Your Ultimate Guide to Sourcing Women’S On Shoes

Guide to Women’S On Shoes

- Introduction: Navigating the Global Market for women’s on shoes

- Understanding women’s on shoes Types and Variations

- Key Industrial Applications of women’s on shoes

- Strategic Material Selection Guide for women’s on shoes

- In-depth Look: Manufacturing Processes and Quality Assurance for women’s on shoes

- Comprehensive Cost and Pricing Analysis for women’s on shoes Sourcing

- Spotlight on Potential women’s on shoes Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for women’s on shoes

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the women’s on shoes Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of women’s on shoes

- Strategic Sourcing Conclusion and Outlook for women’s on shoes

Introduction: Navigating the Global Market for women’s on shoes

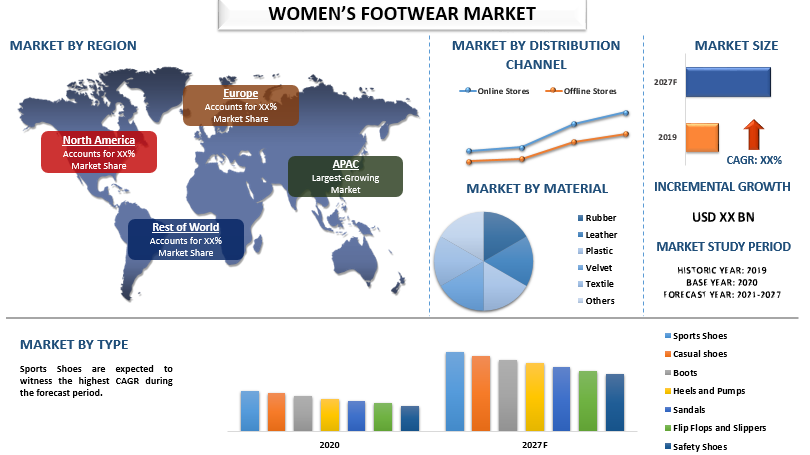

In today’s dynamic global footwear industry, women’s on shoes have emerged as a key segment with significant growth potential. As a B2B buyer, understanding the nuances of this market is crucial to capitalizing on emerging trends, consumer preferences, and supply chain opportunities across diverse regions such as Africa, South America, the Middle East, and Europe. Women’s on shoes are not just functional; they embody fashion, innovation, and comfort, making them a vital product category for brands seeking differentiation and competitive advantage.

This comprehensive guide offers critical insights into every aspect of sourcing women’s on shoes—from understanding various types and materials to evaluating manufacturing processes and quality control standards. It also provides actionable intelligence on identifying reliable suppliers, assessing costs, and navigating regional market dynamics. Whether you are exploring new supply chains or optimizing existing ones, this resource equips you with the knowledge needed to make informed, strategic decisions.

By leveraging these insights, international B2B buyers can effectively mitigate risks, enhance product quality, and meet the evolving demands of women consumers worldwide. Specifically tailored for buyers from emerging markets and mature economies alike, this guide aims to empower you with the expertise necessary to succeed in a competitive, fast-changing landscape—transforming sourcing challenges into opportunities for growth and innovation.

Illustrative Image (Source: Google Search)

Understanding women’s on shoes Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Sneakers / Athletic Shoes | Cushioned soles, breathable materials, flexible design | Sportswear, casual retail, promotional events | Pros: High demand, versatile; Cons: High competition, fast fashion turnover |

| Formal / Dress Shoes | Sleek, polished leather or synthetic uppers, minimal embellishments | Formalwear, corporate gifting, retail boutiques | Pros: Higher profit margins; Cons: Seasonal demand, size variability |

| Sandals / Open-Toe Shoes | Open design, often with straps, lightweight materials | Summer collections, resort markets | Pros: Growing market in warm climates; Cons: Limited year-round demand |

| Boots / Ankle & Knee-High | Sturdy construction, often with heels or laces | Fashion, outdoor wear, workwear | Pros: Durable, seasonal appeal; Cons: Bulkier logistics, size complexity |

| Flats / Loafers | Low profile, comfortable, slip-on style | Office wear, casual fashion, school markets | Pros: Consistent demand, easy to stock; Cons: Price competition from fast fashion |

Sneakers / Athletic Shoes

Sneakers are characterized by their cushioned soles, breathable mesh or synthetic uppers, and flexible designs suited for physical activity. They are a staple in both casual and sportswear markets worldwide. For B2B buyers, sneakers present a high-volume opportunity, especially with the rise of athleisure trends. Key considerations include sourcing quality materials, ensuring compliance with international safety standards, and understanding regional preferences for styles and sizes. The fast-paced nature of sneaker fashion demands agility in inventory turnover and the ability to respond quickly to trending designs.

