trade Terms for Shoe Palace Careers

1. OEM (Original Equipment Manufacturer)

An OEM produces shoes based on the buyer’s specifications and designs. Understanding OEM relationships is vital for buyers seeking customized products or exclusive branding, often common when sourcing from large manufacturers in Asia or Europe.

2. MOQ (Minimum Order Quantity)

MOQ defines the smallest quantity a manufacturer will accept per order. This term impacts inventory planning and cash flow, especially for buyers from regions with smaller retail outlets or limited storage capacity. Negotiating MOQs can lead to more flexible sourcing strategies.

3. RFQ (Request for Quotation)

An RFQ is a formal request sent to suppliers asking for price quotes based on specific product requirements. Efficient RFQ processes enable buyers to compare costs, lead times, and quality across multiple suppliers, facilitating better negotiation and procurement decisions.

4. Incoterms (International Commercial Terms)

Incoterms are globally recognized trade terms that define responsibilities for shipping, insurance, and tariffs between buyers and sellers. Common terms like FOB (Free on Board) or CIF (Cost, Insurance, Freight) clarify who bears costs and risks at various stages, reducing misunderstandings in international transactions.

5. Lead Time

This refers to the duration from order placement to delivery. Accurate knowledge of lead times helps buyers plan inventory, avoid stockouts, and synchronize supply chains, especially important when dealing with overseas manufacturing hubs.

6. Quality Certification Terms

Certifications such as ISO standards or specific industry compliance marks ensure products meet safety, environmental, and quality benchmarks. Recognizing these certifications assures buyers of consistent quality and can be a prerequisite for entering certain markets.

By mastering these technical properties and trade terms, international B2B buyers can streamline their sourcing processes, negotiate effectively, and ensure they acquire high-quality shoes tailored to their market needs. Clear communication and understanding of industry standards are essential for building reliable supplier relationships and achieving long-term success in the shoe industry.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the shoe palace careers Sector

Market Overview & Key Trends

The global shoe industry is experiencing dynamic shifts driven by technological innovation, evolving consumer preferences, and geopolitical factors. For B2B buyers, understanding these drivers is essential to navigate market opportunities effectively. Emerging digital platforms and supply chain management tools enable more transparent and efficient sourcing, especially for international buyers from Africa, South America, the Middle East, and Europe. For instance, AI-driven demand forecasting and blockchain traceability are increasingly used to ensure authenticity and streamline procurement processes.

Current market dynamics show a rising demand for customized and sustainable footwear, prompting manufacturers to adopt advanced manufacturing techniques such as 3D printing and automation. These innovations reduce lead times and costs, opening avenues for smaller or regional suppliers to compete globally. Additionally, trade policies and tariffs influence sourcing strategies, particularly in regions like Europe and South America, where local regulations favor sustainable and ethically sourced products.

For African, Middle Eastern, and South American buyers, proximity to emerging manufacturing hubs in Asia and Eastern Europe offers cost advantages and flexibility. However, geopolitical tensions and supply chain disruptions, exemplified by the COVID-19 pandemic, have underscored the importance of diversified sourcing networks. Buyers should prioritize building resilient supply chains by establishing partnerships with multiple suppliers and leveraging digital platforms for real-time market intelligence.

Furthermore, the shift towards direct-to-consumer (DTC) channels has impacted traditional wholesale models, encouraging brands to invest in regional partnerships and localized marketing strategies. This trend offers opportunities for international buyers to collaborate directly with brands and manufacturers, gaining better control over product quality and delivery timelines.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a central pillar of strategic sourcing in the shoe industry, driven by increased consumer awareness and regulatory pressures. For B2B buyers, integrating environmentally responsible practices not only aligns with global standards but also enhances brand reputation and market competitiveness. Ethical supply chains are critical, especially for regions like Europe, where consumers demand transparency regarding labor practices and environmental impact.

Key sustainability initiatives include the adoption of eco-friendly materials such as recycled polyester, organic cotton, and biodegradable leathers. Certifications like Global Organic Textile Standard (GOTS), Forest Stewardship Council (FSC), and Fair Trade are increasingly important markers of credibility, enabling buyers to verify compliance with social and environmental standards. Green certifications can also facilitate market access in eco-conscious regions like the European Union and parts of South America.

Environmental impacts of sourcing—such as water usage, carbon emissions, and waste generation—must be managed through sustainable practices. Implementing closed-loop manufacturing processes and renewable energy sources can significantly reduce ecological footprints. For instance, some suppliers in Spain and Brazil are pioneering the use of solar-powered factories and water recycling systems.

