Your Ultimate Guide to Sourcing Size 14 Mens Shoes

Guide to Size 14 Mens Shoes

- Introduction: Navigating the Global Market for size 14 mens shoes

- Understanding size 14 mens shoes Types and Variations

- Key Industrial Applications of size 14 mens shoes

- Strategic Material Selection Guide for size 14 mens shoes

- In-depth Look: Manufacturing Processes and Quality Assurance for size 14 mens shoes

- Comprehensive Cost and Pricing Analysis for size 14 mens shoes Sourcing

- Spotlight on Potential size 14 mens shoes Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for size 14 mens shoes

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the size 14 mens shoes Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of size 14 mens shoes

- Strategic Sourcing Conclusion and Outlook for size 14 mens shoes

Introduction: Navigating the Global Market for size 14 mens shoes

In the competitive landscape of global footwear trade, size 14 men’s shoes represent a significant market segment with substantial growth potential. As larger shoe sizes become increasingly sought after across diverse regions, understanding the nuances of sourcing and supply chain dynamics for this niche is vital for B2B buyers. Whether you’re a distributor, retailer, or manufacturer, securing reliable, quality suppliers of size 14 shoes can differentiate your offerings and meet rising consumer demand.

This comprehensive guide equips international buyers—particularly from Africa, South America, the Middle East, and Europe (including Turkey and Indonesia)—with actionable insights to navigate this specialized market effectively. It covers essential aspects such as the various types of size 14 footwear, the materials used, manufacturing standards, quality control practices, and sourcing strategies. Additionally, it provides detailed market analysis, cost considerations, and answers to frequently asked questions to streamline decision-making.

By leveraging this guide, B2B buyers will be empowered to identify reputable suppliers, evaluate product quality, optimize costs, and ensure compliance with regional standards. Navigating the complexities of global sourcing for size 14 men’s shoes requires a strategic approach—this resource aims to facilitate informed, confident purchasing decisions that foster sustainable growth in your footwear portfolio.

Understanding size 14 mens shoes Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Classic Leather Dress Shoes | Premium leather, formal design, available in various finishes | Corporate gifting, luxury retail, uniform supply | Pros: High demand, premium margins; Cons: Higher procurement costs, limited seasonal variation |

| Athletic/Training Shoes | Cushioned soles, breathable mesh, sport-specific designs | Sports teams, fitness centers, casual retail | Pros: Growing market, versatile; Cons: Faster obsolescence, high return rates |

| Casual Sneakers | Trendy styles, lightweight, versatile for everyday wear | Wholesale to retailers, online marketplaces | Pros: Popular with youth markets, high turnover; Cons: Price competition, trend dependency |

| Work/Safety Boots | Durable materials, reinforced toe caps, slip-resistant soles | Industrial sectors, construction, logistics | Pros: Consistent demand, bulk orders; Cons: Regulatory compliance, inventory complexity |

| Formal Oxford Shoes | Sleek, minimalistic, often in polished leather or suede | Corporate uniform suppliers, luxury brands | Pros: Stable demand in professional sectors; Cons: Limited seasonal variation, high quality standards |

Classic Leather Dress Shoes

These shoes are characterized by their high-quality leather construction and formal aesthetic, making them ideal for professional and ceremonial settings. For B2B buyers, sourcing size 14 leather dress shoes offers opportunities in corporate gifting, uniform supply, and luxury retail channels. They tend to have longer lead times due to the craftsmanship involved but can command premium pricing. Buyers should consider quality certifications, leather sourcing transparency, and the ability to meet high standards of finish and durability.

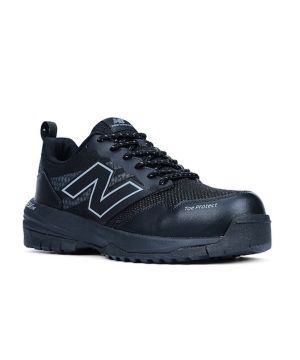

Athletic/Training Shoes

Designed with comfort and performance in mind, athletic shoes for size 14 are increasingly in demand across markets that emphasize health, fitness, and casual wear. These shoes often feature breathable mesh uppers, cushioned insoles, and sport-specific designs. For wholesalers, the focus should be on establishing reliable manufacturing partners capable of consistent quality and innovation. The rapid pace of fashion change and technological advances means inventory turnover is high, so agile supply chain management is essential.

Casual Sneakers

Casual sneakers are among the most popular footwear types globally, especially among younger demographics. They offer a wide range of styles, from minimalist designs to bold, trendy patterns. For B2B buyers, wholesale distribution to retail outlets or online platforms can generate significant volume. However, the fast-changing fashion landscape requires close attention to current trends and flexible sourcing strategies. Price competitiveness and branding are critical success factors in this segment.

