Master Mexico Shoe Size to US Conversion for Accurate B2B

Guide to Mexico Shoe Size To Us

- Introduction: Navigating the Global Market for mexico shoe size to us

- Understanding mexico shoe size to us Types and Variations

- Key Industrial Applications of mexico shoe size to us

- Strategic Material Selection Guide for mexico shoe size to us

- In-depth Look: Manufacturing Processes and Quality Assurance for mexico shoe size to us

- Comprehensive Cost and Pricing Analysis for mexico shoe size to us Sourcing

- Spotlight on Potential mexico shoe size to us Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for mexico shoe size to us

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the mexico shoe size to us Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of mexico shoe size to us

- Strategic Sourcing Conclusion and Outlook for mexico shoe size to us

Introduction: Navigating the Global Market for mexico shoe size to us

Understanding the nuances of international shoe sizing is crucial for B2B buyers seeking reliable and consistent product sourcing. For companies across Africa, South America, the Middle East, and Europe—particularly from Italy and Turkey—navigating the translation from Mexico shoe sizes to U.S. standards can significantly impact product fit, customer satisfaction, and ultimately, market success. An accurate grasp of these sizing conversions ensures that orders meet expectations, reduces costly returns, and enhances brand reputation in competitive markets.

This comprehensive guide delves into the critical aspects of Mexico-to-U.S. shoe size conversions, offering actionable insights tailored for international buyers. It covers the various types of footwear, common materials, manufacturing and quality control standards, and key supplier considerations. Additionally, it provides strategic guidance on sourcing costs, market trends, and addressing frequently asked questions—empowering buyers to make informed, confident purchasing decisions.

By understanding the complexities and subtleties of sizing differences, B2B buyers can optimize their sourcing strategies, negotiate better terms, and establish strong relationships with reliable suppliers. Whether sourcing for mass-market retail, luxury brands, or niche markets, this guide equips you with the knowledge needed to navigate the global footwear landscape effectively, ensuring your products align perfectly with your target markets’ expectations.

Understanding mexico shoe size to us Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Numeric Size Conversion Charts | Standardized numeric system, direct correlation between Mexico and US sizes | Shoe manufacturing, wholesale distribution, retail sales | Easy to implement, universally recognized; may lack precision for custom fits but simplifies bulk ordering |

| US Letter Size Approximation | Uses US letter sizing (e.g., 7, 8, 9) with approximate equivalents for Mexico | Importing finished shoes, brand licensing, cataloging | Familiar to US and European markets; risk of sizing discrepancies if not verified |

| European Sizing Equivalence | Converts Mexico sizes to European standards (e.g., EU 40, 42) for broader compatibility | Export to European markets, multi-region suppliers | Facilitates broader market access; requires careful cross-referencing to avoid errors |

| Custom Conversion Tables | Proprietary or industry-specific conversion charts tailored to brands or suppliers | Private label manufacturing, bespoke footwear production | Enhances fit accuracy; requires ongoing updates and validation for consistency |

| Digital Sizing Tools & Apps | Online calculators and apps that convert Mexico sizes to US sizes dynamically | E-commerce platforms, online B2B sales, virtual fittings | Improves accuracy and customer confidence; dependent on digital infrastructure and data accuracy |

Characteristics, Suitability, and Key B2B Considerations

Numeric Size Conversion Charts:

This is the most straightforward and widely adopted method for translating Mexico shoe sizes to US standards. It relies on standardized numeric charts that map sizes directly, making bulk ordering and inventory management more streamlined. For B2B buyers, especially importers and wholesalers, these charts reduce confusion and facilitate consistent ordering. However, they may lack precision for brands with unique fitting profiles or custom designs, which can lead to sizing mismatches if not supplemented with actual product samples or detailed specifications.

US Letter Size Approximation:

Using US letter sizing (like 7, 8, 9) offers familiarity for buyers dealing predominantly with North American markets. It simplifies cataloging and sales processes, especially when dealing with retail chains or online platforms that list sizes in US standards. The main consideration is the potential for discrepancies—Mexico sizes often do not align perfectly with US letter sizes, so validation through sample fittings or detailed sizing specs is essential. This approach is best suited for standardized mass-produced footwear where slight variations are acceptable.

European Sizing Equivalence:

Many B2B buyers from Europe or those targeting European consumers convert Mexico sizes to EU standards (e.g., EU 40, 42). This facilitates seamless integration into European supply chains and retail outlets. It requires precise cross-referencing, as misalignments can cause costly returns or customer dissatisfaction. For importers, working with reliable conversion data or verified suppliers ensures consistency. This approach is particularly valuable for brands exporting to multiple regions, enabling easier inventory management and clearer communication.

Custom Conversion Tables:

Some brands and manufacturers develop proprietary conversion charts tailored to their specific fits or customer demographics. These are especially useful for bespoke or high-end footwear where precise sizing impacts customer satisfaction. B2B buyers leveraging these tables benefit from improved fit accuracy, reducing returns and exchanges. However, maintaining and updating these charts demands ongoing quality control and close communication with suppliers to ensure they reflect actual product specifications.

Digital Sizing Tools & Apps:

Modern B2B operations increasingly incorporate digital tools that dynamically convert Mexico sizes to US sizes. These tools support online ordering platforms, virtual fittings, and remote sales, enhancing accuracy and customer confidence. For international buyers, especially those engaging in e-commerce or virtual B2B marketplaces, these tools mitigate the risks associated with manual conversions. The key considerations include investing in reliable technology, ensuring data accuracy, and integrating these tools into existing digital workflows for maximum benefit.