Moreover, ethical sourcing extends beyond environmental considerations to include fair labor practices and community engagement. B2B buyers should conduct rigorous due diligence, leveraging supplier audits and blockchain-enabled traceability systems to ensure ethical compliance throughout the supply chain. Building partnerships with suppliers committed to sustainability fosters long-term resilience and aligns with the increasing demand for socially responsible products across diverse markets.

Brief Evolution/History

The shoe industry has undergone significant transformation over the past century, evolving from artisanal craftsmanship to highly automated, globalized manufacturing networks. Initially localized in regions with skilled artisans, the industry shifted towards mass production in the mid-20th century, driven by innovations like assembly lines and synthetic materials.

In recent decades, globalization facilitated sourcing from emerging markets in Asia, Latin America, and Africa, creating complex, multi-tiered supply chains. The rise of fast fashion and e-commerce further accelerated product cycles and demanded rapid, cost-effective manufacturing solutions. Simultaneously, consumer awareness about sustainability and labor rights prompted industry shifts toward greener and more ethical practices.

For B2B buyers, understanding this evolution is vital to adapting sourcing strategies, managing risks, and capitalizing on innovations. The transition towards digital integration, sustainability, and regional manufacturing hubs continues to reshape the landscape, presenting new opportunities and challenges in the shoe industry’s ongoing development.

Frequently Asked Questions (FAQs) for B2B Buyers of shoe palace careers

1. How can I effectively vet suppliers for Shoe Palace careers to ensure reliability and quality?

To vet suppliers effectively, start with comprehensive background checks, including verifying business licenses, certifications, and references from other international buyers. Request samples to assess product quality firsthand and review their compliance with international standards such as ISO or CE. Conduct site visits if possible or engage third-party inspection services to evaluate manufacturing practices. Additionally, evaluate their communication responsiveness and transparency regarding production processes, lead times, and pricing. A reliable supplier should provide clear documentation, demonstrate consistent quality, and have positive references from other global clients.

2. What customization options are typically available for Shoe Palace careers, and how do they impact lead times and costs?

Most Shoe Palace careers suppliers offer customization in design, branding (e.g., logo placement), packaging, and sometimes material selection. Clearly communicate your specifications early to receive accurate quotes and lead time estimates. Customization can extend lead times by several weeks, especially if it involves unique materials or complex designs. Costs vary depending on the extent of customization—larger orders with standard designs tend to be more economical. Always request detailed prototypes or samples to approve before mass production, and negotiate terms that include flexibility for adjustments without significant delays or costs.

3. What are typical MOQs, lead times, and payment terms for international orders of Shoe Palace careers?

Minimum order quantities (MOQs) vary widely but generally range from 500 to 5,000 units, depending on the supplier and customization level. Lead times typically span 4 to 12 weeks, factoring in production, quality checks, and shipping logistics. Payment terms often include a 30% deposit upfront with the balance payable before shipment, or letters of credit for larger orders. Establish clear contractual agreements detailing payment schedules, penalties for delays, and conditions for order modifications. Building strong relationships with suppliers can also enable more flexible terms, especially for repeat business.

4. What quality assurance measures and certifications should I look for when sourcing Shoe Palace careers internationally?

Ensure your supplier complies with internationally recognized quality standards such as ISO 9001, which indicates a robust quality management system. Request documentation of relevant safety and environmental certifications, especially if products are intended for markets with strict regulations (e.g., CE marking for Europe). Conduct or commission third-party inspections during and after production to verify adherence to specifications. Additionally, review their quality control processes, including testing procedures for durability, comfort, and safety. Reliable suppliers should readily share certification documentation and be transparent about their QA protocols.