Formal / Dress Shoes

Formal shoes are distinguished by their polished appearance, often crafted from leather or high-quality synthetics, with minimal embellishments. They serve corporate, ceremonial, and upscale retail markets. For international buyers, these shoes offer higher profit margins but require careful attention to sizing consistency and quality control. Seasonal fluctuations and regional preferences for styles (e.g., pointed toes, loafers) influence procurement decisions. Ensuring reliable supply chains for premium materials and maintaining high standards of craftsmanship are critical for success in this segment.

Sandals / Open-Toe Shoes

Designed with open straps or minimal coverage, sandals are lightweight and breathable, making them ideal for warm climates. They are increasingly popular in summer collections and resort destinations. B2B buyers should consider the seasonal nature of this category, emphasizing flexible manufacturing and inventory planning. Sourcing durable yet comfortable materials, such as eco-friendly leathers or synthetic alternatives, can appeal to environmentally conscious markets. Additionally, variability in style preferences across regions necessitates diversified product offerings.

Boots / Ankle & Knee-High

Boots feature sturdy construction, often with decorative or functional laces, zippers, and heels. They cater to fashion-forward consumers, outdoor enthusiasts, and workwear sectors. For buyers, boots offer opportunities for premium pricing but demand careful attention to size ranges, material sourcing, and seasonal inventory planning. Durability and weather resistance are key selling points, especially in colder or wetter climates. Ensuring compliance with safety standards (e.g., slip resistance, waterproofing) enhances market competitiveness.

Flats / Loafers

Known for their low profile, slip-on design, flats and loafers are favored for comfort and versatility. They are staples in office, casual, and school markets globally. B2B buyers benefit from steady demand and the ease of stocking a broad size range. Cost-effective manufacturing, trend-responsive designs, and quality control are essential for maintaining competitiveness. Given their broad appeal, flats and loafers are suitable for a wide range of retail channels, from high-end boutiques to mass-market outlets.

Illustrative Image (Source: Google Search)

Key Industrial Applications of women’s on shoes

| Industry/Sector | Specific Application of women’s on shoes | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Healthcare & Medical | Non-slip footwear for hospital staff and caregivers | Ensures safety, reduces fall risk, enhances compliance with safety standards | Slip-resistant soles, antimicrobial materials, compliance with health regulations |

| Hospitality & Tourism | Uniform footwear for hotel staff, tour guides, and service personnel | Promotes professionalism, comfort for long shifts, brand consistency | Durability, comfort, stylish design, ease of cleaning |

| Construction & Industrial | Safety shoes for female workers in construction sites | Protects against physical hazards, meets safety standards, boosts productivity | Impact-resistant toes, slip-resistant soles, durability in tough environments |

| Retail & Fashion | Wholesale supply of trendy women’s on shoes for retail chains | Supports fashion-forward offerings, quick turnaround, brand differentiation | Trend compliance, quality consistency, sustainable sourcing |

| Sports & Fitness | Athletic footwear for women in gyms, sports clubs, and fitness centers | Enhances performance, provides support, reduces injury risks | Shock absorption, lightweight materials, breathability |

Healthcare & Medical

Women’s on shoes designed for healthcare environments are critical for ensuring safety and hygiene. Non-slip soles are essential to prevent falls on wet or smooth hospital floors, especially in high-traffic areas. International B2B buyers from regions like Africa and South America should prioritize sourcing shoes with slip-resistant, antimicrobial, and easy-to-clean materials that meet local safety and health standards. These shoes help healthcare providers maintain compliance and reduce liability risks, making them a strategic procurement choice for medical institutions worldwide.

Hospitality & Tourism

In the hospitality sector, women’s on shoes serve both functional and aesthetic purposes. Hotel staff, tour guides, and service personnel require footwear that balances comfort with a professional appearance. For international buyers, sourcing shoes that are durable enough for long shifts while maintaining style is vital. Emphasizing quality materials, slip resistance, and ease of maintenance ensures staff safety and enhances guest experience. This sector benefits from reliable supply chains that can deliver fashionable, comfortable shoes in bulk, aligning with regional hospitality standards.

Construction & Industrial

Women’s safety shoes are increasingly essential in construction and industrial sectors, especially as more women enter traditionally male-dominated roles. These shoes must meet rigorous safety standards, offering impact resistance, puncture protection, and slip resistance. For buyers in regions like the Middle East or Europe, sourcing durable, high-performance footwear tailored to female ergonomics can improve worker safety and productivity. Ensuring compliance with local safety certifications and using high-quality, weather-resistant materials are key considerations for international procurement.