Key Industrial Applications of mexico shoe size to us

| Industry/Sector | Specific Application of mexico shoe size to us | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Footwear Manufacturing | Standardizing sizing for export to US and international markets | Ensures product consistency, reduces returns, and enhances customer satisfaction | Accurate size conversion, compliance with international standards, reliable suppliers |

| E-commerce & Retail | Online shoe sales targeting US, European, and Middle Eastern markets | Facilitates precise product listings, reduces sizing discrepancies, boosts sales conversion | Clear size charts, quality control, fast logistics, and flexible MOQ options |

| Industrial Safety Gear | Manufacturing of safety footwear aligned with US sizing standards | Guarantees proper fit for safety compliance, minimizes injury risk | Accurate sizing data, certifications for safety standards, adaptable production lines |

| Custom Footwear Design | Designing bespoke shoes for international clients based on size conversions | Offers tailored solutions, enhances brand reputation, broadens client base | Precise size translation, high-quality materials, reliable communication channels |

| Athletic & Performance Shoes | Producing sports and performance footwear for global markets | Meets specific athletic sizing needs, improves product performance | Accurate sizing conversion, durable materials, adherence to sport-specific standards |

Footwear Manufacturing

For manufacturers in Mexico aiming to export shoes to the US and other international markets, understanding the precise conversion from Mexico shoe sizes to US sizes is critical. Accurate sizing ensures product consistency, reduces the likelihood of returns, and enhances customer satisfaction. B2B buyers from Africa, South America, and Europe should prioritize sourcing from suppliers with robust calibration processes and clear size conversion charts, ensuring compliance with international standards such as ASTM or ISO. Reliable suppliers that offer transparent sizing metrics facilitate smoother market entry and brand reputation building.

E-commerce & Retail

Online footwear retailers targeting US, European, and Middle Eastern consumers rely heavily on accurate size conversions to prevent mismatched orders and negative reviews. Implementing precise Mexico-to-US shoe size charts allows for seamless product listings, reducing sizing discrepancies that often lead to high return rates. B2B buyers should seek suppliers with proven quality control, fast logistics capabilities, and flexible minimum order quantities (MOQs). This approach supports scalable inventory management and ensures customer trust in international markets.

Industrial Safety Gear

Manufacturers producing safety footwear for sectors such as construction, oil & gas, or manufacturing must adhere to strict US sizing standards to ensure proper fit and safety compliance. Accurate size conversion from Mexico shoe sizes to US sizes helps prevent injuries caused by ill-fitting footwear. International B2B buyers should prioritize sourcing from suppliers with certifications for safety standards (e.g., ANSI, ASTM) and reliable calibration processes. Proper sizing ensures safety gear effectiveness, reducing liability and fostering long-term business relationships.

Custom Footwear Design

B2B companies offering bespoke footwear services to international clients benefit from precise size conversions to deliver perfectly fitting shoes. Accurate translation from Mexico shoe sizes to US sizes allows designers to create customized products that meet specific customer requirements across different markets. Sourcing high-quality materials and maintaining clear communication channels are essential for ensuring fit accuracy and client satisfaction. This approach enhances brand reputation and expands market reach.

Athletic & Performance Shoes

Manufacturers specializing in sports and performance footwear need precise sizing conversions to meet the demands of athletes and active consumers worldwide. Correctly translating Mexico shoe sizes to US sizes ensures optimal fit, which directly impacts comfort and performance. B2B buyers should focus on sourcing from suppliers who utilize durable materials, adhere to sport-specific standards, and have rigorous quality assurance processes. Accurate sizing is vital to delivering high-performance products that meet international athletic standards.

Strategic Material Selection Guide for mexico shoe size to us

Material Analysis for Mexico Shoe Size to US Conversion

When selecting materials for manufacturing or sourcing footwear components aligned with Mexico shoe size to US sizing standards, B2B buyers must consider material properties, cost implications, manufacturing complexity, and compliance with international standards. Here, we analyze four common materials—leather, synthetic polymers, rubber, and textiles—focusing on their suitability for footwear applications and considerations for global buyers from Africa, South America, the Middle East, and Europe.

Leather

Key Properties:

Leather remains a traditional and premium material for footwear, offering excellent breathability, flexibility, and aesthetic appeal. It possesses high durability and conforms well to foot shape over time. Leather’s natural properties also provide moderate water resistance, though it often requires treatment for enhanced weatherproofing.

Pros & Cons:

Leather’s advantages include superior comfort, longevity, and a high-end appearance, making it ideal for premium shoe lines. However, it involves higher manufacturing costs due to raw material expenses and complex processing steps such as tanning, which can extend lead times. Leather’s variability based on grade and source can impact consistency.

Impact on Application:

Leather performs well across various media, including moisture and temperature fluctuations, provided it is properly treated. It is suitable for both formal and casual footwear, aligning with international aesthetic standards.

International B2B Considerations:

Buyers from regions like Europe and Turkey often prefer high-quality leather complying with standards such as ISO 9001 or environmental certifications like the Leather Working Group (LWG). Import regulations may require documentation on origin and processing methods, especially for eco-conscious markets. Leather’s sustainability concerns may influence procurement decisions in regions emphasizing eco-friendly products.

Synthetic Polymers (e.g., Polyurethane, PVC)

Key Properties:

Synthetic polymers offer versatility, with properties adjustable through formulation. Polyurethane (PU) is valued for its flexibility, lightweight nature, and good abrasion resistance, while PVC provides durability and weather resistance at a lower cost. These materials can be engineered for specific performance characteristics like water resistance and colorfastness.

Pros & Cons:

Synthetic materials typically reduce manufacturing costs and simplify production processes, making them attractive for mass-produced footwear. They are lightweight and resistant to environmental factors such as moisture and chemicals. However, they may lack the breathability of natural materials, potentially affecting comfort. Durability varies depending on formulation, with some synthetics prone to cracking or degradation over time.