Work/Safety Boots

These boots are built for durability, featuring reinforced toes, slip-resistant soles, and rugged materials. They are essential in industrial sectors such as construction, manufacturing, and logistics. B2B buyers should prioritize suppliers with proven compliance with safety standards and certifications. Bulk purchasing agreements and inventory management are key to maintaining steady supply, especially as safety regulations can vary across regions.

Formal Oxford Shoes

Sleek and minimalistic, Oxford shoes are staples in corporate environments and luxury markets. They often feature polished leather or suede finishes, with meticulous craftsmanship. For wholesale buyers, consistent quality and supply reliability are paramount, as these shoes are typically purchased in larger quantities for uniform or corporate branding. Seasonal fluctuations are minimal, but high standards for material sourcing and finishing are essential to meet client expectations.

This variety of size 14 men’s shoes presents diverse opportunities for international B2B buyers. By understanding the specific characteristics, applications, and procurement considerations of each type, buyers can optimize sourcing strategies, negotiate better terms, and meet the evolving demands of their target markets effectively.

Key Industrial Applications of size 14 mens shoes

| Industry/Sector | Specific Application of size 14 mens shoes | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Construction & Heavy Industry | Safety footwear for site workers, especially in rugged environments | Ensures worker safety, reduces injury risk, and complies with safety standards | Durability, slip resistance, compliance with local safety regulations |

| Logistics & Warehousing | Staff footwear for long shifts on factory floors or warehouses | Enhances comfort, reduces fatigue, and improves productivity | Ergonomic design, availability in bulk, reliable supply chain |

| Mining & Extraction | Specialized boots for miners, often in harsh terrains | Protects against physical hazards, offers stability and support | Heavy-duty construction, waterproofing, resistance to abrasion |

| Sporting Goods & Recreation | Custom athletic or outdoor shoes for sports or adventure activities | Meets specific performance needs, appeals to niche markets | Customization options, high-quality materials, regional preferences |

| Military & Security | Tactical footwear for personnel in operational environments | Provides durability, support, and safety in demanding conditions | Military-grade standards, high-quality outsole grip, supply consistency |

Construction & Heavy Industry

Size 14 men’s shoes are critical in the construction and heavy industry sectors, where safety and durability are paramount. These shoes are used as safety boots for workers operating in rugged, often hazardous environments. International B2B buyers in regions like Africa and South America should prioritize sourcing footwear that complies with local safety standards, such as OSHA or equivalent certifications. Durable materials, slip resistance, and protective features like steel toes are essential to mitigate workplace injuries and ensure regulatory compliance, especially in regions with variable safety enforcement.

Logistics & Warehousing

In logistics and warehousing, size 14 men’s shoes serve as essential gear for staff working extended shifts on factory floors or warehouse environments. These shoes help reduce fatigue and improve overall productivity by providing comfort and support for long hours of standing and movement. For international buyers, especially from Turkey or Indonesia, sourcing shoes with ergonomic features, reliable supply chains, and bulk availability can significantly enhance operational efficiency. Consider local climate adaptations, such as breathable materials for hot climates or waterproofing for rainy regions.

Mining & Extraction

Mining operations demand rugged footwear capable of withstanding extreme conditions. Size 14 men’s shoes in this sector often include specialized boots with reinforced soles, waterproofing, and abrasion resistance. These shoes protect miners from physical hazards such as falling debris, uneven terrain, and moisture. For B2B buyers in South America or the Middle East, sourcing high-quality, heavy-duty footwear that meets industry standards (e.g., ASTM, ISO) is crucial. Ensuring consistent supply and regional customization can help mitigate operational risks and improve safety compliance.

Sporting Goods & Recreation

The outdoor and sporting sectors utilize size 14 men’s shoes for activities such as hiking, trail running, or adventure sports. Customization, high-performance materials, and regional style preferences are key considerations for B2B buyers targeting niche markets. Suppliers should offer options that balance durability with lightweight comfort, catering to consumers in Europe and Southeast Asia. Sourcing from reputable manufacturers with regional distribution capabilities ensures timely delivery and product quality.

Military & Security

Tactical footwear for military and security personnel must combine durability, support, and grip. Size 14 shoes are often used in tactical boots designed for demanding operational environments. International buyers from the Middle East or Africa should focus on sourcing footwear that meets military-grade standards, including high traction soles and reinforced construction. Consistent quality, regional customization, and reliable logistics are vital to meet the critical needs of defense and security agencies across diverse terrains.