Retail & Fashion

The wholesale supply of women’s on shoes to retail chains and fashion brands is a significant industrial application. Buyers seek trendy, high-quality footwear that aligns with current fashion trends and sustainability standards. For European and South American markets, sourcing fashionable shoes with consistent quality, sustainable materials, and quick turnaround times can provide a competitive edge. Establishing reliable manufacturing partnerships ensures product availability and helps brands meet seasonal demand fluctuations.

Sports & Fitness

Women’s athletic shoes are essential in gyms, sports clubs, and fitness centers, demanding high-performance features. International buyers from Africa and the Middle East look for lightweight, breathable shoes with excellent shock absorption and support to prevent injuries. Sourcing shoes with advanced materials that combine durability and comfort can enhance athlete performance and reduce injury risks. Ensuring compliance with international sports safety standards and sustainability practices further adds value to these products in global markets.

Strategic Material Selection Guide for women’s on shoes

Analysis of Common Materials for Women’s On Shoes

Leather (Full-Grain, Top-Grain, or Genuine Leather)

Leather remains one of the most traditional and desirable materials for women’s on shoes, especially in premium segments. Its key properties include excellent durability, breathability, and a natural aesthetic appeal. Leather can withstand significant wear and tear, making it suitable for high-end and everyday footwear. Additionally, it offers good flexibility and molds to the wearer’s foot over time, enhancing comfort.

From a B2B perspective, leather’s advantages include its premium perception, which can command higher price points, and its compatibility with various finishes and dyes for branding purposes. However, leather production involves complex manufacturing processes, including tanning, which can increase costs and lead to environmental concerns. Cost varies significantly depending on grade; full-grain leather is more expensive but offers superior durability, whereas genuine leather is more affordable but less durable.

International buyers, especially from Africa, South America, the Middle East, and Europe, should consider compliance with environmental standards such as REACH (EU), ASTM (US), or local regulations concerning chemical use in tanning. Leather sourced from sustainable suppliers adhering to eco-friendly practices can also enhance brand reputation and meet regulatory expectations.

Synthetic Materials (Polyurethane, PVC)

Synthetic materials like polyurethane (PU) and polyvinyl chloride (PVC) are popular alternatives to natural leather due to their lower cost and ease of manufacturing. PU, in particular, can mimic the look and feel of genuine leather while offering consistent quality and color. These materials are lightweight, water-resistant, and require less maintenance, making them suitable for casual, athletic, or fashion-forward women’s shoes.

From a manufacturing standpoint, synthetics are easier to process, allowing for rapid production and customization. They are also more environmentally friendly in terms of resource use, although concerns about chemical emissions and recyclability persist. Cost-wise, synthetics are generally low to medium, making them attractive for mass-market products.

International buyers should verify that synthetic materials comply with local regulations regarding chemical content and emissions, such as REACH in Europe or JIS standards in Japan. Additionally, synthetic materials must meet durability standards for abrasion and weather resistance, especially in regions with high humidity or temperature fluctuations, like the Middle East or tropical areas.

Rubber and EVA (Ethylene Vinyl Acetate)

Rubber and EVA are primarily used in the soles of women’s on shoes, but their properties influence overall product performance significantly. Rubber offers excellent slip resistance, durability, and shock absorption, making it ideal for athletic and casual footwear. EVA, on the other hand, is lightweight, flexible, and provides good cushioning, often used in midsole components.

From a B2B perspective, rubber is more durable but can be more expensive and heavier, impacting shipping costs. EVA is cost-effective and lightweight, suitable for budget-conscious markets. Both materials are resistant to water and environmental conditions, but rubber may degrade under prolonged exposure to UV light unless treated.

International buyers should ensure that rubber compounds meet relevant standards such as ASTM D2000 or DIN 53507 for weathering and aging. In regions with high temperatures or intense sunlight, UV-stabilized rubber is advisable. For markets like Europe and the Middle East, compliance with environmental regulations concerning VOC emissions and recyclability is critical.

Summary Table of Material Options for Women’s On Shoes

| Material | Typical Use Case for women’s on shoes | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Leather | Premium casual, formal, and high-end athletic shoes | Natural look, durability, breathability | High manufacturing complexity, environmental concerns, cost varies | High |

| Synthetic (PU, PVC) | Casual, fashion, and mass-market footwear | Cost-effective, consistent quality, water-resistant | Less breathable, environmental impact, lower natural appeal | Low to Medium |

| Rubber & EVA | Athletic, casual, and comfort-focused shoes | Slip-resistant, lightweight, shock absorption | Rubber can be heavy and costly; EVA may degrade over time | Low |

This comprehensive understanding of material properties and their implications helps international B2B buyers make strategic sourcing decisions aligned with regional standards, consumer preferences, and sustainability goals. Selecting the right materials ensures product quality, compliance, and market competitiveness across diverse regions.