Impact on Application:

Synthetic materials are suitable for a wide range of footwear types, including casual, athletic, and fashion shoes. Their chemical composition allows for customization to meet specific media resistance requirements, like saltwater or UV exposure.

International B2B Considerations:

Buyers in Africa and South America often favor synthetics for their cost-effectiveness and ease of sourcing. Compliance with standards such as ASTM D2047 (for slip resistance) or REACH regulations (chemical safety, especially in Europe) is essential. Synthetics with eco-labels or low VOC emissions are increasingly preferred, aligning with regional regulations and consumer preferences.

Rubber (Natural and Synthetic)

Key Properties:

Rubber offers excellent elasticity, impact absorption, and water resistance. Natural rubber provides high resilience and durability, while synthetic variants like SBR (styrene-butadiene rubber) are engineered for specific performance traits such as heat resistance or chemical stability.

Pros & Cons:

Rubber’s primary advantage is its durability and flexibility, making it ideal for outsoles and protective components. It also performs well under diverse environmental conditions. The downside includes higher weight and potential cost variations depending on grade and source. Natural rubber can be susceptible to environmental degradation if not properly stabilized.

Impact on Application:

Rubber is predominantly used in outsole manufacturing, ensuring slip resistance and durability. Its chemical resistance makes it suitable for work and outdoor footwear, especially in regions with rugged terrain or harsh climates.

International B2B Considerations:

Buyers from the Middle East and Europe often seek rubber components compliant with standards like DIN or ASTM for safety and performance. Sustainability certifications, such as FSC or Fair Rubber, influence procurement decisions, especially where environmental regulations are strict. Cost fluctuations due to raw material supply can impact sourcing strategies.

Textiles (e.g., Mesh, Canvas, Synthetic Fabrics)

Key Properties:

Textile materials are valued for breathability, lightweight properties, and flexibility. Modern synthetic textiles can also provide water resistance and UV protection through advanced coatings or treatments.

Pros & Cons:

Textiles are generally cost-effective and easy to process, making them suitable for casual and sports footwear. They excel in comfort and ventilation but may lack durability compared to leather or rubber, especially under heavy use or exposure to moisture.

Impact on Application:

Textile components are often used for uppers, linings, and insoles. Their adaptability allows for diverse aesthetic and functional designs, aligning with regional preferences for lightweight, breathable shoes.

International B2B Considerations:

Buyers from Africa and South America prioritize textiles with certifications like OEKO-TEX or GOTS to meet health and safety standards. Compatibility with regional standards such as JIS (Japan Industrial Standards) or ISO is important for export compliance. Cost and availability of high-performance textiles influence procurement choices.

Summary Table

| Material | Typical Use Case for Mexico Shoe Size to US | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Leather | Upper, formal footwear | Premium look, breathability, durability | High cost, complex processing, variability | High |

| Synthetic Polymers (PU, PVC) | Casual, athletic, fashion footwear | Cost-effective, lightweight, customizable | Less breathable, environmental concerns | Med |

| Rubber | Outsoles, protective components | Impact absorption, durability, water resistance | Heavier, cost varies with grade | Med |

| Textiles (Mesh, Canvas) | Uppers, linings, insoles | Lightweight, breathable, versatile | Less durable under heavy use | Low |

This comprehensive analysis equips international B2B buyers with essential insights into material selection, emphasizing regional preferences, compliance standards, and cost considerations. Proper material choice tailored to target markets can significantly enhance product quality, compliance, and competitiveness in the global footwear supply chain.