Strategic Material Selection Guide for size 14 mens shoes

Analysis of Common Materials for Size 14 Men’s Shoes

Leather

Leather remains the most traditional and widely used material in high-quality men’s footwear, especially for size 14 shoes. Its key properties include excellent durability, breathability, and aesthetic appeal. Leather can conform to the shape of the foot over time, providing comfort and a premium look. From a B2B perspective, sourcing high-grade leather (such as full-grain or top-grain) ensures longevity and customer satisfaction.

Pros & Cons:

– Pros: High durability, natural breathability, attractive finish, and good aging characteristics.

– Cons: Relatively high cost, complex manufacturing processes, and sensitivity to moisture and temperature variations. Leather requires proper treatment to resist water and stains, which can add to production costs.

Impact on Application:

Leather performs well in various climates but may require additional waterproofing treatments for humid or rainy regions. It is compatible with standard shoe manufacturing processes but demands quality control to maintain consistency, especially for larger sizes like 14.

International Buyer Considerations:

Buyers from Africa, South America, the Middle East, and Europe should prioritize suppliers compliant with international standards such as ISO 9001 for quality management. Tanning methods (vegetable vs. chrome) may influence environmental compliance, which is increasingly scrutinized in Europe and the Middle East. Leather sourcing should also consider import tariffs and sustainability certifications to meet regional regulations and consumer preferences.

Synthetic Materials (e.g., PU, PVC)

Synthetic materials are popular alternatives to leather, offering cost advantages and manufacturing flexibility. Polyurethane (PU) and polyvinyl chloride (PVC) are common in budget-friendly footwear, especially for mass production.

Illustrative Image (Source: Google Search)

Pros & Cons:

– Pros: Lower cost, easier to manufacture at scale, consistent quality, and resistant to water and stains.

– Cons: Generally less durable than leather, can degrade faster under UV exposure, and may lack the breathability of natural materials.

Impact on Application:

Synthetic materials are suitable for casual or fashion-oriented shoes where cost and appearance are prioritized over longevity. They are compatible with various manufacturing techniques, including injection molding and layering, which can be advantageous for producing larger sizes efficiently.

International Buyer Considerations:

Buyers should verify supplier certifications for safety standards such as REACH (Europe) or ASTM compliance (US/others). Environmental concerns around PVC, especially related to plasticizers and emissions, are critical in Europe and increasingly in other regions. Sourcing from manufacturers with eco-friendly formulations or recycled content can enhance market acceptance.

EVA and Rubber Soles

While not a primary material for the upper, EVA (ethylene-vinyl acetate) and rubber are vital for midsoles and outsoles in size 14 shoes, impacting comfort and durability.

Pros & Cons:

– Pros: Lightweight, shock-absorbing, and flexible. Rubber offers excellent wear resistance and grip.

– Cons: EVA can degrade under prolonged UV exposure, and high-quality rubber can be costly. Both materials may require specific manufacturing techniques for large sizes to ensure structural integrity.

Impact on Application:

EVA and rubber are essential for comfort and safety, especially in larger sizes where weight distribution and shock absorption are critical. Compatibility with various outsole designs makes them versatile for different shoe styles.

International Buyer Considerations:

Buyers should ensure materials meet regional safety and environmental standards, such as REACH in Europe or ISO standards. The sourcing of eco-friendly or recycled rubber/EVA can also be a competitive advantage in markets with sustainability mandates.

Summary Table

| Material | Typical Use Case for size 14 mens shoes | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Leather | Upper material for formal, casual, and premium shoes | High durability, aesthetic appeal, comfortable fit | Expensive, sensitive to moisture, complex processing | High |

| Synthetic (PU, PVC) | Casual, fashion, and mass-market shoes | Cost-effective, water-resistant, consistent quality | Less durable, environmental concerns, less breathable | Low |

| EVA and Rubber Soles | Midsoles and outsoles for cushioning and grip | Lightweight, shock absorption, high grip | UV degradation (EVA), costlier high-quality rubber | Low to Med |

This comprehensive analysis enables B2B buyers to make informed decisions aligned with regional market demands, compliance standards, and end-user preferences, ensuring optimal material selection for size 14 men’s shoes across diverse international markets.

In-depth Look: Manufacturing Processes and Quality Assurance for size 14 mens shoes

Manufacturing Processes for Size 14 Men’s Shoes

Producing size 14 men’s shoes involves a series of precise, standardized manufacturing stages designed to ensure consistency, durability, and comfort. For B2B buyers, understanding these processes helps in evaluating supplier capabilities and aligning expectations.

1. Material Preparation and Selection

The process begins with sourcing high-quality raw materials tailored to the specific requirements of larger sizes, which often demand reinforced components for durability. Common materials include full-grain leathers, synthetic leathers, textiles, and rubber soles. Suppliers typically perform initial quality checks on incoming materials, including visual inspections and testing for tensile strength, colorfastness, and moisture content, aligned with ISO 9001 standards.