In-depth Look: Manufacturing Processes and Quality Assurance for women’s on shoes

Manufacturing Processes for Women’s On Shoes

The production of women’s on shoes involves a series of carefully orchestrated stages, each critical to ensuring product quality, durability, and aesthetic appeal. For international B2B buyers, understanding these stages helps in assessing supplier capabilities and compliance with standards.

Material Preparation

The manufacturing process begins with sourcing and preparing raw materials, including upper fabrics (mesh, leather, synthetic textiles), midsoles (foam, EVA, TPU), outsoles (rubber, thermoplastic elastomers), and adhesives. Suppliers often select materials based on targeted performance characteristics such as breathability, flexibility, and lightweight properties. It is vital to verify that materials meet international safety standards and environmental regulations, especially for markets with strict import controls like the EU and the UK.

Key considerations for buyers:

– Request material certificates (e.g., REACH, OEKO-TEX) to ensure compliance.

– Confirm suppliers’ ability to supply consistent quality in large volumes.

– Evaluate the sustainability credentials of sourcing materials, especially important for European markets.

Forming and Assembly

The core manufacturing phase involves shaping the components and assembling the shoe. Techniques include:

– Cutting: Using automated CNC cutters or manual cutting for upper materials.

– Sewing and Bonding: Assembly of the upper via sewing or adhesive bonding, depending on design complexity.

– Molding: Midsoles and outsoles are formed through injection molding or compression molding, ensuring precise fit and cushioning.

– Lasting: The upper is stretched over a shoe last to shape the final form, a critical step impacting fit and comfort.

– Attachment: The upper is attached to the midsole/outsole via adhesives or mechanical fasteners, with attention to secure bonding and seamless finish.

Key industry techniques:

– Use of automated sewing machines for consistency.

– Precision molding to ensure uniform cushioning.

– Application of high-quality adhesives tested for durability.

Finishing

Final steps include trimming excess materials, applying decorative elements, adding insoles, and performing detailed quality checks. Finishing may involve:

– Surface treatments such as polishing or coating for water resistance.

– Embossing or branding.

– Final inspection for defects, including stitching quality, surface blemishes, and structural integrity.

Quality Control in Women’s On Shoes Manufacturing

Quality assurance (QA) is integral to delivering consistent, safe, and compliant products. International standards like ISO 9001 provide a foundation for establishing robust quality management systems, while industry-specific certifications such as CE mark (Europe), API (North America), or other regional standards are often required depending on the market.

Key QC Stages

-

Incoming Quality Control (IQC):

– Raw materials are inspected upon arrival.

– Tests include visual inspection, dimensional verification, and material property testing (e.g., tensile strength, colorfastness).

– Suppliers should provide material test reports and certificates. -

In-Process Quality Control (IPQC):

– Conducted during manufacturing to ensure processes adhere to specifications.

– Includes monitoring stitching accuracy, adhesive application, molding precision, and assembly alignment.

– Statistical process control (SPC) tools are often employed for consistency. -

Final Quality Control (FQC):

– Complete product inspection before shipment.

– Checks for visual defects, structural integrity, sole adhesion, and overall finish.

– Functional tests such as flexibility, weight, and slip resistance may be performed.

Common Testing Methods

- Dimensional and Visual Inspection: Ensures conformity to design specifications.

- Mechanical Testing: Tensile, shear, and peel tests for adhesives and assembly.

- Environmental Testing: Water resistance, UV durability, and abrasion tests.

- Comfort and Fit Testing: Using mannequins or fit models to verify ergonomic standards.

How B2B Buyers Can Verify Supplier QC

Effective verification involves a combination of documentation review, audits, and third-party inspections:

- Supplier Documentation: Request detailed quality manuals, test reports, and compliance certificates.

- Factory Audits: Conduct or commission audits focusing on process controls, cleanliness, equipment calibration, and staff training.

- Third-Party Inspection Agencies: Engage organizations like SGS, Bureau Veritas, or Intertek to perform unannounced inspections and verify compliance with contractual quality standards.

- Sample Testing: Purchase samples for independent testing against specifications and standards relevant to target markets.

QC and Certification Nuances for International Buyers

Different regions impose specific standards and certifications that influence manufacturing and quality assurance:

- Europe (UK, France):

- CE marking is mandatory for products with electronic components or specific safety features.

- Reach and RoHS compliance ensure restricted substances are not used.

-

EU-based buyers should prioritize suppliers with ISO 9001 and environmental certifications.

-

Africa and South America:

- Market-specific standards may vary; some countries require local certification or conformity assessments.

- Buyers should verify whether suppliers are familiar with regional import regulations and have experience navigating local quality standards.