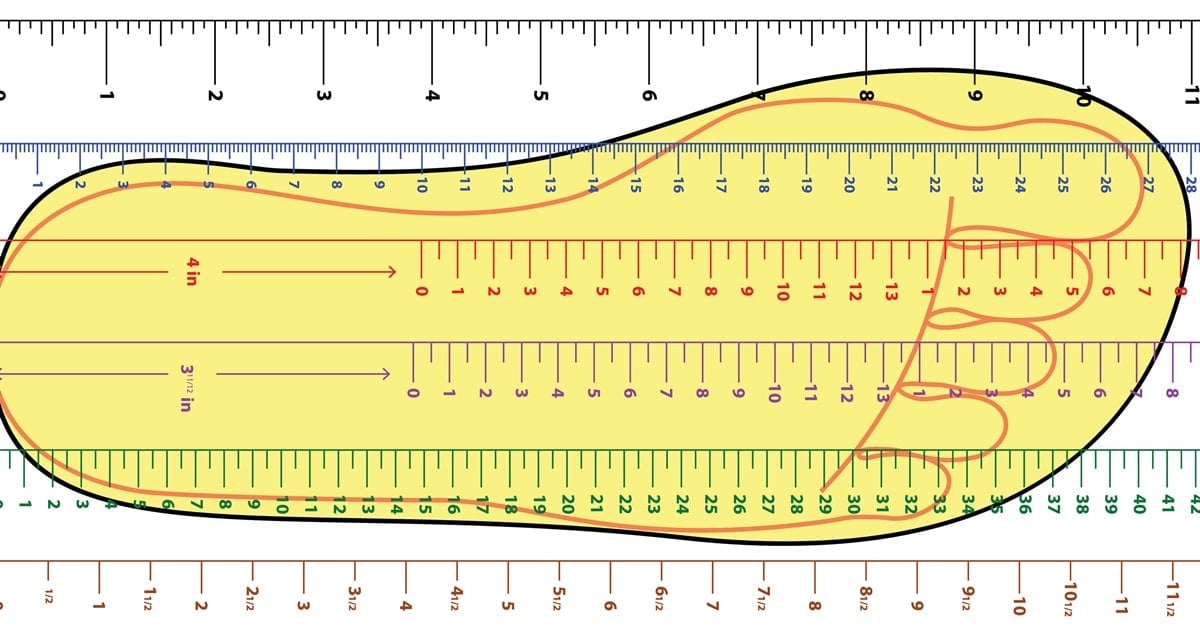

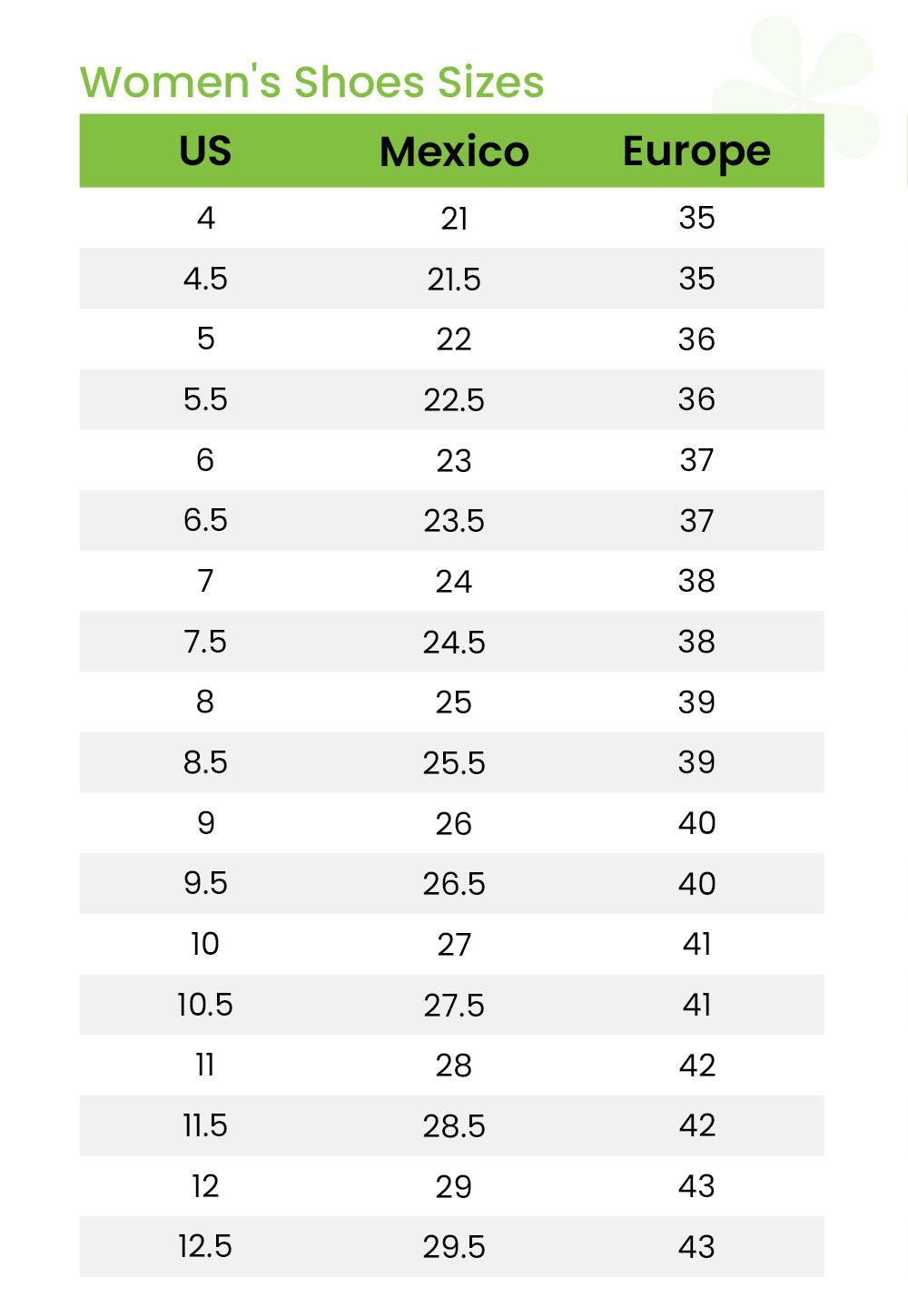

Illustrative Image (Source: Google Search)

In-depth Look: Manufacturing Processes and Quality Assurance for mexico shoe size to us

Manufacturing Processes in Mexico Shoe Production

The manufacturing of footwear in Mexico follows a structured sequence of stages, each critical to ensuring product quality and consistency. Understanding these processes enables international B2B buyers to better evaluate potential suppliers and ensure alignment with their standards.

1. Material Preparation

This initial phase involves sourcing and preparing raw materials such as leather, synthetic fabrics, rubber, and adhesives. Suppliers often source high-quality leathers from regional tanneries, ensuring compliance with environmental and safety standards. Material inspection occurs at this stage, including visual checks for defects, thickness measurements, and moisture content assessments, aligning with ISO 9001 standards to ensure traceability and quality consistency.

2. Cutting and Patterning

Using computer-aided design (CAD) systems and automated cutting machines, suppliers achieve precise patterning to minimize waste and ensure size accuracy, including conversions from Mexico shoe sizes to US standards. This stage requires tight control to prevent deviations that could affect fit and comfort. B2B buyers should verify that suppliers utilize advanced patterning technology and maintain calibration records.