2. Cutting and Pattern Making

Patterns are carefully designed to accommodate larger shoe sizes, ensuring proper fit and comfort. Cutting can be manual or automated (using CNC or laser cutting machines), with strict adherence to pattern accuracy to minimize waste and ensure uniformity across production batches. For size 14 shoes, extra attention is given to seam placement and reinforcement zones.

3. Forming and Component Assembly

The upper components are stitched, glued, or welded together, depending on the design and materials. Lasting processes (attaching the upper to the sole) are particularly critical for larger sizes, as they require reinforced structures to prevent deformation. Techniques such as cementing, Goodyear welt, or direct injection are common, chosen based on quality and cost considerations.

4. Sole Attachment and Final Assembly

Soles are attached through adhesive bonding or stitching, with larger shoes often requiring additional reinforcement for the outsole. Midsole and insole assembly involve precise placement to ensure comfort and durability. Heat sealing and vulcanization are also employed, especially for rubber soles, to enhance longevity.

5. Finishing and Quality Control

The final stages include trimming excess material, polishing, and applying branding or decorative elements. Finishing ensures aesthetic appeal and consistency across batches. For size 14 shoes, extra care is taken to maintain symmetry and proper alignment, given the larger dimensions.

Quality Assurance (QA) and Control for Size 14 Men’s Shoes

Robust QA practices are vital to meet international standards and satisfy B2B expectations, particularly when dealing with larger sizes that may be more prone to structural issues.

1. International Standards and Industry Certifications

Most reputable manufacturers adhere to ISO 9001 standards for quality management systems, which cover process control, documentation, and continuous improvement. For specific markets, additional certifications such as CE (Europe), API (for safety standards), or ASTM (US standards) may be required, especially for specialized footwear.

2. Quality Control Checkpoints

– Incoming Quality Control (IQC): Raw materials are inspected upon receipt. Checks include visual assessments, tensile tests, and chemical analysis to ensure compliance with specifications.

– In-Process Quality Control (IPQC): During manufacturing, periodic inspections verify process consistency. For example, stitching quality, alignment, and bonding strength are monitored at key stages.

– Final Quality Control (FQC): Completed shoes undergo comprehensive testing before shipment. This includes visual inspections, dimensional checks, and functional tests such as flexibility, adhesion, and wear resistance.

3. Common Testing Methods

– Dimensional Verification: Ensures that the shoe size, shape, and component placements meet design specifications, critical for large sizes.

– Durability Testing: Simulates wear through flexing, abrasion, and tensile tests. For size 14 shoes, reinforced components are tested for fatigue resistance.

– Comfort and Fit Testing: Ensures proper ergonomics, especially for larger sizes which may experience additional stress points.

– Environmental Testing: Assesses resistance to moisture, temperature fluctuations, and UV exposure.

4. Verification and Auditing for B2B Buyers

Buyers should conduct or commission audits of supplier facilities, focusing on production capabilities for larger sizes, quality management systems, and adherence to standards. Request detailed QC reports, test certificates, and third-party inspection reports. Engaging third-party inspectors or certification bodies (e.g., SGS, Bureau Veritas) provides unbiased verification, particularly vital for buyers in Africa, South America, the Middle East, and Europe.

Nuances and Best Practices for International B2B Buyers

1. Supplier Qualification and Due Diligence

– Verify manufacturing certifications (ISO 9001, ISO 14001, etc.) and industry-specific compliance.

– Review past export records and client references, especially those involving size 14 shoes or larger footwear.

– Conduct on-site audits focusing on equipment capabilities, quality control procedures, and worker expertise.

2. Quality Agreements and Specifications

– Clearly define quality standards, inspection criteria, and testing methods in purchase agreements.

– Specify tolerances for size, weight, and aesthetic details, with particular emphasis on larger sizes that may have unique structural considerations.

3. Sampling and Pre-Shipment Inspection

– Implement rigorous sampling plans (e.g., AQL standards) to evaluate batch quality.

– Consider third-party pre-shipment inspections, especially when dealing with remote suppliers in regions like Turkey, Indonesia, or South America, to ensure compliance before shipment.

4. Continuous Improvement and Feedback Loops

– Establish communication channels for quality feedback and corrective actions.

– Encourage suppliers to adopt lean manufacturing and Six Sigma methodologies to reduce defects and enhance consistency, especially crucial for larger shoe sizes prone to structural issues.

Conclusion

For B2B buyers sourcing size 14 men’s shoes internationally, a comprehensive understanding of manufacturing and quality assurance processes is essential. Emphasizing adherence to international standards, rigorous QC checkpoints, and proactive verification methods ensures product quality, reduces risk, and fosters long-term supplier relationships. Tailoring these practices to regional nuances and market requirements will optimize procurement outcomes and enhance brand reputation across diverse markets.