-

Emphasize supplier transparency and documentation to ease customs clearance.

-

Middle East:

- Compliance with GCC standards and certification marks may be necessary.

- Suppliers should demonstrate adherence to safety, environmental, and quality standards to facilitate smooth market entry.

Strategic Recommendations for B2B Buyers

- Develop a Clear Quality Specification: Define precise material and construction standards aligned with target market regulations.

- Implement Rigorous Supplier Qualification: Combine documentation review, factory audits, and sample testing to assess supplier capabilities.

- Establish Ongoing Quality Monitoring: Regular audits and third-party inspections ensure sustained compliance and quality improvements.

- Leverage Regional Expertise: Collaborate with local QC agencies or consultants familiar with regional standards and market expectations.

- Foster Transparent Communication: Maintain open channels with suppliers regarding quality expectations, inspection reports, and corrective actions.

By understanding and actively managing manufacturing processes and quality assurance protocols, international B2B buyers can mitigate risks, ensure product compliance, and build reliable partnerships in the women’s on shoes industry.

Comprehensive Cost and Pricing Analysis for women’s on shoes Sourcing

Cost Structure Overview

Understanding the comprehensive cost structure for women’s On shoes is essential for effective sourcing and pricing negotiations. The primary components include raw materials, labor, manufacturing overheads, tooling, quality control, logistics, and profit margins. Each element varies significantly based on production location, order volume, and customization requirements.

Materials: The choice of materials—such as mesh, EVA foam, rubber, textiles, and sustainable fabrics—directly impacts costs. Premium or eco-friendly materials generally command higher prices. Suppliers often offer discounts for bulk purchases, which is crucial for buyers aiming to reduce unit costs.

Labor: Labor costs differ markedly across regions. European and Middle Eastern manufacturers tend to have higher wages but often compensate with superior craftsmanship and quality standards. Conversely, African and South American suppliers might offer lower labor costs, but buyers should evaluate the associated risks in quality consistency and compliance.

Manufacturing Overheads: These include factory expenses, machinery depreciation, and energy costs. Advanced automation and efficient production processes can lower overheads, influencing the final price. Suppliers with higher efficiency typically offer more competitive pricing for large orders.

Tooling and Development: Initial tooling costs—molds, dies, and prototypes—are significant for customized designs. These are usually amortized over large production runs, making small or sample orders more expensive on a per-unit basis.

Quality Control and Certifications: Ensuring product standards and compliance with certifications (e.g., ISO, REACH, or fair labor standards) can add to costs but are vital for market acceptance, especially in Europe and developed markets. Suppliers with established QC protocols might charge higher but reduce risks of delays or rejections.

Logistics and Incoterms: Shipping costs depend on destination, volume, and chosen Incoterms (e.g., FOB, CIF). Buyers from Africa and South America should consider freight consolidation and local port handling fees, which can significantly influence total landed costs. European buyers often benefit from proximity to manufacturing hubs, reducing transit times and costs.

Margins: Suppliers typically include a markup to ensure profitability, often ranging from 10% to 30%, depending on order volume and complexity.

Price Influencers

Several factors influence the final pricing and should be carefully negotiated:

-

Order Volume & MOQ: Larger orders generally lead to lower per-unit costs due to economies of scale. Many suppliers offer discounts for MOQ beyond a certain threshold, which benefits buyers planning for high-volume sales.

-

Specifications & Customization: Custom designs, branding, or specialized features (e.g., waterproofing, specific colorways) increase costs. Clear specifications help avoid misunderstandings and unexpected expenses.

-

Material Choices: Premium or sustainable materials increase costs but can justify higher retail pricing and meet consumer demand for eco-friendly products.

-

Quality & Certifications: Higher standards and certifications often come with added costs but are essential for markets with strict regulatory requirements, especially in Europe and the Middle East.

-

Supplier Factors: Established suppliers with good reputation and reliable delivery may charge premiums but provide peace of mind. New entrants might offer lower prices but require rigorous vetting.

-

Incoterms & Shipping: FOB (Free on Board) terms shift transportation costs to the buyer, while CIF (Cost, Insurance, Freight) includes shipping in the price. Buyers should evaluate total landed costs when comparing quotes.

Buyer Tips for Cost Optimization

-

Negotiate for Volume Discounts: Leverage larger order quantities to secure better unit prices, especially when sourcing from emerging markets where suppliers are eager for stable orders.

-

Focus on Total Cost of Ownership (TCO): Consider all costs—material, labor, shipping, customs, duties, and after-sales service—rather than just unit price. This holistic view prevents surprises and ensures profitability.

-

Build Strong Supplier Relationships: Long-term partnerships often lead to preferential pricing, better payment terms, and priority in production schedules.