3. Forming and Assembly

In this phase, components such as uppers, insoles, and outsoles are assembled. Techniques like stitching, lasting, and bonding are employed, often using automated sewing machines and heat-pressing equipment. The use of eco-friendly adhesives and sustainable materials is increasingly common, especially for buyers emphasizing sustainability. Consistent process control here ensures dimensional stability and adherence to specified size conversions.

4. Finishing

Final touches include polishing, coloring, applying protective coatings, and quality labeling. Automated finishing lines ensure uniformity, while manual inspections verify aesthetic details. During this stage, suppliers perform final dimensional checks, especially relevant when translating Mexico shoe sizes to US standards, to ensure proper fit and compliance with international sizing charts.

Quality Control (QC) Protocols and Standards

Effective QC is vital for ensuring that shoes meet both local and international standards, especially for B2B buyers from diverse markets like Africa, South America, the Middle East, and Europe.

1. International Standards Compliance

Most reputable Mexican manufacturers adhere to ISO 9001, emphasizing a quality management system that ensures continuous improvement. For footwear intended for export to Europe, compliance with CE marking requirements is often mandatory, covering safety, chemical, and environmental standards (REACH, RoHS). In the Middle East and other regions, adherence to local standards and certification schemes further enhances product credibility.

2. Industry-Specific Certifications

Depending on the target market, additional certifications may be necessary. For example, footwear exported to Europe might require compliance with EN standards related to safety and durability. Suppliers aiming at the US market should demonstrate ASTM or ASTM-derived standards, particularly for safety footwear.

3. Inspection Types and Checkpoints

– Incoming Quality Control (IQC): Raw materials are inspected upon arrival for defects, consistency, and compliance with specifications. B2B buyers should request detailed IQC reports and ensure supplier adherence to ASTM D4966 for leather testing or equivalent standards for synthetics.

– In-Process Quality Control (IPQC): During manufacturing, checkpoints monitor critical dimensions, stitching quality, and adherence to size conversions. Regular sampling ensures ongoing process stability.

– Final Quality Control (FQC): Before shipment, finished shoes undergo comprehensive inspections covering appearance, size accuracy (including Mexico to US sizing), structural integrity, and labeling accuracy. Functional testing, such as slip resistance or durability tests, can also be conducted.

4. Testing Methods

Common testing methods include:

– Dimensional measurement: Verifying size conversions with calipers and sizing gauges.

– Tensile and adhesion tests: Ensuring bonding strength of components.

– Flex testing: Assessing durability under repeated bending.

– Chemical analysis: Confirming absence of harmful substances per REACH or FDA standards.

Verifying Supplier Quality Assurance for International B2B Buyers

International buyers must implement rigorous verification strategies to ensure supplier compliance and quality consistency, especially when dealing with suppliers from Mexico.

1. Conduct Formal Audits

On-site audits provide comprehensive insights into manufacturing practices, equipment calibration, QC procedures, and workforce training. For buyers from Africa, South America, and the Middle East, partnering with third-party inspection agencies (e.g., SGS, Bureau Veritas) can supplement internal audits, especially when language barriers or logistical challenges exist.

2. Review Quality Documentation

Request detailed quality reports, test certificates, and process documentation. Suppliers should provide ISO 9001 certificates, test reports aligned with international standards, and traceability records for raw materials.

3. Implement Third-Party Inspection and Certification

Third-party inspections at various production stages help validate supplier claims. Pre-shipment inspections ensure product conformity, size accuracy, and correct labeling, including size conversions from Mexico to US standards. B2B buyers should specify inspection criteria tailored to their market requirements.

4. Establish Clear Communication and Quality Agreements

Define quality expectations explicitly in purchase contracts, including tolerances for size deviations, durability standards, and chemical safety. Regular communication and feedback loops foster continuous improvement and supplier accountability.

Special Considerations for European, Italian, Turkish, and Middle Eastern Buyers

Buyers from Europe and the Middle East must pay particular attention to compliance with regional standards and certifications. Italy, known for high craftsmanship standards, often demands detailed documentation and adherence to CE standards, including chemical safety and ergonomic requirements.

Turkish manufacturers, a significant hub for footwear, often possess ISO 9001 and ISO 14001 certifications, facilitating easier market entry. European buyers should verify these certifications and request test reports aligned with EN standards.

For Middle Eastern markets, ensuring compliance with local certification schemes and chemical safety regulations (e.g., Gulf Standards) is crucial. Establishing supplier partnerships with transparent QC processes and third-party verification mechanisms reduces risks and ensures product integrity.

Conclusion

For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding the manufacturing and QC nuances of Mexican footwear suppliers is essential. A comprehensive evaluation encompassing process transparency, adherence to international standards, rigorous inspection protocols, and reliable certification verification will significantly mitigate risks. Building strong partnerships with suppliers committed to quality and compliance ensures the delivery of consistent, high-quality shoes that meet diverse market standards and customer expectations.

Comprehensive Cost and Pricing Analysis for mexico shoe size to us Sourcing

Cost Structure Breakdown for Mexico Shoe Size to US Sourcing

Understanding the comprehensive cost structure is essential for international buyers aiming to optimize their sourcing from Mexico. The primary components influencing the landed cost include raw materials, labor, manufacturing overhead, tooling, quality control, logistics, and profit margins.

Materials:

Shoe materials—leather, synthetic fabrics, rubber, and insoles—constitute a significant portion of costs. Variations in material quality and sourcing—local versus imported—can impact pricing. For example, premium leather or specialized synthetics increase costs but may be necessary for higher-end markets.

Labor:

Mexico offers competitive wages relative to North America and Europe, but labor costs vary by region and complexity of shoe design. Skilled craftsmanship for custom or branded shoes commands higher wages, influencing overall costs. Efficient labor management and automation can reduce per-unit costs for large orders.