Comprehensive Cost and Pricing Analysis for size 14 mens shoes Sourcing

Cost Structure Breakdown for Size 14 Men’s Shoes

Understanding the comprehensive cost structure for sourcing size 14 men’s shoes is crucial for B2B buyers aiming to optimize procurement strategies. The primary cost components include raw materials, labor, manufacturing overhead, tooling, quality control, logistics, and profit margin.

Materials: High-quality leathers, synthetic uppers, and durable soles are standard, with premium materials increasing costs. For size 14 shoes, additional material volume slightly elevates raw material expenses, though bulk purchasing can mitigate this. Material costs typically account for 40-50% of the total FOB price.

Labor: Labor costs vary significantly by country. Countries like Turkey and Indonesia offer competitive wages, often translating into lower production costs, whereas European manufacturers may have higher labor expenses. Efficient production lines and automation can reduce labor costs, which generally range from 10-20% of the FOB price.

Manufacturing Overhead: This includes factory utilities, machinery depreciation, and quality assurance processes. Overhead costs are influenced by factory size, automation levels, and local energy prices. Factories with advanced technology tend to have higher upfront costs but can offer better consistency and quality.

Tooling and Setup: Tooling costs, including molds and cutting dies, are mostly fixed and amortized over large production runs. For size 14 shoes, specific molds may cost between $1,000 to $3,000, depending on complexity and material. These costs are spread across the order volume, making larger MOQ (Minimum Order Quantity) more cost-effective.

Quality Control & Certifications: Ensuring compliance with international standards (ISO, CE, environmental certifications) adds to costs but is essential for market acceptance, especially in Europe and North America. Higher quality standards may increase inspection costs but reduce returns and rework.

Logistics & Shipping: Shipping costs are highly variable, depending on destination, shipping mode, and current freight rates. For Africa, South America, and the Middle East, sea freight remains common, with costs influenced by container size, fuel prices, and port fees. FOB prices typically include basic logistics, but buyers should budget for inland transportation, customs, and duties.

Profit Margin: Manufacturers aim for a margin of 10-20%, but this can fluctuate based on order volume, relationship strength, and market competition.

Price Influencers and Their Impact

Several factors influence the final pricing of size 14 men’s shoes in international sourcing:

- Order Volume & MOQ: Larger orders significantly reduce per-unit costs due to economies of scale. Many suppliers prefer MOQs of 500-1,000 pairs for size 14 shoes, but flexible suppliers may negotiate lower MOQs at a premium.

- Customization & Specifications: Custom designs, branding, or special materials increase costs. Standard models are more economical, while bespoke features can add 20-30% to the unit price.

- Material Choices: Premium leathers or eco-friendly materials will elevate costs, but they can also command higher retail prices in destination markets.

- Quality & Certifications: Certified products that meet international safety and environmental standards typically command higher prices but reduce market entry barriers.

- Supplier Factors: Factory reputation, production capacity, and location influence pricing. Established manufacturers with certifications may charge a premium but offer reliability and quality assurance.

- Incoterms & Delivery Terms: FOB (Free on Board) prices are common, but buyers should also consider CIF (Cost, Insurance, Freight) for comprehensive budgeting. Shipping terms impact overall costs and delivery timelines.

Strategic Tips for International Buyers

Negotiate Effectively: Leverage volume commitments to negotiate better unit prices. Discuss flexible MOQs, especially when testing new markets or suppliers. Building long-term relationships can lead to preferential pricing.

Focus on Total Cost of Ownership (TCO): Beyond FOB prices, account for customs duties, inland transportation, warehousing, and potential rework costs. A slightly higher initial price may be offset by lower logistics or rework expenses.

Consider Lead Times and Flexibility: Longer lead times can reduce costs via economies of scale but may impact inventory management. Ensure suppliers can meet your demand fluctuations without compromising quality.

Pricing Nuances for Different Regions: Buyers from Africa and South America should account for higher inland freight and customs fees, while Middle Eastern and European buyers benefit from proximity to manufacturing hubs like Turkey and Portugal, potentially reducing logistics costs.

Disclaimers: Indicative prices for size 14 men’s shoes generally range from $15 to $35 FOB per pair, depending on quality, customization, and order volume. Prices can fluctuate based on market conditions, raw material prices, and geopolitical factors.

Final Recommendations

To optimize costs effectively, conduct detailed supplier comparisons, request detailed quotations, and consider multiple sourcing regions. Building strategic partnerships with manufacturers who offer consistent quality, flexible MOQs, and reliable logistics will enable better cost management and market competitiveness. Always evaluate the entire supply chain to identify hidden costs and ensure alignment with your business objectives.