-

Understand Pricing Nuances: Be aware that initial quotes may not include all costs; clarify inclusions such as tooling, samples, certifications, and logistics.

-

Leverage Trade Agreements & Tariffs: Familiarize yourself with regional trade agreements (e.g., EU trade deals, African Continental Free Trade Area) that may reduce tariffs and improve cost competitiveness.

Disclaimer

Indicative prices for women’s On shoes can vary widely based on specifications, order volume, and market conditions. As a general guide, FOB prices for standard models range from $20 to $50 per pair in large volumes. Premium or customized shoes may cost upwards of $50 to $80 per pair. Always conduct due diligence and request detailed quotations tailored to your specific requirements to ensure accurate cost assessment.

By comprehensively analyzing these components and factors, international B2B buyers from Africa, South America, the Middle East, and Europe can strategically plan their sourcing, negotiate effectively, and optimize their total procurement costs for women’s On shoes.

Spotlight on Potential women’s on shoes Manufacturers and Suppliers

- (No specific manufacturer data was available or requested for detailed profiling in this section for women’s on shoes.)*

Essential Technical Properties and Trade Terminology for women’s on shoes

Critical Technical Properties for Women’s On Shoes

1. Material Quality and Grade

The choice of materials—such as synthetics, leathers, textiles, and rubber—directly influences durability, comfort, and aesthetic appeal. High-grade materials typically undergo stricter quality controls, ensuring consistent performance and longer product life. For B2B buyers, specifying material grades ensures suppliers meet your standards, reducing risks of defects or compliance issues in different markets.

2. Sole Thickness and Flexibility

Sole thickness impacts shock absorption, stability, and overall comfort, especially for active or prolonged wear. Flexibility ratings, often measured in terms of bend radius, influence how easily the shoe moves with the foot. Clear specifications help ensure the shoes meet end-user expectations for comfort, especially in competitive markets like Europe or Middle East where comfort standards are high.

3. Tolerance and Manufacturing Precision

Tolerance levels refer to the allowable deviations in dimensions such as width, length, and heel height. Precise tolerances are crucial for consistent fit, reducing returns or dissatisfaction. For international trade, understanding tolerance standards helps align manufacturing quality with market expectations, particularly in regions with strict product regulations.

4. Weight and Balance

Weight influences comfort, especially for women’s shoes designed for extended wear or athletic purposes. Proper weight distribution ensures stability and reduces fatigue. B2B buyers should specify acceptable weight ranges based on target consumer needs, ensuring competitiveness in diverse markets.

5. Colorfastness and Finish

Colorfastness ensures that the shoe’s appearance remains intact after exposure to water, sweat, or washing. Finish quality—such as matte or gloss—also affects the visual appeal. These properties are vital for maintaining product integrity and brand reputation across different climatic and usage conditions.

6. Compliance and Certification Standards

Adherence to regional safety and quality standards (e.g., REACH in Europe, ISO certifications) is essential for market access. Suppliers should provide documentation verifying compliance, which reassures buyers about product safety and legality in target markets.

Essential Industry and Trade Terminology

1. OEM (Original Equipment Manufacturer)

Refers to factories or suppliers that produce shoes based on the buyer’s specifications and branding. Understanding OEM relationships allows buyers to negotiate custom designs, quality standards, and production timelines effectively.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce per order. Knowledge of MOQ helps buyers plan procurement volumes, negotiate better terms, and avoid overstocking, especially when entering new markets or testing new designs.

3. RFQ (Request for Quotation)

A formal request sent to suppliers asking for price, lead time, and terms for specific shoe models. Properly crafted RFQs streamline negotiations and ensure clarity on costs, delivery, and technical requirements.

4. Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities of buyers and sellers for delivery, risk, and costs. Common Incoterms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) help clarify shipping responsibilities, crucial for international logistics planning.

5. Lead Time

The period from order placement to product delivery. Accurate understanding of lead times enables better planning, inventory management, and meeting market deadlines, especially in competitive regions like Europe and the Middle East.

6. Sampling and Prototyping

The process of creating sample shoes for approval before mass production. This step minimizes risks by allowing buyers to verify technical properties, fit, and aesthetic details, ensuring the final product aligns with market demands.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions, negotiate effectively, and ensure compliance across diverse markets. Clear communication and a solid understanding of these concepts are fundamental to establishing successful sourcing relationships in the women’s on shoes industry.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the women’s on shoes Sector

Market Overview & Key Trends

The global women’s on shoes sector is experiencing robust growth driven by technological innovation, shifting consumer preferences, and increasing demand for performance-oriented footwear. As a B2B buyer, understanding these dynamics is crucial for strategic sourcing and market positioning. Emerging trends include the integration of smart technology—such as fitness tracking and adaptive cushioning—enhancing product appeal for health-conscious consumers. Additionally, customization and personalization are becoming standard expectations, prompting suppliers to adopt flexible manufacturing processes.