Manufacturing Overhead:

Overheads include factory utilities, equipment depreciation, and supervisory salaries. Factories with modern facilities and efficient processes tend to have lower overhead costs, providing better pricing stability. Buyers should consider the factory’s certifications (ISO, fair labor standards) as these can influence cost and compliance requirements.

Tooling and Development:

Initial tooling costs—molds, dies, and prototypes—are often one-time expenses but can significantly impact upfront costs, especially for custom designs or small batch runs. Negotiating tooling costs or spreading them over larger orders can improve unit economics.

Quality Control:

Rigorous QC protocols ensure product consistency and compliance with buyer specifications. While adding to costs, robust QC reduces the risk of costly returns or rework. Certification standards (e.g., ISO, environmental standards) may also influence pricing.

Logistics and Incoterms:

Shipping costs depend on order volume, destination, and chosen Incoterms (FOB, CIF, DDP). FOB (Free on Board) is common, leaving logistics responsibility to the buyer, who can negotiate freight rates directly. Larger volumes typically benefit from lower per-unit freight costs, but buyers should also factor customs clearance, duties, and taxes into total landed cost calculations.

Profit Margins:

Suppliers’ margins vary depending on market competitiveness, order size, and relationship strength. Transparent communication about margins is essential for negotiations, especially when ordering large quantities or establishing long-term partnerships.

Key Price Influencers for B2B Buyers

-

Order Volume & MOQ:

Higher volumes reduce per-unit costs due to economies of scale. Many suppliers offer discounts or better payment terms for larger orders. Identifying reliable suppliers capable of meeting your MOQ requirements can lead to significant savings. -

Specifications & Customization:

Custom designs, branding, or specialized materials increase costs. Clear specifications upfront help avoid costly revisions or rework, ensuring accurate quotes and smoother negotiations. -

Material Selection & Quality Standards:

Premium materials and certifications (e.g., eco-labels, fair trade) influence pricing. Aligning quality expectations with supplier capabilities ensures cost-effective sourcing without compromising standards. -

Supplier Reliability & Certification:

Established suppliers with proven quality records and certifications tend to be more predictable in pricing and delivery timelines. This reduces risk and potential hidden costs associated with delays or quality issues. -

Incoterms & Shipping Arrangements:

Choosing FOB allows buyers to control freight costs but requires logistics expertise. DDP (Delivered Duty Paid) simplifies process but often at a premium. Understanding these terms helps optimize total landed costs.

Strategic Tips for International B2B Buyers

-

Negotiate for Volume Discounts & Flexible Payment Terms:

Leverage larger orders to secure better prices and payment conditions. Building long-term relationships can also unlock preferential rates. -

Focus on Total Cost of Ownership (TCO):

Beyond unit price, consider costs related to quality assurance, lead times, customs duties, and post-sale support. A slightly higher unit price may be justified if it reduces rework or delays. -

Understand Pricing Nuances:

Prices are often indicative and vary based on order specifics, market conditions, and supplier negotiations. Always request detailed quotations and clarify what costs are included. -

Assess Logistics & Lead Times Carefully:

Longer lead times can incur storage costs or impact inventory planning. Factor in potential delays due to customs or transportation disruptions, especially in volatile global markets. -

Stay Informed on Tariffs & Trade Agreements:

Trade policies between Mexico and your country can affect import duties and taxes, influencing overall costs. Keeping abreast of regional trade agreements can provide cost advantages.

Final Note

While this analysis provides a general framework, actual costs can vary widely based on specific project requirements, supplier relationships, and market dynamics. Conducting detailed supplier evaluations and obtaining multiple quotes are essential steps toward optimizing your sourcing strategy from Mexico for US shoe sizes.

Spotlight on Potential mexico shoe size to us Manufacturers and Suppliers

- (No specific manufacturer data was available or requested for detailed profiling in this section for mexico shoe size to us.)*

Essential Technical Properties and Trade Terminology for mexico shoe size to us

Critical Technical Properties for Mexico to US Shoe Size Conversion

1. Material Grade and Composition

The raw materials used in footwear—such as leather, synthetic fibers, or rubber—are classified by grade, impacting durability and comfort. For B2B buyers, understanding material grades ensures product consistency and aligns with end-user expectations. High-grade materials typically command higher prices but offer superior longevity and aesthetic appeal.

2. Manufacturing Tolerance

Tolerance refers to the permissible deviation in shoe dimensions during production, such as length, width, and volume. Precise tolerances are essential for maintaining uniform sizing, especially when converting Mexico shoe sizes to US standards. Consistent tolerances reduce returns and increase customer satisfaction across markets.

3. Sizing Standards and Fit Specifications

Different countries follow distinct sizing algorithms; Mexico and the US have unique measurement systems. Accurate conversion requires detailed knowledge of how Mexico shoe sizes correlate with US sizes, including width fittings (e.g., narrow, standard, wide). Clear specifications prevent sizing errors and facilitate smoother international trade.

4. Finish and Quality Control Metrics

Surface finish, stitching quality, and sole attachment are critical quality indicators. Strict quality control metrics ensure the shoes meet international standards, reducing defect rates. For B2B transactions, consistent quality metrics foster trust and streamline supply chain processes.

5. Durability and Testing Standards

Standards such as tensile strength, abrasion resistance, and flexibility testing ensure shoes withstand typical usage conditions. Meeting recognized testing standards (e.g., ASTM, ISO) guarantees product reliability, which is vital for international buyers seeking durable footwear for diverse markets.

6. Weight and Packaging Specifications

Accurate weight measurements and standardized packaging dimensions influence logistics and freight costs. B2B buyers benefit from optimized packaging that reduces shipping expenses and facilitates handling across different supply chain nodes.