Spotlight on Potential size 14 mens shoes Manufacturers and Suppliers

- (No specific manufacturer data was available or requested for detailed profiling in this section for size 14 mens shoes.)*

Essential Technical Properties and Trade Terminology for size 14 mens shoes

Critical Technical Properties for Size 14 Men’s Shoes

1. Material Grade and Composition

The quality of the raw materials—such as leather, synthetic fibers, or rubber—is fundamental. Higher-grade materials ensure durability, comfort, and a premium appearance, which are key selling points in international markets. Suppliers often specify material grades (e.g., full-grain leather vs. bonded leather) to meet different price points and quality standards. B2B buyers should verify material certifications to ensure compliance with safety and environmental regulations in their target markets.

2. Shoe Construction Tolerance

Tolerance refers to the permissible variation in dimensions during manufacturing, such as length, width, and heel height. Tight tolerances (e.g., ±1mm) guarantee consistency across batches, reducing the risk of returns or dissatisfaction. For size 14 shoes, precise tolerances are especially critical because larger sizes are more visible and often subject to higher customer expectations regarding fit.

3. Sole and Upper Attachment Strength

The durability of the bond between the shoe’s sole and upper is vital for longevity. Common methods include cementing, stitching, or a combination. High-quality attachment methods prevent separation, especially in larger sizes where stress and wear are more pronounced. B2B buyers should request technical specifications and testing reports to confirm product robustness.

4. Weight and Flexibility

The weight impacts comfort, especially for larger shoes that can feel cumbersome if overly heavy. Flexibility, often measured through bend tests, indicates the shoe’s comfort during movement. Suppliers should provide data sheets detailing these properties, which help buyers assess suitability for different end-user needs, such as casual wear or formal settings.

5. Colorfastness and Finish Quality

This property measures how well the shoe’s color resists fading or bleeding during cleaning or exposure to elements. For international markets, especially in regions with high humidity or varied climates, durable finishes are essential. Technical data on colorfastness ratings (e.g., ISO standards) help buyers evaluate product longevity and appearance retention.

Common Industry and Trade Terms

1. OEM (Original Equipment Manufacturer)

Refers to manufacturers that produce shoes based on a buyer’s specifications and branding. Understanding OEM relationships allows buyers to customize designs, materials, and packaging, making it crucial for private-label products. Clarify OEM capabilities and minimum order quantities (MOQs) when negotiating.

2. MOQ (Minimum Order Quantity)

The smallest number of units a supplier will accept for a production run. MOQs vary widely depending on the manufacturer and product complexity. For size 14 shoes, larger sizes might have higher MOQs due to increased material costs or manufacturing constraints. Negotiating MOQs is key to balancing inventory costs with supply reliability.

3. RFQ (Request for Quotation)

A formal request sent by buyers to suppliers seeking price, lead time, and technical details. An RFQ is essential for initial sourcing, especially when dealing with different regional suppliers. Clear RFQs that specify size, material, and quality standards help streamline the procurement process.

4. Incoterms

Standardized international trade terms published by the International Chamber of Commerce, defining responsibilities for shipping, insurance, and tariffs. Common Incoterms like FOB (Free on Board) or CIF (Cost, Insurance, Freight) specify who bears costs and risks at each stage. Understanding Incoterms helps buyers manage logistics costs and avoid misunderstandings.

5. Lead Time

The duration from order placement to product delivery. Larger sizes may require longer lead times due to manufacturing complexities or raw material availability. Accurate knowledge of lead times allows buyers to plan inventory and avoid stockouts.

6. Quality Assurance (QA) and Certification

Refers to the testing and certification processes ensuring products meet safety, environmental, and quality standards (e.g., ISO, REACH). For international trade, especially in regulated markets, verifying QA procedures reduces compliance risks and enhances product credibility.

By understanding these technical properties and trade terms, B2B buyers from Africa, South America, the Middle East, and Europe can make informed procurement decisions, negotiate effectively, and ensure that size 14 men’s shoes meet the desired quality and compliance standards in their target markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the size 14 mens shoes Sector

Market Overview & Key Trends

The size 14 men’s shoe segment is experiencing notable shifts driven by global economic, technological, and consumer preference changes. Historically considered a niche, this segment is gaining prominence due to increased awareness of larger foot sizes across diverse markets, especially in regions with taller populations or specific occupational needs.