From a sourcing perspective, digital platforms and supply chain transparency tools are transforming procurement practices. E-commerce marketplaces like Alibaba, Global Sources, and industry-specific B2B platforms facilitate direct supplier engagement, enabling buyers from Africa, South America, the Middle East, and Europe to access a broader range of manufacturers with verified credentials. Advances in 3D printing and rapid prototyping also allow for faster product development cycles, reducing time-to-market and inventory costs.

Market dynamics are influenced by fluctuating raw material costs, geopolitical factors, and trade policies. For instance, tariffs and import restrictions can impact pricing and lead times, especially for European and Middle Eastern buyers sourcing from Asia. Conversely, regional manufacturing hubs in Europe and South America are gaining prominence, offering shorter supply chains and potentially lower logistics costs. Buyers should prioritize diversified sourcing strategies, leveraging regional manufacturing options to mitigate risks and optimize supply chain resilience.

Furthermore, sustainability concerns are increasingly shaping procurement decisions. Buyers are seeking suppliers with transparent practices, ethical labor standards, and the ability to meet certifications such as ISO 14001 or B Corp. Staying ahead of these trends requires continuous market intelligence, fostering relationships with innovative suppliers, and adopting digital tools for supply chain monitoring.

Illustrative Image (Source: Google Search)

Sustainability & Ethical Sourcing in B2B

Sustainability has become a cornerstone in the women’s on shoes industry, influencing procurement, design, and consumer perception. Environmental impacts associated with footwear production—such as water consumption, waste generation, and carbon emissions—necessitate responsible sourcing. B2B buyers from Africa, South America, the Middle East, and Europe are increasingly prioritizing suppliers committed to eco-friendly practices, driven by consumer demand and regulatory pressures.

Ethical sourcing involves ensuring fair labor conditions, avoiding child labor, and promoting fair wages throughout the supply chain. Certification schemes like Fair Trade, SA8000, and WRAP are vital indicators of compliance and social responsibility. Suppliers with these credentials demonstrate a commitment to ethical standards, reducing reputational risks for buyers.

In terms of materials, the shift towards sustainable options is notable. Recycled fabrics, bio-based leathers, and natural dyes are gaining traction, reducing reliance on environmentally harmful inputs. Additionally, innovative materials such as Piñatex (pineapple leaf fiber) and Mycelium (mushroom-based leather) offer sustainable alternatives that appeal to eco-conscious consumers.

For B2B buyers, establishing partnerships with suppliers who hold verifiable sustainability certifications is essential. Incorporating sustainability clauses into contracts, conducting regular audits, and supporting suppliers in achieving green certifications can enhance supply chain transparency. Investing in traceability technologies—like blockchain—further ensures accountability and fosters trust among stakeholders.

Brief Evolution/History

While the women’s on shoes sector has historically focused on fashion and comfort, recent decades have seen a significant shift towards performance, sustainability, and technological integration. Initially driven by sports and athletic markets, innovation has filtered into everyday footwear, emphasizing lightweight design, durability, and smart features. This evolution reflects broader industry trends towards health, wellness, and environmental responsibility, influencing B2B sourcing strategies. Recognizing this trajectory helps buyers anticipate future developments and align their procurement with emerging standards.

This comprehensive understanding of market dynamics, sourcing trends, and sustainability considerations provides B2B buyers with actionable insights to navigate the complex landscape of women’s on shoes effectively. Emphasizing diversified sourcing, technological adoption, and ethical practices will enhance competitiveness and resilience in this evolving industry.

Frequently Asked Questions (FAQs) for B2B Buyers of women’s on shoes

-

How can I verify the credibility and reliability of a women’s on shoes supplier?

To ensure supplier credibility, conduct comprehensive due diligence: review their business licenses, certifications, and industry reputation. Request product samples and references from previous international clients. Check for compliance with international quality standards (e.g., ISO, BSCI, SEDEX). Utilize third-party verification platforms like Alibaba’s Gold Supplier status or Global Sources verified suppliers. Engaging in a factory audit or video tour can provide firsthand insight into production capabilities. Establish clear communication channels and request detailed catalogs, pricing, and lead time information to gauge transparency and professionalism. -

What customization options are typically available, and how do they impact order lead times and costs?