Essential Trade Terminology for Mexico to US Shoe Size Conversion

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce footwear on behalf of other brands. Understanding OEM arrangements helps buyers negotiate manufacturing terms, customize designs, and ensure quality standards are met during size conversions and production.

2. MOQ (Minimum Order Quantity)

The smallest number of units a manufacturer agrees to produce per order. Recognizing MOQ is crucial for planning inventory and managing costs, especially when dealing with custom sizing or specialized shoe models for different markets.

3. RFQ (Request for Quotation)

A formal process where buyers solicit price and lead time estimates from suppliers. Submitting clear RFQs with detailed technical specs and size conversion requirements enables accurate quotations and better supplier selection.

4. Incoterms (International Commercial Terms)

Standardized trade definitions (e.g., FOB, CIF, DDP) that specify responsibility for shipping, insurance, and tariffs. Familiarity with Incoterms allows buyers to negotiate terms that optimize costs and risk management when importing shoes across borders.

5. Lead Time

The duration from order placement to product delivery. Awareness of lead times helps buyers coordinate production schedules, especially when adjusting sizes for different markets and ensuring timely market entry.

6. Quality Certification Standards

Certifications such as ISO, CE, or local compliance marks validate product safety and quality. Ensuring footwear meets relevant certifications reduces legal barriers and facilitates smoother trade between Mexico and US markets.

Summary:

For effective international trade, B2B buyers must grasp key technical properties—like material quality, manufacturing tolerances, and sizing standards—that influence product fit and durability. Simultaneously, familiarizing themselves with industry jargon such as OEM, MOQ, RFQ, and Incoterms helps streamline negotiations, logistics, and compliance. Mastery of these elements ensures smoother transactions, minimizes risks, and enhances competitiveness in the global footwear market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the mexico shoe size to us Sector

Market Overview & Key Trends

The Mexico shoe size to US sector is a dynamic component of the broader footwear supply chain, driven by both regional manufacturing strengths and global consumer preferences. Mexico’s strategic geographic location, skilled labor force, and established manufacturing infrastructure position it as a key sourcing hub for international B2B buyers from Africa, South America, the Middle East, and Europe. These regions increasingly leverage Mexico’s proximity to the US market to reduce lead times and transportation costs, making it an attractive alternative or supplement to Asian manufacturing.

Emerging trends include the integration of advanced manufacturing technologies such as automation, 3D printing, and digital design tools, which enhance efficiency and product customization. Moreover, there is a notable shift towards flexible production models that accommodate small-batch, high-variety orders—aligning with the increasing demand for personalized footwear. B2B buyers are also prioritizing transparency and traceability, seeking suppliers that can provide detailed origin and process data.

In terms of sourcing trends, there is a rising preference for suppliers offering value-added services like quality assurance, rapid prototyping, and sustainable materials. Buyers from Italy and Turkey, for instance, are increasingly collaborating with Mexican manufacturers that demonstrate agility and innovation. Additionally, digital platforms and trade fairs facilitate direct engagement, enabling buyers to assess supplier capabilities in real-time.

Market dynamics are influenced by fluctuating raw material costs, trade policies, and geopolitical factors. Recent trade agreements and tariffs impact sourcing strategies, prompting buyers to diversify supply chains and build resilient, multi-sourcing networks. Overall, the sector continues to evolve with a focus on agility, technological integration, and sustainable practices, shaping a competitive landscape for international B2B buyers.

Sustainability & Ethical Sourcing in the Sector

Sustainability has become a critical consideration within the Mexico shoe size to US sector, driven by increasing consumer awareness and stricter regulatory standards worldwide. B2B buyers from regions such as Europe and the Middle East are actively seeking suppliers that prioritize environmentally responsible practices. This includes the use of eco-friendly raw materials—such as organic leather, recycled synthetics, and biodegradable glues—that reduce the sector’s carbon footprint.

Ethical sourcing is equally vital, with buyers demanding transparency throughout the supply chain. This involves verifying fair labor practices, ensuring workers’ rights are upheld, and avoiding child or forced labor. Certification schemes like Fair Trade, Global Organic Textile Standard (GOTS), and Leather Working Group (LWG) are gaining prominence as benchmarks for responsible sourcing.

Incorporating ‘green’ certifications and sustainable materials can serve as a competitive advantage. Suppliers that can demonstrate adherence to environmental standards—through reduced water and energy consumption or waste management—are more attractive to international buyers. Additionally, integrating circular economy principles, such as recycling footwear components or designing for disassembly, aligns with global sustainability goals.

For B2B buyers, establishing partnerships with suppliers committed to ethical and sustainable practices not only mitigates reputational risks but also meets the evolving demands of eco-conscious consumers. Transparency, third-party audits, and ongoing supplier development programs are essential tools for ensuring compliance and fostering long-term, responsible collaborations.

Brief Evolution/History

The Mexico shoe manufacturing sector has evolved significantly over the past few decades, transitioning from predominantly low-cost, volume-driven production to a more sophisticated, innovation-focused industry. Initially capitalizing on proximity to the US market and competitive labor costs, Mexico became a major player in footwear exports, especially for regional and North American brands.

Illustrative Image (Source: Google Search)

In recent years, there has been a strategic shift towards higher-quality, design-oriented footwear catering to premium segments. This transformation is partly driven by collaborations with international brands and the adoption of advanced manufacturing technologies. Sustainability initiatives and ethical sourcing practices have also gained prominence, reflecting global consumer trends and regulatory pressures.