For international B2B buyers from Africa, South America, the Middle East, and Europe (including Turkey and Indonesia), the key driver is the rising demand for tailored footwear solutions that cater to larger foot sizes without compromising on style or comfort. Emerging trends include the integration of advanced manufacturing technologies like 3D printing and automated cutting, which enable rapid prototyping and customization, reducing lead times and costs. Digital platforms and B2B marketplaces are also transforming sourcing, offering greater transparency, wider supplier networks, and streamlined procurement processes.

Market dynamics are influenced by several factors: fluctuating raw material costs, shifts toward sustainable sourcing, and the increasing importance of supply chain resilience. Buyers are now prioritizing suppliers with proven capabilities in producing durable, comfortable shoes at scale, while also adhering to international standards. For regions like Africa and South America, local manufacturing partnerships are becoming more viable due to lower transportation costs and tariffs, whereas European and Middle Eastern buyers often look for premium, ethically sourced products with advanced quality control.

The growing influence of e-commerce and digital supply chain management tools is enabling smaller brands and retailers to access global suppliers more efficiently. This democratization of sourcing is particularly advantageous for B2B buyers seeking consistent quality and innovative designs in the size 14 segment, positioning them well to meet evolving consumer preferences.

Sustainability & Ethical Sourcing in B2B

Sustainability is increasingly central to sourcing decisions in the size 14 men’s shoe market, driven by both consumer demand and regulatory pressures. Environmentally conscious buyers from regions like Europe and the Middle East are actively seeking suppliers who demonstrate a commitment to reducing carbon footprints, minimizing waste, and utilizing eco-friendly materials.

Key sustainable practices include sourcing vegetable-tanned leathers, recycled textiles, and biodegradable components. Certifications such as ISO 14001, Leather Working Group (LWG), and Fair Trade are becoming essential benchmarks for verifying environmental and ethical standards. For B2B buyers, establishing relationships with suppliers holding these certifications ensures compliance and enhances brand reputation in environmentally sensitive markets.

Ethical sourcing extends beyond environmental considerations to labor practices. Transparency in supply chains—through traceability tools and third-party audits—is vital to prevent exploitation and ensure fair wages, especially in regions where oversight may be limited. B2B buyers should prioritize suppliers with verifiable ethical credentials, fostering long-term partnerships rooted in shared sustainability goals.

Investing in ‘green’ materials and sustainable production methods not only aligns with corporate social responsibility (CSR) objectives but can also provide competitive differentiation. For instance, offering shoes made from recycled plastics or natural, low-impact dyes appeals to eco-conscious consumers and can command premium pricing. As sustainability standards tighten globally, proactive sourcing strategies in this domain will be crucial for securing reliable supply chains and maintaining market relevance.

Brief Evolution/History (Optional)

The evolution of the size 14 men’s shoe market reflects broader industry trends toward customization and inclusivity. Historically, footwear manufacturing focused predominantly on standard sizes, with larger sizes often overlooked due to perceived limited demand. Over the last two decades, demographic shifts, increased awareness of diverse consumer needs, and advances in manufacturing have expanded the market for larger shoes.

Technological innovations, such as digital patterning and flexible manufacturing systems, have made producing size 14 shoes more feasible and cost-effective. Additionally, the rise of e-commerce platforms has democratized access, allowing smaller brands and retailers worldwide to source larger-sized footwear directly from manufacturers. This evolution underscores a shift toward more inclusive, sustainable, and technologically integrated supply chains, offering B2B buyers greater agility and capacity to meet global demand with tailored solutions.

Illustrative Image (Source: Google Search)

Frequently Asked Questions (FAQs) for B2B Buyers of size 14 mens shoes

1. How can I effectively vet suppliers for size 14 men’s shoes to ensure quality and reliability?

To vet suppliers effectively, start by requesting comprehensive company credentials, including business licenses, export licenses, and quality certifications such as ISO or CE. Review their product catalogs and request samples to assess craftsmanship and material quality. Check references or seek feedback from existing clients, especially from your region or industry. Additionally, verify their production capacity and lead times to ensure they can meet your volume requirements. Utilizing third-party inspection services before shipment can further mitigate risks. A transparent supplier with clear communication and a track record of compliance is vital for long-term reliability.

2. What are the best options for customizing size 14 men’s shoes for my target market?

Customization options vary widely among suppliers but often include branding (logos, labels), material choices (leather, synthetic, eco-friendly options), and design features (colorways, sole types). For markets in Africa, South America, or the Middle East, consider offering region-specific styles or materials suited to climate and cultural preferences. Engage suppliers who offer OEM/ODM services and provide clear design specifications. Establish a detailed communication process to ensure your customization requests are accurately translated into production. Be aware that customization may influence MOQ, lead times, and pricing, so plan accordingly for your market entry strategy.