Suppliers often offer customization in design, materials, colors, packaging, and branding (e.g., logos). Customization can significantly enhance your product differentiation but may increase lead times by 2–6 weeks depending on complexity. Costs vary based on order volume, complexity, and tooling requirements. To optimize, clearly define your specifications upfront and negotiate minimum order quantities (MOQs) that align with your budget. Request detailed quotes that itemize setup fees, tooling costs, and additional charges to avoid surprises and plan your procurement schedule accordingly. -

What are typical MOQs, lead times, and payment terms for women’s on shoes in international trade?

Most suppliers require MOQs ranging from 300 to 1,000 pairs, depending on the manufacturer and customization level. Lead times generally span 4–12 weeks, influenced by order complexity and production capacity. Common payment terms include a 30% deposit upfront with the balance payable before shipment or upon delivery, though terms can vary—some suppliers may accept letters of credit or open accounts for trusted partners. Always negotiate flexible payment options and confirm lead times in writing to align with your inventory planning and cash flow. -

What quality assurance measures and certifications should I look for in a supplier?

Ensure your supplier adheres to international quality standards such as ISO 9001, and check for social compliance certifications like BSCI, SEDEX, or SA8000. Request copies of their quality control procedures, including inspection reports and third-party testing certificates for materials like leather, adhesives, and dyes. Consider hiring an independent inspection service to verify product quality before shipment. Establish clear quality benchmarks and include penalties or corrective actions in your contract to mitigate risks of defective products reaching your market. -

How can I manage logistics effectively when importing women’s on shoes from overseas?

Coordinate with your supplier to select reliable freight forwarders experienced in international shipping. Decide between air freight for faster delivery or sea freight for cost efficiency on large orders. Clarify Incoterms (e.g., FOB, CIF) to delineate responsibilities and costs. Track shipments proactively and request documentation such as bill of lading, packing list, and certificates of origin. Be aware of customs procedures, import duties, and taxes specific to your country—consult local customs authorities or freight specialists. Building strong logistics partnerships reduces delays and ensures timely market entry. -

What should I do if I encounter disputes or quality issues with my supplier?

Establish clear contractual terms covering quality standards, inspection procedures, and dispute resolution methods before placing an order. If issues arise, communicate promptly with detailed documentation—photos, inspection reports, and correspondence—to support your claim. Negotiate amicably with the supplier for corrective actions, replacements, or refunds. If unresolved, consider mediation or arbitration under international trade laws. Engaging legal counsel familiar with international commerce can help enforce contracts and protect your interests. Maintaining good communication and documented agreements is key to resolving disputes efficiently. -

How do I ensure compliance with import regulations and product standards in my country?

Research your country’s import regulations, product safety standards, and labeling requirements for footwear. Many countries require compliance with standards related to chemical safety (e.g., REACH in Europe), labeling (size, material, country of origin), and environmental regulations. Work with customs brokers or compliance consultants to ensure all documentation—commercial invoices, certificates of origin, safety certificates—is complete and accurate. Regularly update your knowledge on regulatory changes and establish ongoing communication with local authorities to avoid customs delays or penalties. This proactive approach safeguards your supply chain and market reputation. -

What are best practices for building long-term relationships with international suppliers of women’s on shoes?

Foster transparent, consistent communication and mutual trust through regular updates, feedback, and responsiveness. Start with smaller pilot orders to evaluate performance before scaling up. Pay promptly and honor contractual commitments to build credibility. Share market insights and collaborate on product development to create value-added partnerships. Invest in supplier visits and participate in trade shows to strengthen relationships. Long-term partnerships often result in better pricing, priority production slots, and customized support. Continuously monitor supplier performance and provide constructive feedback to ensure ongoing alignment with your quality and delivery expectations.

Strategic Sourcing Conclusion and Outlook for women’s on shoes

Strategic Sourcing Conclusion and Outlook for women’s on shoes

Effective strategic sourcing is vital for international B2B buyers aiming to capitalize on the growing demand for women’s on shoes worldwide. Key considerations include identifying reliable suppliers with innovative product offerings, ensuring compliance with quality standards, and optimizing supply chain resilience to mitigate disruptions. Diversifying sourcing regions—such as leveraging manufacturers in Europe, Asia, and emerging markets in Africa and South America—can also enhance agility and cost-efficiency.

As the market continues to evolve, staying ahead requires a proactive approach to supplier relationship management, embracing sustainable practices, and adopting digital procurement tools for better transparency and efficiency. By aligning sourcing strategies with consumer trends—such as eco-conscious materials and comfort-driven designs—buyers can gain a competitive edge.

Looking ahead, international B2B buyers from Africa, South America, the Middle East, and Europe should focus on building strategic partnerships that foster innovation and resilience. Embracing a forward-thinking sourcing approach will not only ensure supply stability but also position your business to meet the dynamic needs of women’s footwear consumers globally. Now is the time to refine your sourcing strategies and unlock new growth opportunities in this vibrant market.