For B2B buyers, understanding this evolution highlights Mexico’s increasing capacity for customization, innovation, and responsible manufacturing—making it a valuable partner in the global supply chain. The sector’s adaptability and ongoing modernization continue to reinforce its importance in the international footwear market, especially for buyers seeking reliable, sustainable, and high-quality sourcing options.

Frequently Asked Questions (FAQs) for B2B Buyers of mexico shoe size to us

1. How can I verify the reliability and quality standards of Mexico shoe size suppliers?

To ensure supplier reliability, start by reviewing their certifications such as ISO, CE, or other industry-specific standards. Request detailed product catalogs, samples, and references from previous international clients, particularly those in your region. Conduct virtual factory audits or visit the supplier if feasible, focusing on production capacity, quality control processes, and compliance with safety standards. Additionally, leverage third-party inspection services before shipment to validate product quality. Establish clear communication channels and contractual quality agreements to minimize risks and ensure consistent standards across orders.

2. What should I consider when requesting customization or specific sizing requirements?

When seeking customization, clearly specify your target US shoe sizes and any regional sizing nuances. Communicate your design, branding, or material preferences upfront to avoid misunderstandings. Confirm whether the supplier can accommodate small batch runs or bulk orders with tailored sizing, and inquire about minimum order quantities (MOQs) for customized products. Establish lead times for development and production, and request prototypes for approval before mass manufacturing. Ensure that your contractual agreement covers intellectual property rights, revision policies, and quality benchmarks to streamline the customization process.

Illustrative Image (Source: Google Search)

3. What are typical MOQs, lead times, and payment terms for sourcing Mexico shoe sizes?

Most suppliers require MOQs ranging from 500 to 2,000 pairs, depending on the supplier’s capacity and the level of customization. Lead times generally range from 4 to 12 weeks, influenced by order complexity and production schedules. Payment terms often include a 30% deposit upfront, with the balance due upon shipment or delivery. Some suppliers may accept letters of credit or bank guarantees, especially for larger orders. Negotiating flexible payment options and clear timelines upfront helps mitigate risks, especially when dealing with international transactions and customs procedures.

4. What certifications or quality assurance measures should I request from suppliers?

Ensure suppliers provide relevant certifications such as ISO 9001 for quality management, safety standards compliance, and any regional certifications relevant to your target markets. Request detailed quality assurance protocols, including in-process inspections, final product testing, and lab reports. Consider third-party inspection services for random sampling and testing before shipment, especially to verify sizing accuracy, material quality, and durability. Having clear quality benchmarks in your contract minimizes disputes and ensures the products meet your specifications and regulatory requirements in your country.

5. How can I manage logistics effectively when importing Mexico shoe sizes to my country?

Establish a reliable logistics plan by choosing experienced freight forwarders familiar with your destination country’s import regulations. Decide on Incoterms that clearly define responsibilities for shipping costs, customs clearance, and risk transfer—common options include FOB or CIF. Factor in transit times, customs duties, taxes, and potential delays at borders. Build relationships with local customs brokers to streamline clearance processes. Additionally, consider warehousing options near your market to reduce lead times and manage inventory efficiently. Regular communication with logistics partners ensures transparency and timely delivery.

6. What should I do if there is a dispute over product quality or delivery?

In case of disputes, first review your contractual agreements and inspection reports to identify discrepancies. Maintain detailed documentation of communications, inspection results, and shipment records. Engage in direct negotiation with the supplier to resolve issues amicably; many suppliers prefer collaborative solutions to maintain long-term relationships. If unresolved, escalate to arbitration or legal channels per your contract’s dispute resolution clause. To prevent future conflicts, include clear quality control standards, inspection rights, and penalties for non-compliance in your agreements from the outset.

7. How can I assess the supplier’s capacity to scale with my growing demand?

Evaluate the supplier’s production capacity, workforce stability, and flexibility in handling larger or more frequent orders. Request information on their existing client base and order history to gauge their ability to meet increased demand. Consider suppliers with modern machinery and diversified production lines, which are better equipped to scale efficiently. Building a strategic partnership, including long-term contracts with volume discounts, can incentivize the supplier to prioritize your orders. Regular performance reviews and open communication channels help ensure the supplier can adapt as your business grows.

8. What are key considerations for ensuring compliance with regional regulations in my country?

Research your country’s import regulations, safety standards, and labeling requirements for footwear. Confirm that the Mexico supplier’s products meet these standards, including necessary certifications or testing reports. Clarify labeling language, materials disclosures, and packaging requirements to ensure compliance upon arrival. Engage local customs brokers or legal advisors familiar with footwear imports to guide documentation and clearance processes. Staying updated on regulatory changes and maintaining transparent documentation reduces the risk of delays, fines, or product rejections, safeguarding your market reputation.

Strategic Sourcing Conclusion and Outlook for mexico shoe size to us

Conclusion and Future Outlook

Effective strategic sourcing of Mexico shoe sizes to the U.S. market offers significant advantages for international B2B buyers, including cost efficiencies, reliable supply chains, and access to high-quality manufacturing. By understanding regional sizing nuances and establishing strong supplier relationships, buyers from Africa, South America, the Middle East, and Europe can mitigate risks and optimize inventory management.

Looking ahead, ongoing global shifts—such as supply chain diversification and technological advancements—present opportunities to strengthen sourcing strategies further. Embracing digital tools, data analytics, and supplier collaboration will be crucial in maintaining competitive edge and ensuring seamless market integration.

For international buyers seeking to expand or refine their footwear supply chain, proactive engagement with Mexican manufacturers and detailed market insights will be vital. Building resilient, flexible sourcing partnerships now will position your business for sustained growth amid evolving global trade dynamics. Take decisive action today to leverage Mexico’s manufacturing strengths and secure a strategic advantage in the U.S. footwear market.