3. What are typical MOQ requirements, lead times, and payment terms for bulk orders of size 14 men’s shoes?

MOQ (Minimum Order Quantity) for size 14 men’s shoes often ranges from 300 to 1,000 pairs, depending on the supplier and customization level. Lead times typically span 4 to 12 weeks, influenced by order complexity, factory capacity, and logistics. Payment terms commonly include a 30-50% deposit upfront with the balance payable before shipment or upon delivery. Some suppliers may offer flexible terms for trusted partners or larger orders, such as letter of credit or open account arrangements. Clarify these details early in negotiations to align production schedules with your market rollout plans.

4. What certifications and quality assurance processes should I look for when sourcing size 14 men’s shoes?

Look for suppliers holding relevant certifications such as ISO 9001 (quality management), environmental standards like ISO 14001, or safety certifications depending on your target market’s regulations. Quality assurance should include pre-production sample approval, in-line inspections, and final quality checks before shipment. Request detailed QA reports, including defect rates, material testing, and compliance documentation. For markets with strict import standards, ensure the supplier can provide relevant test reports (e.g., chemical safety, slip resistance). Working with suppliers who are transparent about their QA processes reduces risks of product rejection and recalls.

5. How can I manage logistics effectively when importing size 14 men’s shoes from overseas suppliers?

Effective logistics management involves selecting reliable freight forwarders experienced in international trade, especially for shipments to Africa, South America, or the Middle East. Consider options like sea freight for bulk orders to reduce costs, or air freight for urgent needs. Negotiate Incoterms (e.g., FOB, CIF) that clarify responsibilities and costs. Be aware of import duties, taxes, and customs clearance procedures in your country, and ensure all documentation (invoice, packing list, certificates) is accurate and complete. Establish a tracking system to monitor shipments and plan for potential delays, especially during peak seasons or customs inspections.

6. What steps should I take to resolve disputes with overseas shoe suppliers efficiently?

Disputes often arise from quality issues, late deliveries, or payment disagreements. To resolve them swiftly, maintain clear and detailed communication records, including contracts, order specifications, and correspondence. Use written dispute resolution clauses in your contracts, specifying arbitration or legal jurisdiction. Engage local legal counsel familiar with international trade laws if necessary. Consider third-party mediation if direct negotiations stall. Building strong relationships and maintaining transparency helps prevent misunderstandings. Always document issues thoroughly, and address disputes promptly to avoid disruption of your supply chain.

Illustrative Image (Source: Google Search)

7. How can I ensure compliance with regional regulations and standards when importing size 14 men’s shoes?

Research import regulations, safety standards, and labeling requirements specific to your target markets (e.g., CE marking for Europe, ASTM standards for the US, or regional customs tariffs). Verify that your supplier complies with these standards by requesting compliance certificates and test reports. Incorporate compliance checks into your quality assurance process, including sampling and testing. Keep abreast of any updates in regulations to avoid delays or penalties. Partnering with local consultants or certification agencies can streamline the process and ensure your products meet all legal requirements, facilitating smoother market entry.

8. What are the key factors to consider when negotiating pricing and payment terms with overseas suppliers?

Focus on achieving a balance between competitive pricing and quality assurance. Negotiate bulk discounts for larger orders, and clarify costs related to customization, packaging, and shipping. Payment terms should be structured to protect your cash flow—common options include letter of credit, open account, or escrow services. Flexibility in payment terms can be advantageous but may require a proven purchasing history. Always request a detailed quote, including all hidden costs, and consider currency exchange implications. Building a strong, transparent relationship with your supplier enhances negotiation leverage and fosters long-term cooperation.

Strategic Sourcing Conclusion and Outlook for size 14 mens shoes

Strategic Sourcing Outlook for Size 14 Men’s Shoes

Effective strategic sourcing is vital for international buyers seeking to secure high-quality size 14 men’s shoes at competitive prices. Key takeaways include the importance of diversifying supply chains across regions such as Turkey, Indonesia, and Eastern Europe, which offer a balance of quality, cost efficiency, and reliable delivery. Leveraging local manufacturing hubs and fostering strong supplier relationships can mitigate risks associated with global disruptions.

For buyers in Africa, South America, the Middle East, and Europe, understanding regional manufacturing strengths and market dynamics is crucial. Emphasizing quality assurance, sustainable sourcing practices, and flexible logistics options will enhance procurement resilience and ensure product consistency. Additionally, staying informed about evolving trade policies and tariffs can create opportunities for cost savings and strategic advantage.

Looking ahead, the demand for size 14 men’s shoes is expected to grow, driven by increasing market segmentation and evolving consumer preferences. International buyers should prioritize building agile, transparent supply networks and invest in long-term partnerships. Proactively adapting sourcing strategies will position your business to capitalize on emerging opportunities and maintain a competitive edge in this specialized segment.