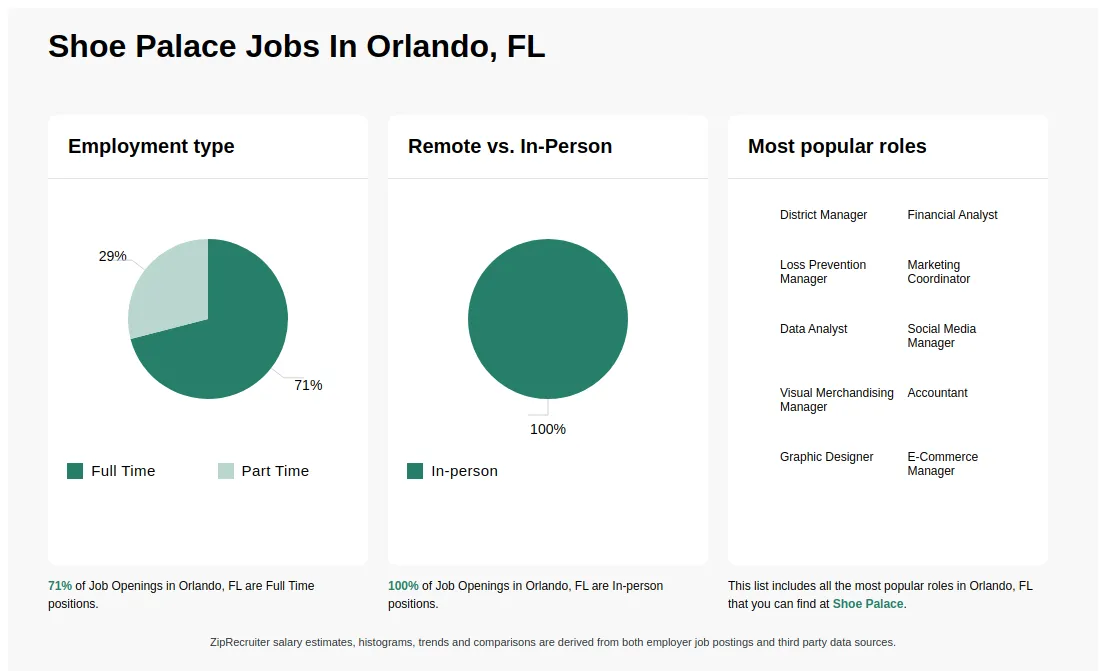

Illustrative Image (Source: Google Search)

5. How can I manage international logistics effectively when importing Shoe Palace careers from overseas suppliers?

Effective management begins with selecting suppliers experienced in international shipping, familiar with export regulations, and able to provide accurate lead times. Work with reliable freight forwarders who can handle customs clearance, freight consolidation, and door-to-door delivery. Consider Incoterms that best suit your risk management (e.g., FOB, CIF). Always account for potential delays, customs duties, and taxes in your budget. Establish clear communication channels with your supplier and logistics partners to track shipments in real-time. Building contingency plans for unforeseen disruptions ensures smoother delivery and inventory management.

6. What are common dispute resolution mechanisms when conflicts arise with international Shoe Palace careers suppliers?

Disputes often stem from quality issues, delays, or payment disagreements. To mitigate risks, include clear dispute resolution clauses in your contracts, specifying arbitration (preferably in neutral locations), jurisdiction, and applicable laws. Many international trade agreements favor arbitration due to its confidentiality and enforceability. Maintain detailed records of all communications, inspections, and transactions to support your case if disputes escalate. Engaging local legal counsel familiar with international trade laws can facilitate swift resolution, and establishing a good relationship with your supplier can often help resolve issues amicably without resorting to litigation.

7. How can I ensure compliance with import regulations and standards in my country when importing Shoe Palace careers?

Start by researching your country’s import regulations, tariffs, and required certifications for footwear products. Work closely with customs brokers who understand local procedures to ensure smooth clearance. Verify that your supplier provides all necessary documentation, such as commercial invoices, certificates of origin, and safety certifications. Be aware of labeling requirements, including language, size, and safety warnings. Regularly update yourself on changes in regulations through government trade portals or industry associations. Proper compliance minimizes delays, penalties, and potential product recalls, safeguarding your investment and reputation.

8. What strategic steps can I take to build long-term, mutually beneficial relationships with Shoe Palace careers suppliers?

Establish open and transparent communication from the outset, clearly articulating your expectations and quality standards. Prioritize building trust through timely payments, constructive feedback, and consistent orders. Consider developing strategic partnerships by sharing market insights, providing feedback for continuous improvement, and exploring joint development opportunities. Regular performance reviews, supplier audits, and recognition of excellence foster loyalty. Additionally, investing in relationship-building activities, such as visits or participation in industry events, can deepen collaboration. Long-term relationships reduce risks, improve lead times, and can lead to better pricing and customization options over time.

Strategic Sourcing Conclusion and Outlook for shoe palace careers

Conclusion and Future Outlook

Effective strategic sourcing is vital for B2B buyers seeking to optimize their shoe supply chains and foster sustainable growth. By prioritizing supplier diversification, quality assurance, and cost efficiency, international buyers—particularly from Africa, South America, the Middle East, and Europe—can unlock competitive advantages in the global footwear market. Leveraging local insights, forging strong supplier relationships, and embracing innovative sourcing technologies will further enhance resilience and agility.

Illustrative Image (Source: Google Search)

Looking ahead, the footwear industry is poised for continued transformation driven by shifting consumer preferences, technological advancements, and geopolitical developments. B2B buyers should proactively adapt their sourcing strategies to capitalize on emerging opportunities, such as sustainable materials and ethical manufacturing practices.

Actionable takeaway: Develop a comprehensive sourcing framework that emphasizes agility, transparency, and sustainability. Engage with local partners and industry networks to stay ahead of market trends. By doing so, you will strengthen your supply chain resilience and position your business for long-term success in the dynamic global footwear landscape.